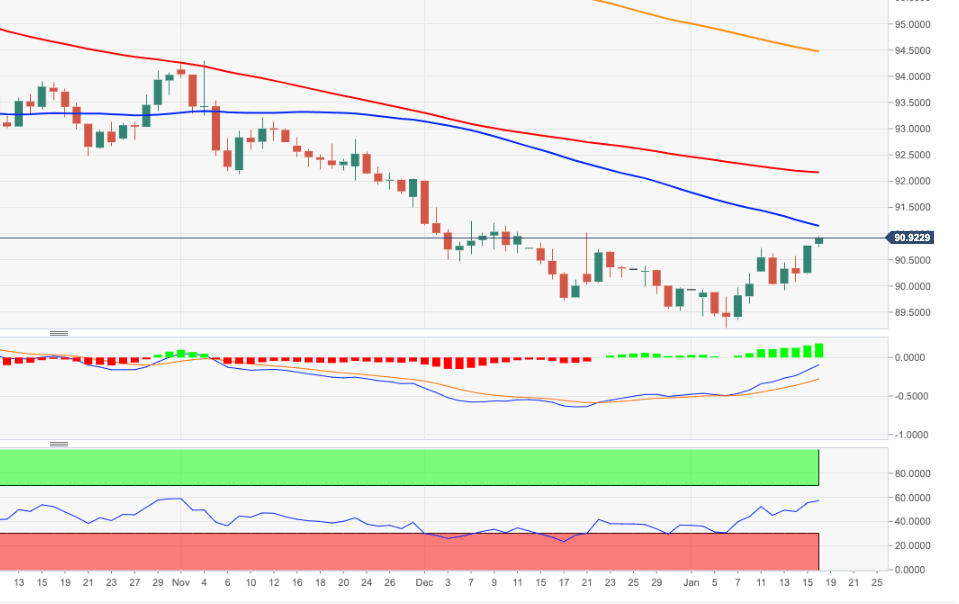

US Dollar Index Price Analysis: Immediately to the upside comes 91.00

- DXY moves further north and approaches the 91.00 level.

- Interim hurdle lines up at the 55-day SMA at 91.15.

DXY extends the march north and already trades at shouting distance from the 91.00 barrier, or new 2021 highs.

Further upside could now see the weekly high in the 91.00 region (December 21) re-tested in the near-term. Above this level, the prevailing downside pressure is expected to mitigate somewhat while targeting the interim hurdle at the 55-day SMA, today ay 91.15.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 94.46, the negative view is forecast to persist.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.