Twitter says show me the money as it stays committed to previously agreed price

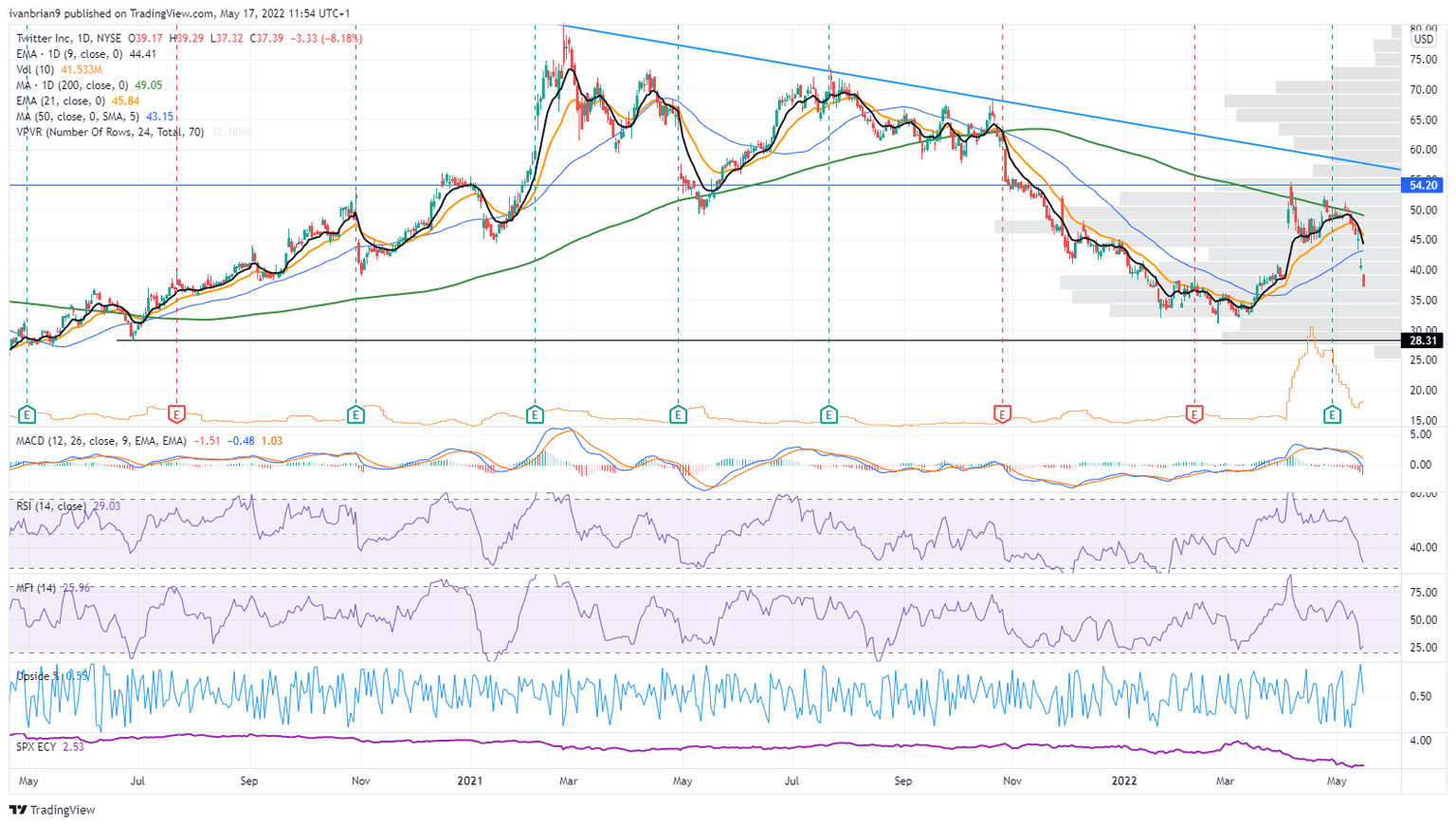

- Twitter clinging to agreed upon $54.20 price.

- Elon Musk still has issues over the number of bot accounts.

- TWTR stock fell 8% on Monday below $40.

Twitter Stock News: Board not backing away from $54.20

Twitter (TWTR) made its intentions quite clear in an announcement this morning. The social media platform said it filed a proxy statement with the Securities & Exchange Commission (SEC) and that it was "committed to completing the transaction on the agreed price and terms as promptly as practicable."

In other words, it is time to put up or shut up for the buyer, Tesla CEO Elon Musk. The deal has been dragging on and on now for some time. It always looked unlikely to get across the line in our view. The market largely agreed as merger arbitrage players never chased this. Last week the bots took over and put the deal on hold! So where are we left? We feel the deal is unlikely to get done even at a lower price now. We base this on market conditions, the decline in Tesla's stock price, as well as the potential for things to turn nasty.

On Monday Musk tweeted that Twitter's legal team had contacted him to say he was in breach of a non-disclosure agreement. So it seems the two parties are getting more entrenched and further apart. Regular readers will know one of our favorite sayings is that the market hates uncertainty, and there is a lot of uncertainty here. Growing by the day.

Twitter Stock Forecast

Twitter stock took a hefty 8% fall on Monday and is now back toward levels preceding Elon Musk announcing his initial stake. There may be more pain to come though, given the Nasdaq is down nearly 20% over that time horizon. Tech stocks are not exactly loaded up with potential buyers. Hence, this is why we outlined our potential short and risk reward thesis. Twitter heads for sub-$30 if this deal falls through. Sentiment and confusion is also hurting Tesla's stock.

TWTR stock chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.