United Health (UNH Stock) Q2 earnings: Weak estimates but history supports a beat

United Health Group Inc (#UnitedHealth ) is the second-largest healthcare company in the world and the most diversified healthcare company in the US; it provides a wide range of healthcare products and services like healthcare coverage and benefits services and also applies technologies to improve access to health and wellbeing services through its 4 subsidiaries – UnitedHealthcare, OptumHealth, OptumInsight, and OptumRX – with over 330,000 employees across the world. Ranked 5th in the Fortune 500 with a market cap of $384.66B, the health care giant is set to release its Q2 2021 earnings report this Thursday (July 15) before the market opens.

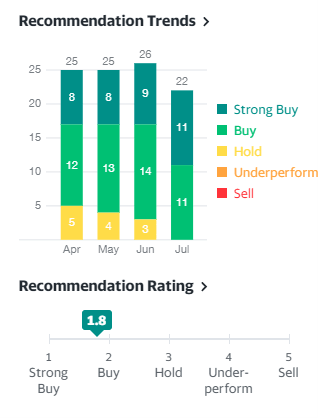

#UnitedHealth is expected to post quarterly earnings of $4.40 EPS, down 38.2% y/y, and revenue of $69.55B, up 11.9% y/y, according to Zack’s consensus estimate. Despite this mixed expectation and Zack’s Most Accurate Estimate unchanged at $4.40 EPS, indicating no revisions by analysts, the company has managed to maintain a #2 buy on the Zack ranking. Over the last 4 quarters, #UNH has beaten the consensus Earnings/share every single time, with the latest release beating estimates by 20.14% ($5.31 EPS against $4.42 EPS expected),, which puts focus on the deviation from expectation for the release. Although the unprecedented amount of monetary stimulus and low-interest rates should prove supportive for companies like #UnitedHealth, 22 analysts from Yahoo finance research estimate a buy and strong buy bias on the share price while Trefis values the 44-year-old company at $422, above the current market price.

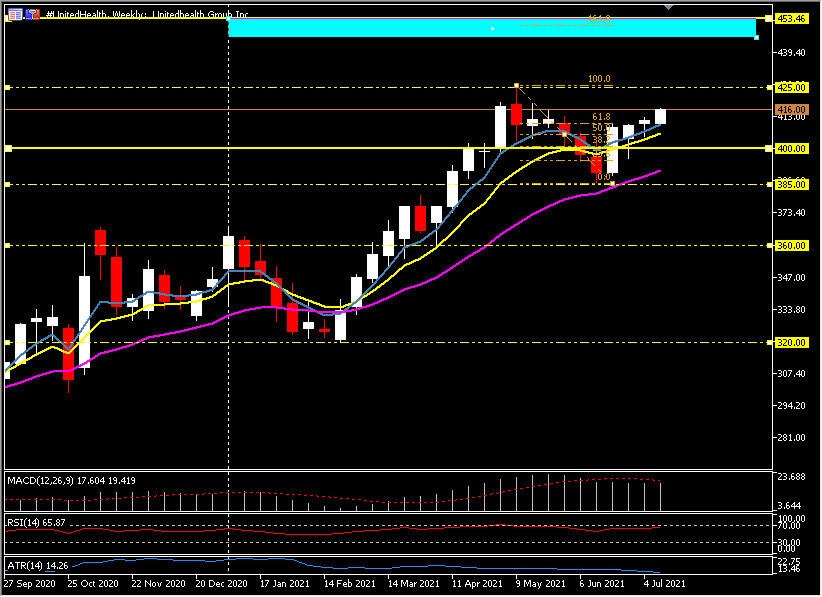

Technically, #UnitedHealth maintains a bullish trend, having risen almost 16% from 2020 highs to create a fresh ATH around $425; it is currently trading around $416 (above the 20 SMA and 50 SMA). May highs at $418 serve as the immediate resistance level and if broken, the $425 ATH will be the next stop if expectations are beaten by a good variance. Technically, the next key Fibonacci levels the 261.8 (from the January-February decline) and the 161.8 (from the May-June decline) create a new target zone $445-453.

On the other hand, a miss in the numbers could see the share price dip from these high levels – an excuse for profit-taking – towards the 20 SMA and 50.0-38.2 Fib zone at $405-400. Below here is the June low at $385, the April low at $360, and the 2021 low from February at $320.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.