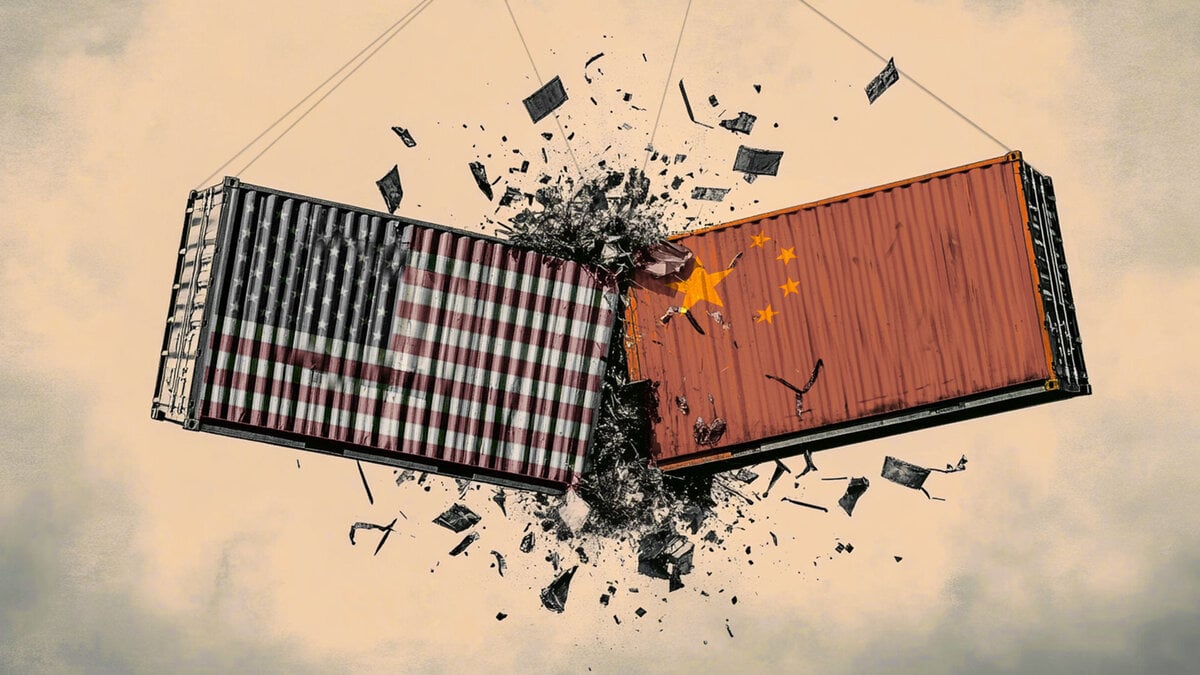

US and China to continue talks today – Commerzbank

On Monday, representatives from the US and China met in London for trade talks. Prior to the meeting, it was reported that Chinese exports had increased by 5.4% in May. However, exports to the US slumped by over 34%, marking the sharpest decline since the start of the pandemic. The reduction in additional tariffs on Chinese exports to the US from 145 to 30 percentage points on 12 May was apparently too late to prevent this significant decline, Commerzbank's FX analyst Volkmar Baur notes.

International trade may remain erratic in the near term

"The US government is planning to withdraw or soften a number of export restrictions on US technologies in order to regain full access to rare earths and their products from China. Following the escalation of the trade dispute in early April (after Liberation Day), China introduced a licensing procedure for the global export of seven rare earths and their products. This led to a decline in exports, particularly of permanent magnets. In May, China reported a year-on-year decline of 5.7% in exports of rare earths, their compounds, and products, although this figure is an improvement on April's."

"Yesterday's talks ended without a resolution, but the parties intend to meet again in London at 10 a.m. British time today. Therefore, it is quite possible that a deal will be reached today that provides for the recent restrictions to be relaxed. It is also possible that US export restrictions introduced under the Biden administration will be withdrawn. This is likely to benefit the US dollar in the short term. However, one should not be fooled by such a minor deal."

"Even after today, the environment for international trade will be worse than before the current US president took office in January. Looking ahead, it is also likely that the political environment for international trade will remain erratic, and could continue to deteriorate structurally from an economic liberal perspective. This will likely contribute to continued high volatility on the currency market."

Author

FXStreet Insights Team

FXStreet

The FXStreet Insights Team is a group of journalists that handpicks selected market observations published by renowned experts. The content includes notes by commercial as well as additional insights by internal and external analysts.