TSLA Stock Forecast: $1,000 retested on Tesla’s first German-made cars rollout

- NASDAQ:TSLA briefly recaptures $1,000 on the new German factory.

- Tesla is hosting GigaFest in Texas on April 7th.

- A cryptic tweet from CEO Elon Musk is bearish on artificial intelligence.

Update: Shares of the electric vehicle (EV) giant Tesla Inc. extended their winning streak into the seventh day in a row on Wednesday, reaching the highest level in two months at $1040.34. TSLA stock price pared some gain to close the day at $999.11, still up 0.52% on the day. The Tesla share price briefly recaptured the $1,000 mark as the company’s CEO Elon Musk officially opened the new Giga Berlin (or Gigafactory Berlin) plant in Grünheide. The Berlin factory is expected to produce up to 500,000 vehicles annually. “Musk was seen dancing as he presided over the delivery of Tesla’s first German-made cars to 30 clients and their families at the carmaker’s 5-billion-euro ($5.5 billion) plant,” per CNBC News.

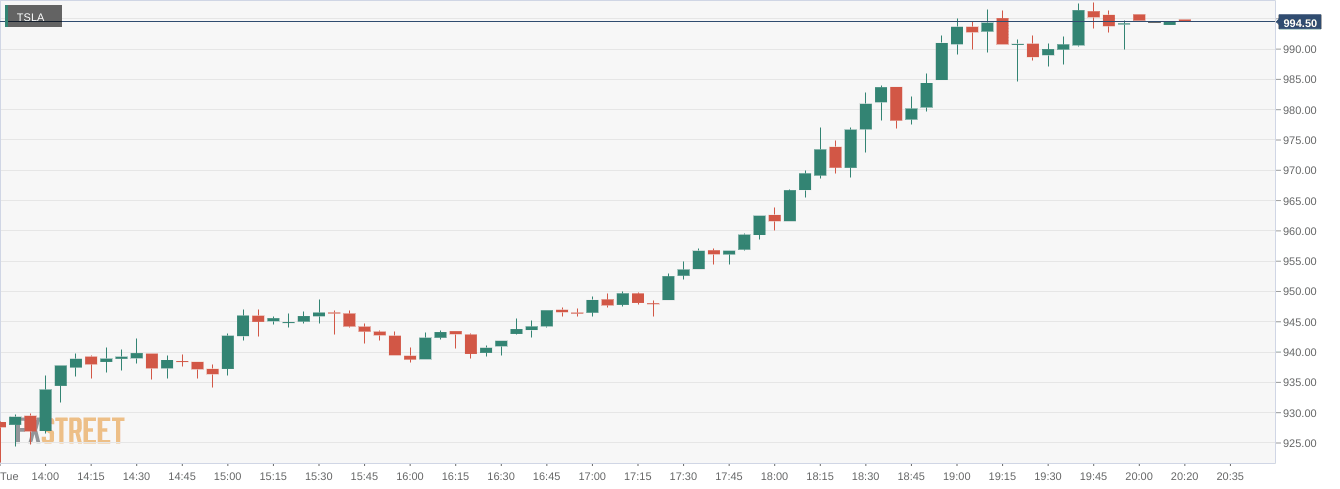

NASDAQ:TSLA has been on fire over the past week and has used the momentum of the Berlin GigaFactory opening as a launchpad back towards $1,000 per share. On Tuesday, shares of TSLA jumped a further 7.91% and closed the trading day at $993.98. It was another bullish day for the broader markets as they continued higher yet again after taking a breather during Monday’s session. The Dow Jones gained 254 more basis points, the S&P 500 added 1.13%, and the NASDAQ soared higher, adding a further 1.95%. Shares of Tesla are now up by a staggering 23% over the past week and more than 30% for the month.

Stay up to speed with hot stocks' news!

After cutting the ribbon to open the Berlin GigaFactory earlier today, Tesla announced that it is holding its GigaFest celebration in Texas on April 7th. Sure these events are mostly for Tesla fans, but if the Berlin opening was any indication there could be some important figures in attendance. Tesla has also used these events in the past to make major announcements for the future of the company, so don’t be surprised if CEO Elon Musk has something up his sleeve with all eyes in the industry focused on Tesla.

TESLA stock news

Speaking of Musk, the enigmatic CEO was back at it on Twitter on Tuesday. Musk had a cryptic tweet that ‘Main Tesla subjects, will be scaling to extreme size, which is needed to shift humanity away from fossil fuels, and AI’. While the mention of fossil fuels is an obvious nod to Tesla’s EV and solar business, the shift away from AI seems to contradict Tesla’s recent Tesla Bot project, as well as the FSD technology for its vehicles.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet