US Dollar holds strong amid mixed US data as Consumer Confidence beats and JOLTS disappoints

- The US Dollar is holding firm after its strongest daily gain since May, fueled by the US-EU trade agreement.

- The Dollar Index (DXY) is up over 2.0% in July, on pace for its first monthly gain since December.

- US JOLTS Job Openings fell to 7.437 million in June, below expectations, indicating a slow labor market cooldown.

The US Dollar (USD) is holding firm on Tuesday after posting its strongest single-day gain since May, rallying 1.0% on Monday. The rally came after the United States (US) and European Union (EU) announced a major trade deal framework on Sunday. Markets welcomed the news, seeing the agreement heavily tilted in favor of Washington. Investors are betting the deal gives the US more economic and strategic power, boosting confidence in the Greenback.

The US Dollar Index (DXY), which measures the Greenback against a basket of six major currencies, is extending Monday’s strong gains during the European trading hours. As of now, the index is consolidating around the 99.00 psychological mark, its highest level since June 23, reflecting continued bullish momentum driven by easing trade tensions and solid US economic fundamentals.

The US Dollar Index hit its lowest level in over three years on July 1, dropping to 96.38. Since then, it has been steadily recovering and is now on track for its first monthly gain since February, rising over 2.0% so far this month. The rebound has been fueled by easing trade tensions ahead of the August 1 deadline, with new agreements reached with major partners like the EU and Japan, as well as smaller economies including Indonesia, the Philippines, and Vietnam. Strong US economic data has also contributed significantly, providing additional strength to the US Dollar.

Looking ahead, focus now shifts to the Federal Reserve’s monetary policy decision on Wednesday, followed by Fed Chair Jerome Powell’s press conference. While the Fed is widely expected to keep interest rates unchanged, traders will pay close attention to Powell’s tone and guidance on inflation, labor market resilience, and the future policy path. Any signals of a more hawkish or cautious stance could influence market expectations and drive the next move in the US Dollar, which is currently trading near multi-week highs.

Market Movers: Trade optimism lifts the US Dollar

- The JOLTS Job Openings report showed vacancies declined by 275,000 to 7.437 million in June, signaling a gradual cooling in labor demand. However, the Conference Board’s Consumer Confidence Index rose to 97.2 in July, up from 95.2 in June and well above expectations of 95.4.

- US Housing Price Index falls 0.2% in May, matching expectations. The monthly decline points to lingering softness in the housing sector, though April’s figure was revised to –0.3% from –0.4%, hinting at a slight easing in downward pressure. Wholesale inventories edged up 0.2% MoM to $907.7 billion in June, rebounding from a 0.3% drop in May and beating market expectations of a 0.1% decline. The US trade deficit in goods narrowed to $86.0 billion in June from $96.4 billion in May, well below the expected $98.4 billion gap. The sharp contraction in the deficit reflects stronger exports or softer imports, supporting GDP growth expectations for Q2.

- The newly announced US-EU trade deal is a major driver of the US Dollar’s rally this week. Unveiled on Sunday, the agreement averted a potentially damaging tariff standoff and delivered significant concessions to Washington. Under the deal, the US will impose a baseline 15% tariff on most EU imports, far lower than the 30% originally threatened, but still above the 10% baseline tariffs. Strategic goods such as aircraft components, semiconductors, and certain pharmaceutical and agricultural products received exemptions, preserving key supply chains. In return, the EU committed to purchasing $750 billion in US energy, primarily Liquefied Natural Gas (LNG), over the next three years, and pledged an additional $600 billion in long-term investment into the US economy. These moves are seen as enhancing the US's economic leverage while deepening transatlantic ties.

- The $600 billion will come entirely from private funds. According to both European Commission (EC) Commerce Commissioner Maroš Šefčovič and EC officials speaking to Politico, the European Commission will play no role in reaching the $600 billion, and the amount will come from private companies. This differs significantly from the Japanese deal, where the government-backed organisations will lead the administration of their investment.

- Earlier in the month, the US-Japan trade agreement took center stage, which cut previously proposed auto tariffs from 27.5% to 15%, while Japan pledged an unprecedented $550 billion investment package in the US to support critical sectors like semiconductors, energy, pharmaceuticals, shipbuilding, and autos.

- Traders are keeping a close eye on the ongoing US-China trade discussions in Stockholm, which resumed today after concluding the first round of talks on Monday. Top-level officials from both sides, including US Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng, are meeting to explore an extension of the current tariff truce set to expire on August 12.

- The US Treasury has announced a massive borrowing plan for the second half of 2025, signaling $1.6 trillion in net new marketable debt — $1.007 trillion in Q3 and $590 billion in Q4. While around $500 billion of that is aimed at rebuilding the Treasury General Account (TGA) rather than new spending, the scale of issuance is putting renewed pressure on bond markets. The timing is tough, yields are already elevated across the curve. The 30-year yield is hovering near 4.96%, the 10-year at 4.41%, and even the 2-year is approaching 4%. With interest costs rising, the government is now rolling over debt at far higher rates than the near-zero levels that defined the past decade. This adds strain to the fiscal outlook and raises questions about how long the Treasury can sustain such high borrowing costs without crowding out private investment.

