US Dollar reverses gains as Trump considers firing Fed Chair Jerome Powell

- The US Dollar slumps on Wednesday after CBS reported Trump asked GOP lawmakers if he should fire Fed Chair Jerome Powell.

- US President Donald Trump finalized a trade deal with Indonesia on Tuesday, imposing a 19% tariff on Indonesian exports.

- June CPI data came in mixed, but the report confirmed the inflationary effect of tariffs and curbed hopes of Fed interest-rate cuts.

The US Dollar slumps on Wednesday after CBS reported that US President Donald Trump asked a group of House Republicans whether he should fire Federal Reserve Chair Jerome Powell. The news offsets earlier gains triggered by softer-than-expected US Producer Price Index (PPI) data for June, which initially lifted the Greenback amid signs of easing producer inflation.

At the time of writing, the US Dollar Index (DXY), which measures the Greenback’s strength against a basket of six major currencies, is trading sharply lower near 98.00 during American trading hours, retreating from an intraday high of 98.91 as traders react to renewed political uncertainty surrounding the Fed.

Headline PPI was flat in June, showing no monthly growth, compared to the 0.2% increase markets had expected, and down from a 0.3% rise in May. On an annual basis, PPI slowed to 2.3%, also below the 2.5% forecast and the 2.6% reading from the previous month.

Core PPI, which excludes food and energy, was also weaker than expected. It came in at 0.0% MoM, missing the 0.2% forecast and down from 0.1% in May. On a yearly basis, Core PPI eased to 2.6%, compared to 2.7% expected and 3.0% in the previous month.

In a fresh development on the trade front, President Donald Trump announced a new bilateral trade agreement with Indonesia on Tuesday. Under the deal, Indonesia will face a 19% tariff on goods exported to the United States, a reduction from the earlier proposed 32%. In return, US exports to Indonesia will be exempt from tariffs and non-tariff barriers.

Trump highlighted that Indonesia has committed to purchasing $15 billion worth of US energy, $4.5 billion in agricultural products, and 50 Boeing jets. The agreement, described as a “landmark deal,” also grants American ranchers, farmers, and fishermen full access to the Indonesian markets, he said.

At the same time, President Trump is threatening to impose new tariffs of up to 200% on pharmaceutical and semiconductor imports from several countries, with measures likely to take effect by the end of the month. “We’re going to start off with a low tariff and give the pharmaceutical companies a year or so to build, and then we’re going to make it a very high tariff,” Trump told reporters on Tuesday as he returned from an artificial intelligence summit in Pittsburgh. He also signaled plans to apply a uniform tariff of over 10% on goods from more than 100 smaller countries, including many in Africa and the Caribbean.

Market Movers: CPI lifts Fed caution, Trump renews rate cut pressure

- The latest CPI report revealed that US headline inflation rose in line with expectations in June, increasing by 0.3% MoM and 2.7% YoY. However, core inflation came in slightly softer than forecast. Core CPI rose 0.2% MoM, compared to a forecast of 0.3% and a prior reading of 0.1%. On a yearly basis, core CPI climbed to 2.9%, below the expected 3.0% and up from 2.8% in May. The report highlighted persistent but not accelerating inflationary pressures.

- Following the June CPI report, President Donald Trump called for immediate interest rate cuts on his social media platform, Truth Social, stating, “Consumer Prices LOW. Bring down the Fed Rate, NOW!!!” He claimed that reducing rates could save the US government over a trillion dollars annually in interest payments. The comments add fresh political pressure on the Federal Reserve, even as inflation remains above the 2% target and markets continue to anticipate only gradual policy easing.

- The June CPI report prompted a notable shift in market expectations for Federal Reserve policy. The probability of a 25 basis point (bps) rate cut in September now stands at 52.6%, down from around 70% a week ago, while chances of a July cut have dropped to just 2.6%.

- Fed officials struck a cautious tone on Tuesday, urging patience amid ongoing inflation pressures and tariff uncertainty. Dallas Fed President Lorie Logan noted that the inflationary impact of new tariffs may not be apparent until the fall, as businesses tend to gradually pass on higher costs. Boston Fed President Susan Collins echoed that view, warning that tariffs could push core inflation closer to 3% by year-end. Both policymakers emphasized a data-dependent approach, reinforcing expectations that the Fed is unlikely to rush into cutting interest rates.

- The US trade landscape remains unsettled as President Trump continues to escalate tariff threats. Over the past week, warning letters were sent to more than 20 countries, including the European Union (EU), Canada, and Mexico, threatening tariffs ranging from 25% to 50% if no trade deals are reached by August 1. The EU has responded by preparing a second tranche of countermeasures, targeting approximately $84 billion worth of US goods. However, formal implementation has been temporarily paused in hopes of negotiations. Trump also signaled that a trade deal with India may be close, as India was notably excluded from the latest round of warning letters.

