US Dollar Index adds to the uptrend around 98.60

- DXY extends the rebound to the vicinity of 98.70.

- Investors’ attention shifts to the inversion of the 10y yield curve.

- February’s Factory Orders will take centre stage in the US docket.

The greenback, in terms of the US Dollar Index (DXY), adds to recent gains and retests the 98.65/70 band at the beginning of the week.

US Dollar Index looks to Fed, geopolitics

The index advances for the third session in a row on Monday and puts further distance from last week’s lows in the 97.70 region.

The lack of positive news from the war in Ukraine appears to be lending some support to the buck along with rising speculation of the Fed’s tighter rate path in the next months. Furthermore, Friday’s release of quite a strong labour market report supports the latter view.

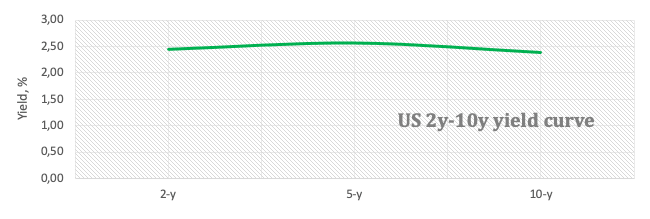

In the US cash markets, the yield curve inverted on Friday and sparked concerns once again about the US economy falling into a recession in the medium term in response to a faster pace of tightening by the Federal Reserve.

Later on the US docket, Factory Orders for the month of February is due along with short-term bill auctions.

What to look for around USD

The dollar managed to regain strong upside traction after bottoming out in the 97.70 region in the second half of last week. In the meantime, near-term price action in the greenback continues to be dictated by geopolitics, while the case for a stronger dollar in the medium/long term remains well propped up by the current elevated inflation narrative, a potentially more aggressive tightening stance from the Fed, higher US yields and the solid performance of the US economy.

Key events in the US this week: Factory Orders (Monday) – Balance of Trade, Final Services PMI, ISM Non-Manufacturing (Tuesday) – MBA Mortgage Applications, FOMC Minutes (Wednesday) – Initial Claims, Consumer Credit Change (Thursday) – Wholesale Inventories (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. The future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.02% at 98.62 and a break above 99.36 (weekly high March 28) would open the door to 99.41 (2022 high March 7) and finally 100.00 (psychological level). On the flip side, the next down barrier emerges at 97.68 (weekly low March 30) seconded by 97.16 (55-day SMA) and then 96.66 (100-day SMA).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.