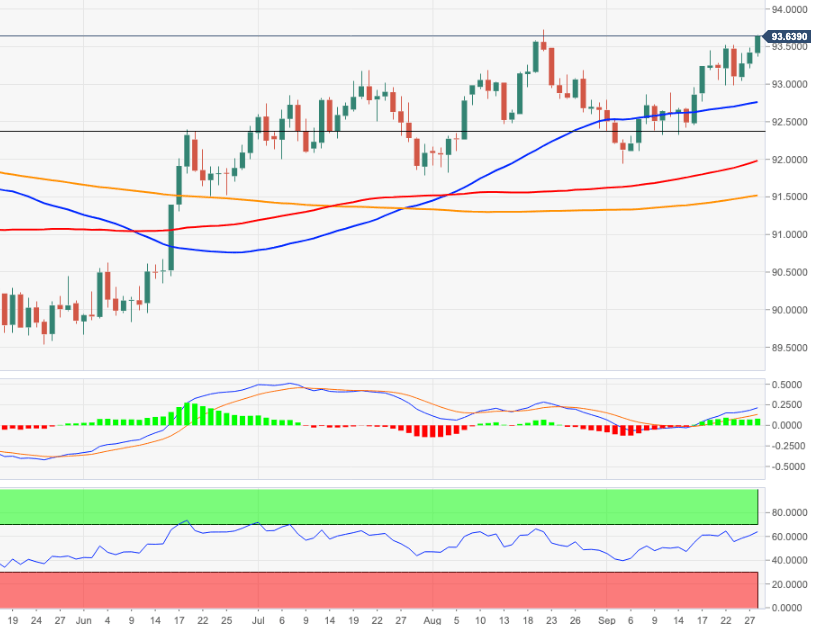

US Dollar Index Price Analysis: Attention shifts to 94.00 and beyond

- DXY picks up further pace and challenges 2021 highs.

- The surpass of 2021 peaks should expose 94.00.

DXY pushes higher and trades closer to the YTD highs past the 93.70 level.

Further upside faces immediate hurdle at the 2021 top at 93.72 while the breakout of this level should put the round level at 94.00 on the radar ahead of the November 2020 high at 94.30.

In the meantime, and looking at the broader scenario, the constructive stance on the dollar is seen unchanged while above the 200-day SMA, today at 91.51.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.