UPST Favors ((2)) pullback – Bullish structure remains intact

Upstart Holdings, Inc., (UPST) operates a cloud-based artificial intelligence (AI) lending platform in the United States. The company operates through three segments: Personal lending, Auto lending & others. It comes under Financial services sector and trades as “UPST” ticker at Nasdaq.

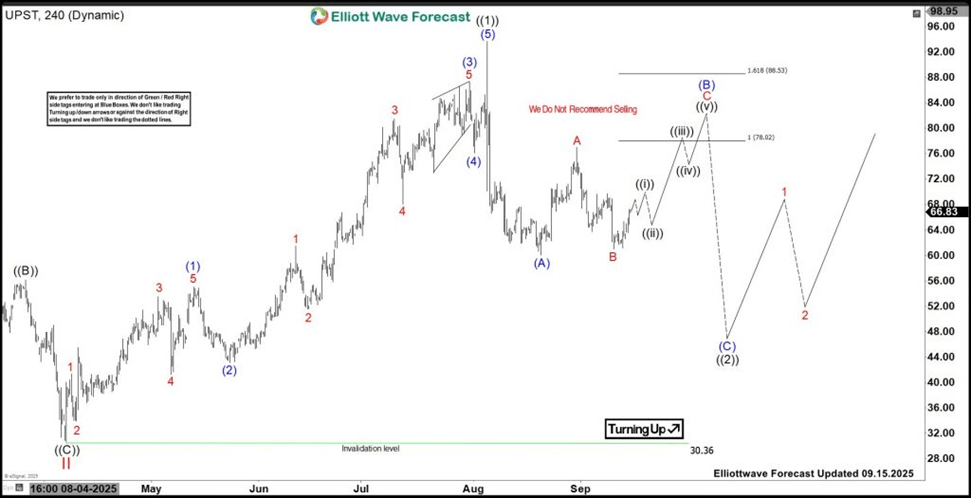

As expected in last article, UPST ended ((1)) impulse from April-2025 low at $93.67 high & correcting in ((2)) in 3 or 7 swings. We like to buy the next pullback in 3, 7 or 11 swings at extreme area, when reach.

UPST – Elliott Wave latest four-hour view

It made all time high of $401.49 in October-2021 & all-time low of $11.93 in May-2023 since inception. Above $11.93 low, it can either be nesting or diagonal structure, missing one more push higher above February-2025 high. Once it confirms 5 swings higher from May-2023 low, we like to buy the next pullback. It placed (I) at $72.58 high in August-2023 & (II) at $19.84 low in November-2023. Above there, it placed I of (III) at $96.43 high in February-2025 & II at $31.40 low in April-2025. Within III, it placed ((1)) at $93.67 high & favors bounce in (B) against 8.05.2025 high before turning lower in (C) of ((2)).

UPST – Elliott Wave latest daily view

Above II low, it placed (1) at $55.05 high, (2) at $43.08 low, (3) at $87.30 high, (4) at $76.08 low & (5) at $93.67 high as ((1)) of I. Currently, it favors ((2)) correction in proposed 3 swing pullbacks. It placed (A) at $60.05 low & favors bounce in (B). Within (B), it ended A at $76.95 high, B at $61.00 low & favors bounce in C against 8.05.2025 high. The wave C can extend towards $78.02 – $88.53 area to finish (B) before turning lower in (C) of ((2)) against April-2025 low. We can project the (C) extreme area, once it ends (B). We like to buy the pullback in (C) against April-2025 low for next move higher.

UPST – Elliott Wave view from 7.28.2025

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com