Breaking: US Consumer Confidence eases slightly in August

- The US CB Consumer Confidence Index drops a tad in August.

- The US Dollar Index remains sidelined around 98.20.

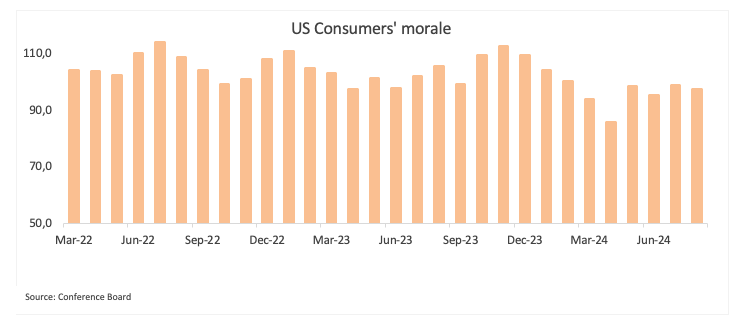

US consumer sentiment loses traction in August, as the Conference Board’s Consumer Confidence Index eased slightly to 97.4 from a revised 98.7, snapping the previous recovery.

Consumer mood deflated somewhat in August. The Present Situation Index dropped by 1.6 points to 131.2. Additionally, the Expectations Index, which measures short-term expectations for income, economic activity, and employment, fell by 1.2 points to 74.8, still remaining below the 80-point level usually associated with recession fears.

According to Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board: “Consumer confidence dipped slightly in August but remained at a level similar to those of the past three months." She added, "The present situation and the expectation components both weakened. Notably, consumers’ appraisal of current job availability declined for the eighth consecutive month, but stronger views of current business conditions mitigated the retreat in the Present Situation Index.”

Market reaction

The US Dollar (USD) trades on the defensive in the low-98.00s on Tuesday against the backdrop of renewed jitters surrounding the Fed’s independence. The move lower in the Greenback is also accompanied by mixed US yields across the curve.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.21% | -0.24% | -0.11% | -0.13% | -0.16% | -0.04% | |

| EUR | 0.25% | 0.11% | 0.12% | 0.15% | 0.17% | 0.33% | 0.23% | |

| GBP | 0.21% | -0.11% | 0.04% | 0.06% | 0.11% | 0.22% | 0.12% | |

| JPY | 0.24% | -0.12% | -0.04% | 0.05% | -0.03% | 0.23% | -0.02% | |

| CAD | 0.11% | -0.15% | -0.06% | -0.05% | -0.01% | 0.15% | -0.08% | |

| AUD | 0.13% | -0.17% | -0.11% | 0.03% | 0.01% | -0.03% | -0.08% | |

| NZD | 0.16% | -0.33% | -0.22% | -0.23% | -0.15% | 0.03% | -0.10% | |

| CHF | 0.04% | -0.23% | -0.12% | 0.02% | 0.08% | 0.08% | 0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

This section below was published as a preview of the US Conference Board's Consumer Confidence report for August at 11:00 GMT.

- The Conference Board survey expects Consumer Confidence in the US to remain subdued in August.

- The survey could shed further light on consumers’ views following the latest inflation and labour data.

- The US Dollar Index faces the next support around the 97.50 region.

The United States (US) will see the release of the August Conference Board’s Consumer Confidence Index on Tuesday. The report is a monthly survey conducted by the Conference Board that gathers information on consumer behaviour, expectations, purchasing intentions, and vacation plans.

The report contains several sub-readings: The Present Situation Index, which measures consumers' perceptions of current business and labour market conditions, and the Expectations Index, which measures the short-term outlook for income, business, and employment.

On the whole, Consumer Confidence is expected to register a mild decline to 96.4 in August after rising to 97.2 in July. In June, the Consumer Confidence Index fell to 95.2.

In July, the Present Index Situation dropped to 131.5, while the Expectations Index increased to 74.4.

How can the Conference Board's report affect the US Dollar?

The US Dollar Index (DXY) sold off on Friday exclusively in response to Federal Reserve (Fed) Chair Powell’s dovish remarks at the Jackson Hole Symposium.

Pablo Piovano, Senior Analyst at FXStreet, notes, “If the DXY slips below its multi-year low of 96.37 (July 1), the next major support lines up at 95.13 (February 4) and 94.62 (January 14).”

“On the flip side, the first obstacle is the August high at 100.25 (August 1); a decisive break there could clear the way to 100.54 (May 29) and then the May peak at 101.97 (May 12),” Piovano adds.

“Momentum indicators are also softening, as the Relative Strength Index (RSI) has eased to nearly 46, suggesting waning bullish momentum, while the Average Directional Index (ADX) is holding near 13, signalling a lack of strong directional trend”, he concludes.

Economic Indicator

Consumer Confidence

The Consumer Confidence index, released on a monthly basis by the Conference Board, is a survey gauging sentiment among consumers in the United States, reflecting prevailing business conditions and likely developments for the months ahead. The report details consumer attitudes, buying intentions, vacation plans and consumer expectations for inflation, labor market, stock prices and interest rates. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish. Note: Because of restrictions from the Conference Board, FXStreet Economic Calendar does not provide this indicator's figures.

Read more.Last release: Tue Jul 29, 2025 14:00

Frequency: Monthly

Actual: -

Consensus: -

Previous: -

Source: Conference Board

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

FXStreet Team

FXStreet