- Industrial production in the United States rose by 0.3% in June, exceeding market expectations of a 0.1% gain.

- Looking ahead, market participants will closely monitor comments from Fed Vice Chair for Supervision Michael Barr, who is scheduled to speak later on Wednesday. Traders will also focus on the Fed’s Beige Book for anecdotal evidence on economic activity, labor market dynamics, and price pressures across regional districts.

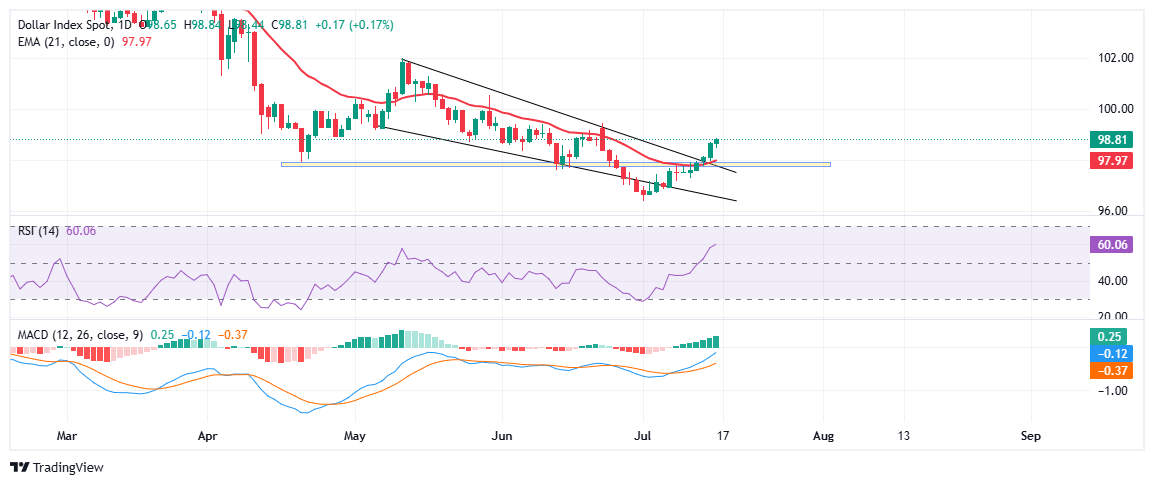

Technical analysis: US Dollar Index breaks falling wedge pattern, tests 50-day EMA

The US Dollar Index (DXY) has reversed course from its lowest levels in over three years, supported by resilient US economic data and an extended tariff negotiation window, which helped ease geopolitical uncertainty.

The index broke decisively above the 97.80-98.00 resistance zone following the latest US CPI report, above the upper boundary of the falling wedge pattern.

The DXY is trading below its 50-day EMA, which stands near 98.77, acting as immediate resistance. A clear breakout above this level on a daily closing basis would likely trigger a push toward the June 23 high at 99.42. The 9-day EMA at 97.97 now serves as initial dynamic support, while the 98.00-97.80 zone offers a strong base in case of pullbacks.

On the momentum front, the Relative Strength Index (RSI) has climbed to around 57, maintaining a steady position above the neutral 50 level. A sustained push above 60 would reinforce bullish conviction and signal acceleration in buying pressure.

Meanwhile, the Moving Average Convergence Divergence (MACD) remains positive, with the MACD line staying above the signal line. The histogram bars are expanding, indicating increasing bullish momentum.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.64% | -0.52% | -1.03% | -0.25% | -0.38% | -0.09% | -0.43% | |

| EUR | 0.64% | 0.14% | -0.41% | 0.40% | 0.22% | 0.51% | 0.24% | |

| GBP | 0.52% | -0.14% | -0.54% | 0.28% | 0.10% | 0.37% | 0.10% | |

| JPY | 1.03% | 0.41% | 0.54% | 0.78% | 0.72% | 0.93% | 0.66% | |

| CAD | 0.25% | -0.40% | -0.28% | -0.78% | -0.14% | 0.05% | -0.19% | |

| AUD | 0.38% | -0.22% | -0.10% | -0.72% | 0.14% | 0.26% | -0.01% | |

| NZD | 0.09% | -0.51% | -0.37% | -0.93% | -0.05% | -0.26% | -0.28% | |

| CHF | 0.43% | -0.24% | -0.10% | -0.66% | 0.19% | 0.01% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.