US Dollar down as markets asses Trump's words

- DXY trades near the 104 zone after Trump’s global tariff announcement on Wednesday.

- Sentiment swings as 10% import tariffs and 25% auto duties add complexity to trade outlook.

- Downside pressure persists below key moving averages, resistance seen near 104.10.

The US Dollar Index (DXY) moved lower during Wednesday’s session, lingering near the 104.00 area after President Donald Trump confirmed sweeping tariffs on global imports. The initial surge in yields and volatility gave way to a more cautious tone as details revealed a 10% blanket tariff and an additional 25% duty on imported vehicles. The announcement, while bold, lacked the aggressive edge markets feared, prompting a partial retreat in safe-haven flows.

Bearish bias persists despite neutral signals

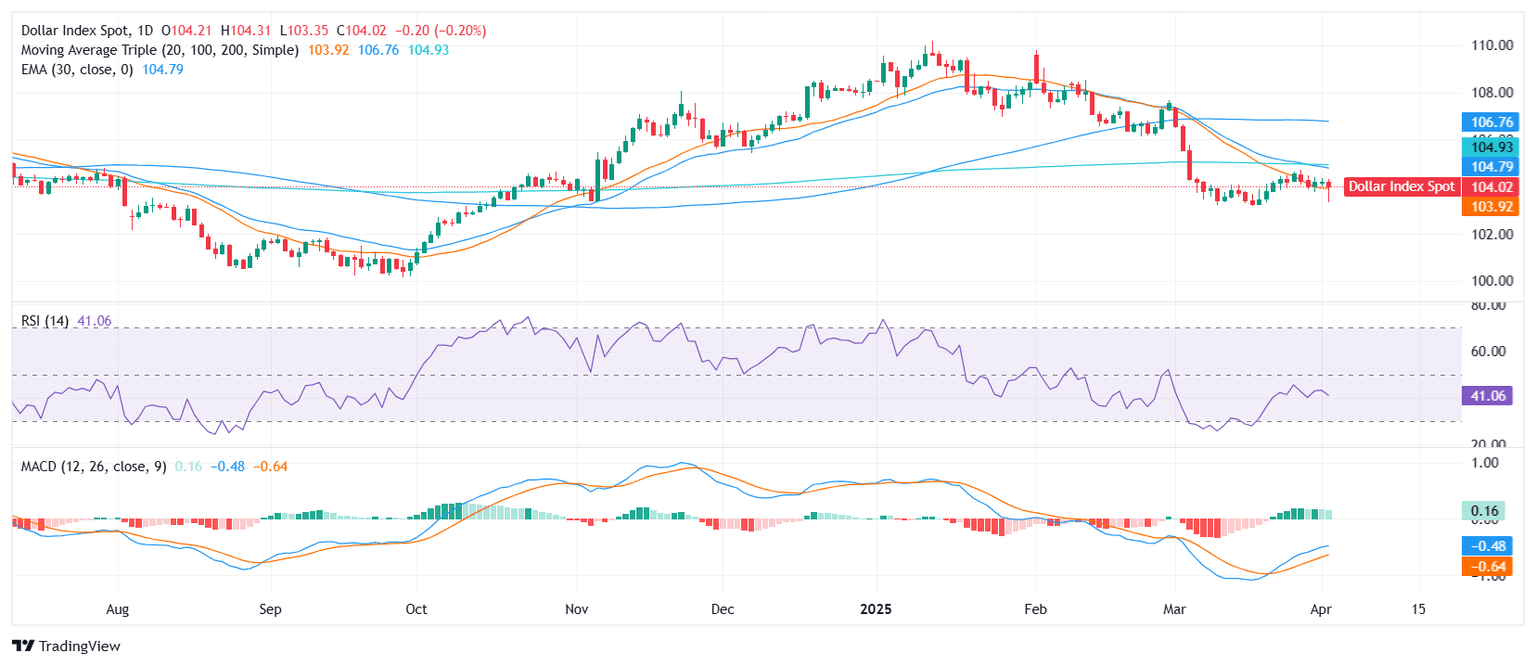

From a technical perspective, the DXY faces downside pressure as it trades around 104.00, stuck between support at 103.68 and resistance at 104.31. The Relative Strength Index (RSI) is hovering near 39, suggesting neutral momentum, while the Moving Average Convergence Divergence (MACD) presents a weak buy signal. Still, the broader picture remains bearish with the 20-day (103.91), 100-day (106.72), and 200-day (104.89) Simple Moving Averages (SMAs) all pointing downward.

Shorter-term indicators such as the 10-day Exponential Moving Average (EMA) and 10-day SMA—both sitting just above 104—further reinforce resistance ahead. Key levels to monitor include resistance at 104.02 and 104.10, while the downside could be challenged at 103.68. Despite some neutral signals from the Awesome Oscillator and Williams %R, the prevailing trend favors the bears unless buyers reclaim ground above 104.10.

DXY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.