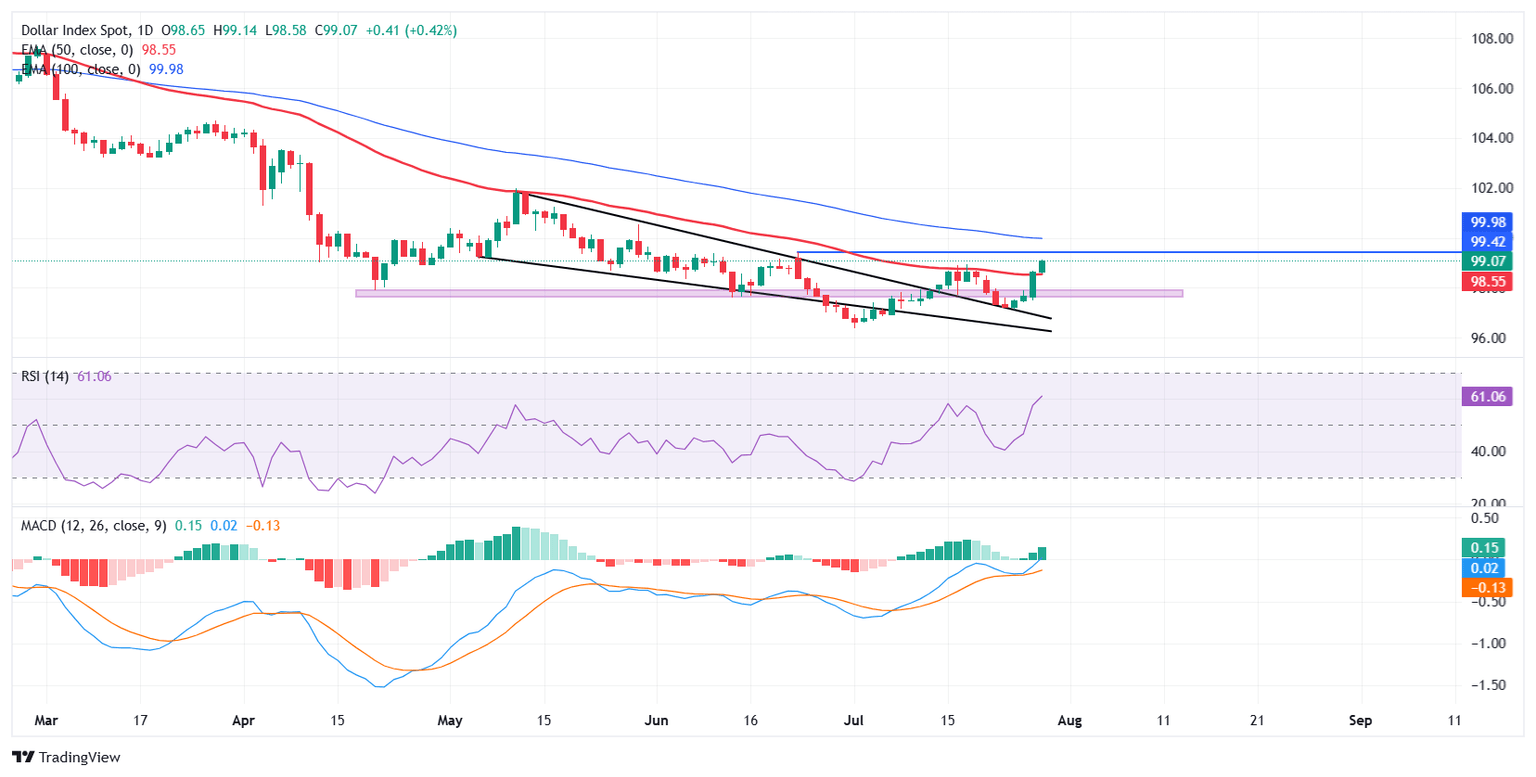

Technical analysis: DXY rally strengthens as RSI and MACD support further upside

The US Dollar Index (DXY) continues to build on its bullish momentum, trading around 98.89 in Tuesday’s session. The index has extended its recovery after successfully retesting the upper boundary of a falling wedge pattern, which it broke earlier this month. The upward move is further validated by a sustained move above the 50-day Exponential Moving Average (EMA) at 98.54, now acting as immediate support, followed by the 97.80-98.00 zone. The next resistance zone lies ahead at 99.42, the high of June 23, followed by the 100-day EMA at 99.97. A successful hold above 98.50, which aligns closely with the 50-day EMA, would reinforce the bullish structure and keep the US Dollar Index on track to challenge the next resistance levels.

Momentum indicators support the bullish bias. The Relative Strength Index (RSI) is climbing, currently around 59, indicating growing buying strength with room for further upside before a potential exhaustion. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator continues to strengthen, with both the MACD and signal lines rising and the histogram bars expanding in positive territory.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.