Trump refocuses on desire for lower interest rates during Fed renovation tour

United States President Donald Trump toured the Federal Reserve's (Fed) main headquarters in Washington, DC on Friday. President Trump recently pivoted to criticizing the Fed's long-planned renovations of its headquarters. Trump, who oversaw a top-to-bottom refurbishment of the White House interior to include gilded accents, has claimed that the Fed's renovation is an unnecessary expense to US taxpayers in a bid to further close the gap between the executive branch's ability to control the US central bank, which currently lies outside of the President's extensive reach.

While Trump was touring the Fed, it was noted that a large part of Trump's calculations on the Fed's overspend on renovations includes a hefty chunk of building costs for projects that were approved and started in 2017 during Trump's first term, and completed within the past five years. The Fed's main Eccles building is also long overdue for upgrades to bring the building back in line with federally mandated health and safety guidelines that the Trump administration appears to be in no rush to eliminate or remove.

During Trump's Fed tour, US Treasury Secretary Scott Bessent gave an interview on Fox Business, reiterating the Trump team's common refrains against the Fed and also pivoting back into talking about US-China trade talks and tariffs in general.

Key Trump highlights

Tough construction job.

A lot of very expensive work at Fed building.

Looks like Fed building costs went up a lot.

Too bad it started.

I want rates lower.

We'll see how the Fed board rules on interest rates.

We looked around. They have to finish it.

Interest rates have to be lower.

We should have the lowest interest rates of any nation.

I want rates down, and the Fed building finished.

Very good Fed tour.

We sort of understand what happened.

We'd do better if we had lower interest rates.

We have to get housing prices down, and interest rates down.

We're in the process of making a deal with Europe.

We're doing well with the EU.

Europe wants to make a deal very badly.

Bessent highlights

Other Fed operations might impact monetary independence.

Fed's footprint has become too big.

The Fed has undue influence on the economy.

The Fed should get back to the basics.

Countries are willing to pay a toll to trade with the US.

The US is in a pretty good place with China on trade.

I will talk to China about them buying sanctioned oil from Russia and Iran.

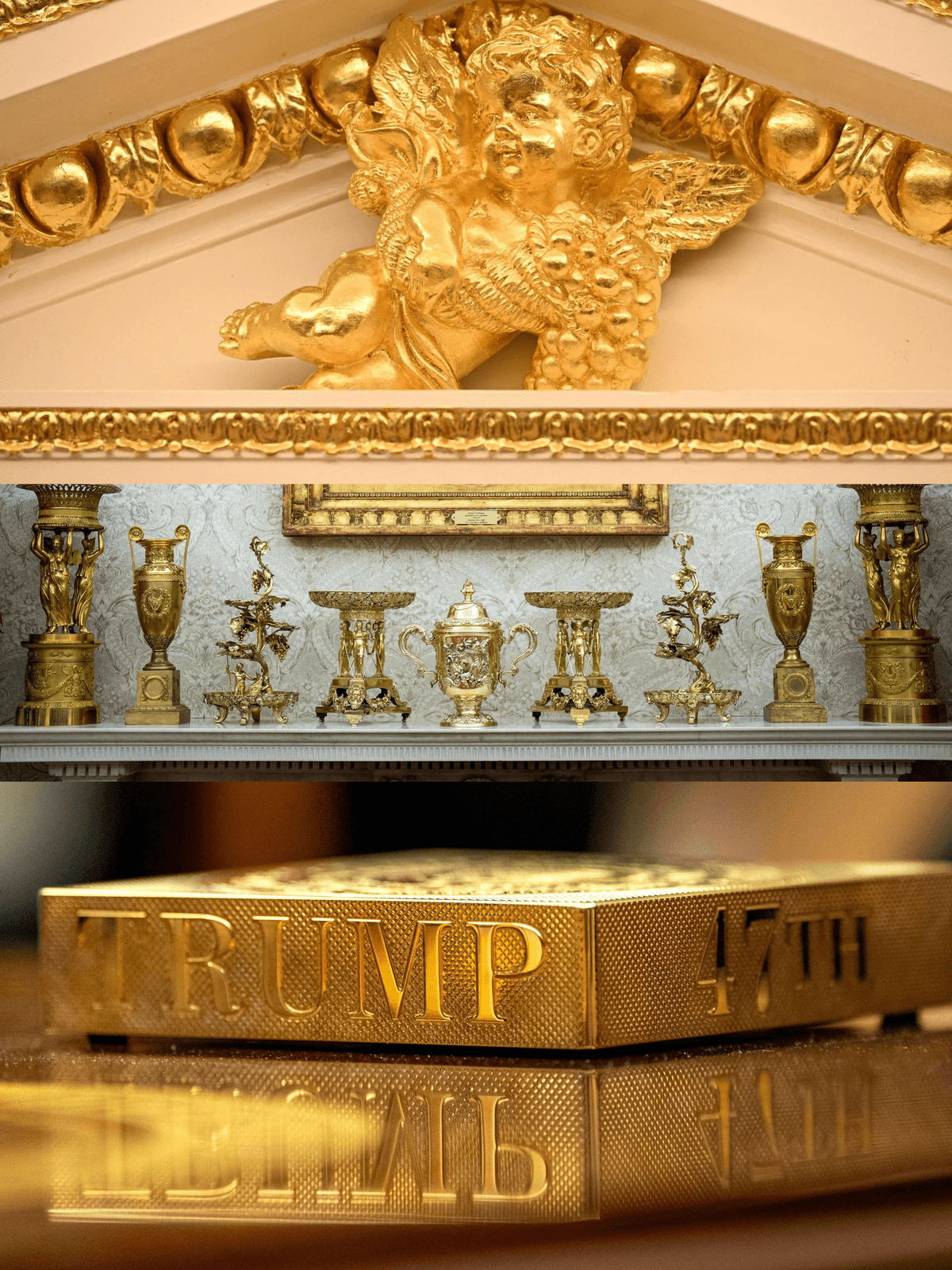

Snapshots of some of the gilded accents and accessories added to the White House by President Trump's retinue during his second term

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.