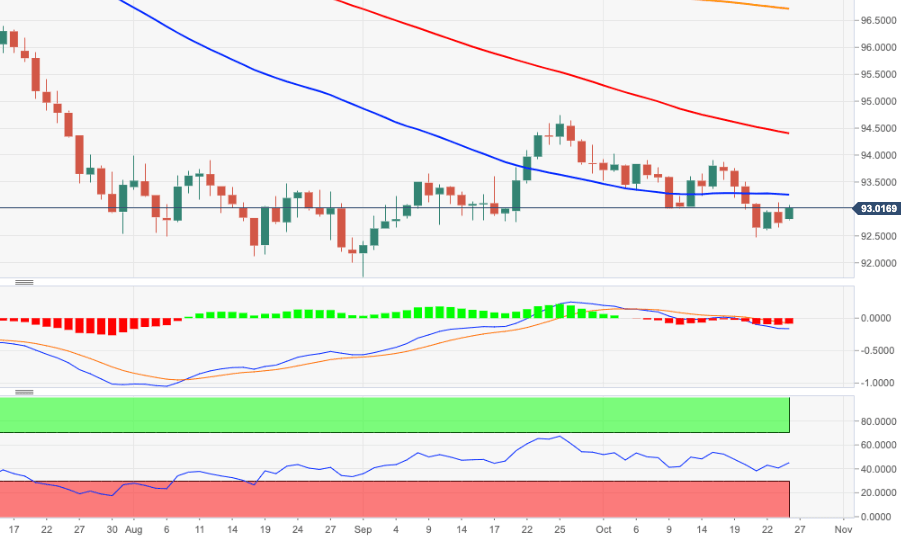

US Dollar Index Price Analysis: Initial resistance comes in near 93.40

- DXY regains the smile and shifts its focus to the 93.00 barrier.

- The 55-day SMA near 93.30 offers interim resistance near-term.

DXY resumes the upside following Friday’s pullback, although the 93.00 barrier appears a tough nut to crack for USD-bulls so far.

If the ongoing bullish attempt gathers further steam, then the next interim hurdle emerges at the 55-day SMA near 93.30 ahead of the 6-month resistance line around 93.40. Further up is located last week’s highs near 93.80.

While below the 200-day SMA, today at 96.70, the negative view on the dollar is expected to persist.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.