TSLA Stock Price and Forecast: Will Elon sell Tesla shares?

- Tesla stock drops nearly 5% on Monday.

- TSLA shares hurt by Elon Musk tweets about selling shares.

- Tesla has been showing up as overbought since breaking above $1,000.

As expected, Tesla (TSLA) shares took a long-awaited tumble on Monday after Elon Musk tweeted about selling some of his stock over the weekend. It is hard to keep up with Elon as he has so much going on, but he does keep Twitter entertaining with his comments and jibes against other billionaires, and he is no stranger to controversy. Elon Musk has irked regulators before with some of his tweets, and this latest one may not be what his shareholders wanted to hear as it seems to have had a direct impact on the stock price.

Just in case you missed it, Musk tweeted over the weekend about selling 10% of his holding in TSLA. He is a large shareholder obviously, so 10% is a serious chunk of change. Mr. Musk ran a Twitter poll asking if he should he sell the stock to pay taxes, and the poll was strongly for him to sell.

Tesla (TSLA) chart, 15-minute

Tesla (TSLA) stock news

Elon Musk posed the question in relation to the proposal by Democrats to tax unrealized gains of billionaires. There are numerous billionaires sitting on huge gains made by the rapid appreciation of their stock price. 2021, in particular, has seen stock prices rocket to record levels, and billionaires with large stakes in public companies like Musk have seen their wealth skyrocket. However, this is paper wealth. Only when realized by being sold does it become liable to tax. The Democrats are talking about changing that though, as America grapples with rising inequality and calls for wealth taxes grow.

EMusk tweeted to his followers on Friday night: “Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.” The poll received about 3.5 million votes with 58% voting in favour of him selling stock. Musk said he would abide by the results of the pool, whichever way it went.

The New York Times ran an interesting article yesterday on Elon Musk's potential upcoming tax liability. The article stated: "He holds nearly 23 million stock options that were awarded in 2012. Those options have since vested and will expire in August 2022...But Brian Foley, an executive compensation consultant, says that because of the size of Mr. Musk’s grant and the way it was structured, much of his 2012 options aren’t likely to qualify for the preferential tax treatment. That means Mr. Musk would owe income taxes when he exercised the grant, which at current prices would be worth just under $30 billion. His tax bill could top $10 billion."

Separately, Reuters is carrying a report this morning from DigiTimes that Tesla is likely to establish another Chinese factory, in addition to its Shanghai plant. China is the world's largest market for electric vehicles, and the government has strong initiatives backing EV usage.

Tesla (TSLA) stock forecast

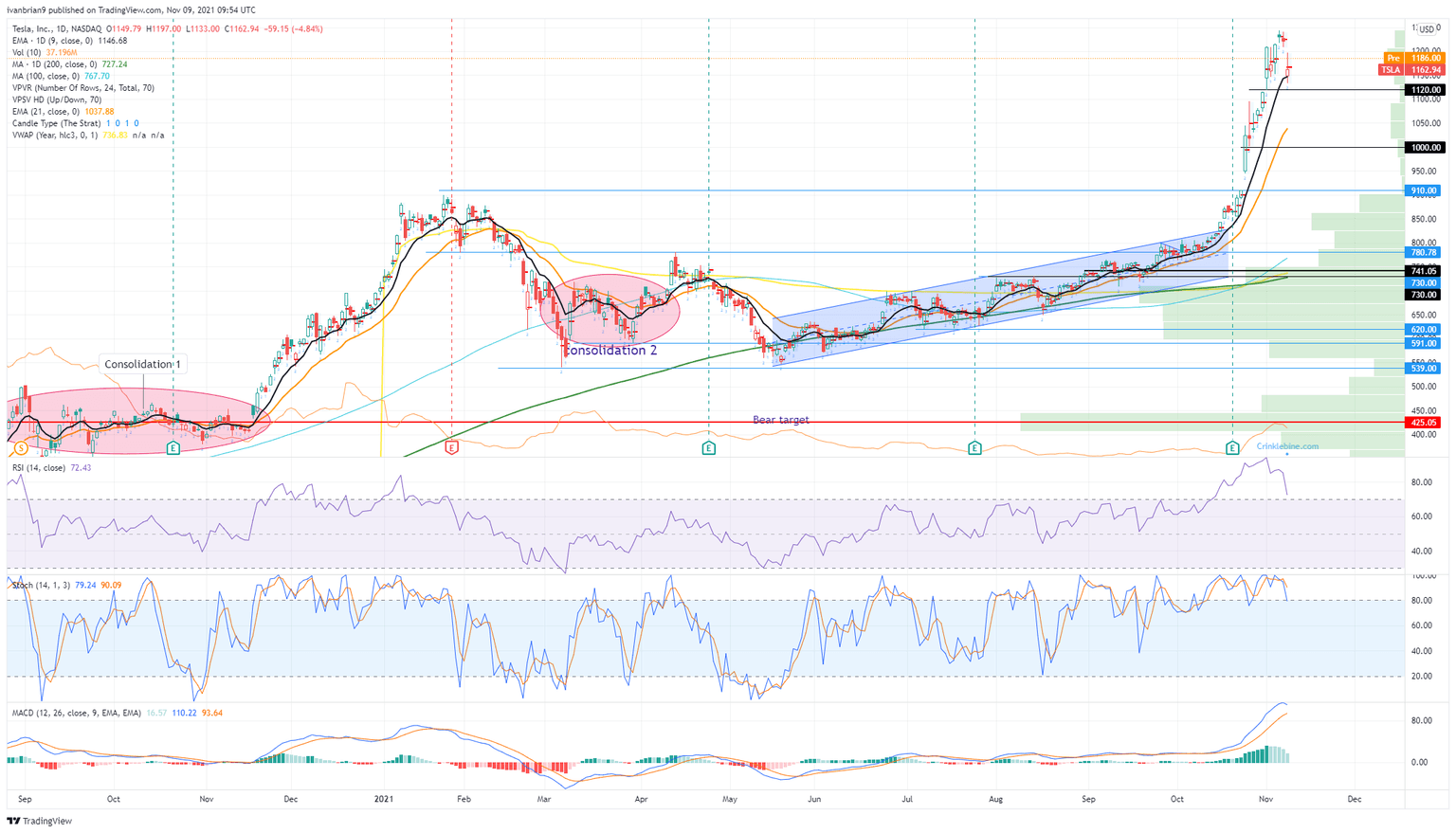

Ignoring all the noise and focusing on the chart, the move on Monday has retraced Tesla shares to the 9-day moving average – perfect short term support then. This is a potential quick swing play for short-term traders, but always have a stop in place. $1,120 is our key pivot in the short term as this is where the second stage of the explosive move took off from. Breaking these will likely see a move to test $1,000. In order for the recent move to have any hope of continuation, it needs to form a continuation pattern, which would mean holding $1,120.

The RSI remains strongly overbought, and we also had a bearish crossover from the stochastic indicator last week. The risk reward looks skewed to the downside in our view.

TSLA daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637720486192885201.png&w=1536&q=95)