TSLA Stock Price and Forecast: Are insiders selling Tesla shares?

- TSLA rally continues as Fed clears the way for more gains.

- Tesla stock struggling to see any bears left alive in this one.

- Some Tesla insiders sell and take advantage of record-high prices.

Tesla (TSLA) stock just keeps on going, pushing the valuation metrics beyond anything comprehensible to normal valuation metrics. We struggle to see how anyone can put a reasonable justification on this one. I am an accountant and economist and can clearly see how the valuation has become stretched even by the standards of mega growth names.

However, I am also a trader and student of behavioural economics and can see how momentum works and draws in more and more, so the trick is to ride that train and manage risk accordingly.

I am also a huge admirer of Tesla and Elon Musk. Both have single-handedly created a marketplace for electric vehicles and dragged mainstream automakers into the space. In effect, Tesla is helping to turn the entire auto industry green. However, despite such admiration, I must confess to seeing the current valuation as sky-high. Can Tesla continue to offer stratospheric growth levels to justify such a high valuation? Amazon went through a similar phase too, so is Tesla on a similar path and growth trajectory to Amazon (AMZN)? Short-term traders need not concern themselves with such valuation calculations. They need to focus on the trend and use strong risk management.

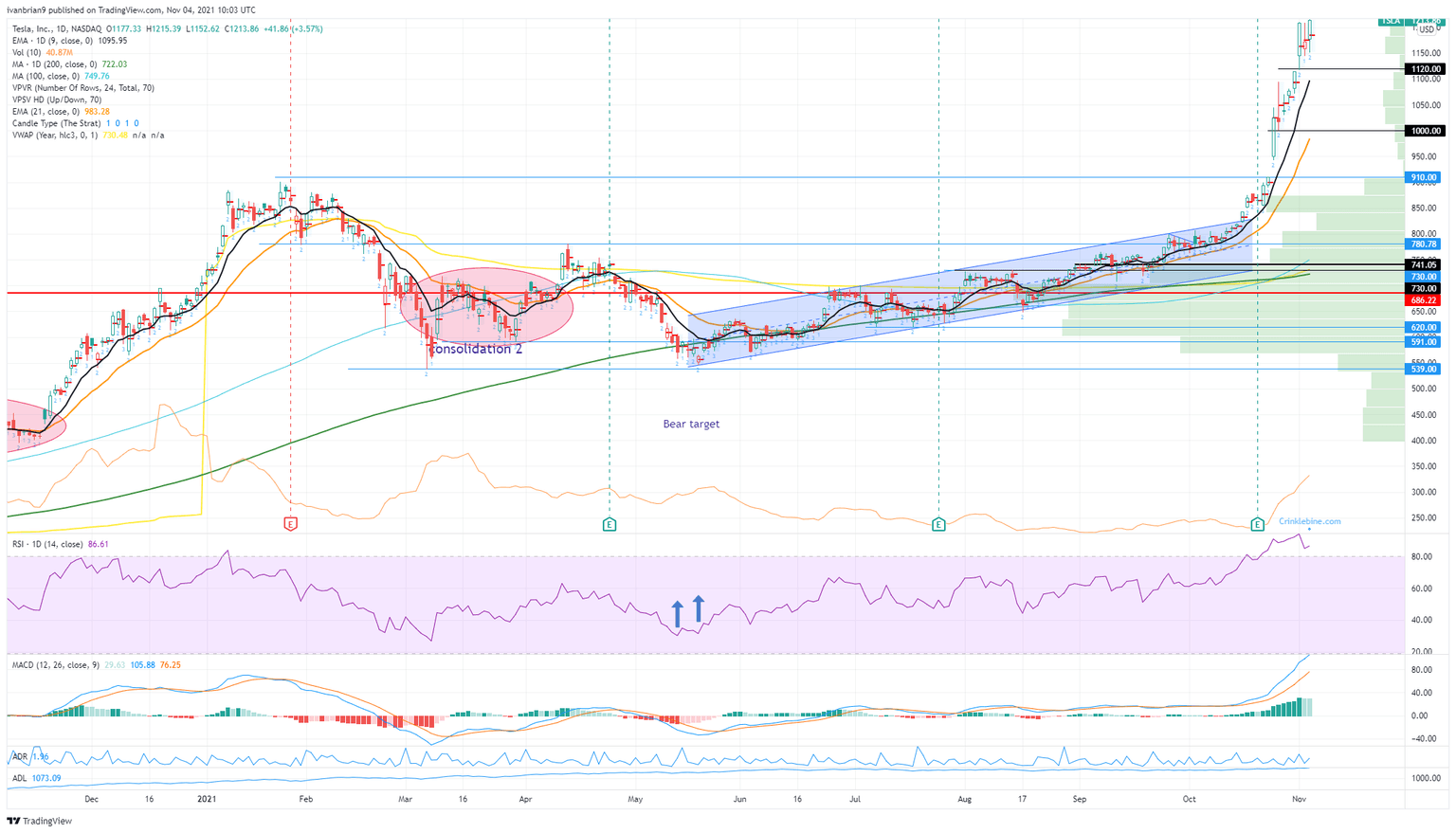

Tesla 15-minute chart

The intraday chart above shows the 40% gain over the last month for Tesla shares and that looks suspiciously like a double top to me.

Tesla (TSLA) stock news

We do note the increasing amount of insider selling seen recently in Tesla stock. No surprise given the stock price appreciation, but pause for thought nonetheless. There have been many studies done on insider sales as a leading indicator for stock price falls, so keep a close eye on this. So far the number of sellers are not large, but watch for further disclosures. The latest sale to hit the SEC filings is a sale of 25,000 shares by Tesla board chair Robyn Denholm. The options for those shares were exercised at a price of $52.38 per share and sold for up to $1,147.30 each, according to the SEC filing. Nice!

Options volume remains sky-high in Tesla (TSLA) with the latest record move being driven by record buying of Tesla call options, many expiring tomorrow, Friday November 5. That could make next week interesting. The whole Hertz saga continues on without much resolve. Elon Musk had dampened down news of the deal with Hertz saying it made no difference to Tesla economics and that no deal was signed anyway. Hertz seemingly responded, saying it had seen huge demand for Teslas and had already taken some deliveries. Hmm, interesting, that one.

Tesla (TSLA) stock forecast

Momentum looks to be stalling her with Wednesday's high only just taking out the high from Monday and Tuesday. The Relative Strength Index (RSI) is massively overbought, so a correction is long overdue. The Moving Average Convergence Divergence (MACD) histogram is also signalling that the speed of the move is too stretched even for Tesla. This though is a dangerous game, trying to pick a top. Usually it is safer to keep the trend on your side, so please use solid risk management if you are taking bearish positions.

We should note that volatility in Tesla is now extremely elevated, so buying call or put options are expensive. For those looking to buy dips, support at $1,120 is where the move really went into overdrive. $1,000 is a round number psychological level. Below $910 is where it all began and where traders witnessed a 12% gap up. We cannot bring ourselves to recommend this as a long despite such a powerful trend. If you are long – well done. Now use some form of trailing stop to protect your profits.

TSLA 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637716172665543770.png&w=1536&q=95)