Three AI-related earnings releases to focus on next week

The upcoming week will feature several key earnings releases from companies operating in the AI sector. Investors will be closely monitoring the financial results of Nvidia, Salesforce, and Dell Technologies. These companies' performance will provide potential valuable insights into the current state of the AI industry and its growth prospects.

Nvidia's Q2 earnings: A crucial test for AI and semiconductor industries

Nvidia's stock price experienced a roller coaster ride in August. Following a brief dip below $100 at the beginning of the month (to around $92), the stock staged a strong recovery, rallying by over 38% to reach around $128 on August 21st.

Nvidia Daily Chart - Source: ActivTrader

As the dominant player in the AI processor market, with an 80% market share, Nvidia's earnings report will be closely watched by investors on Thursday, August 28th, after the close of the trading day. The results will offer valuable insights into the overall health of both the AI and semiconductor industries.

A strong performance, characterised by robust financial results, positive growth prospects, and encouraging guidance, could significantly boost Nvidia's stock price and bolster confidence in the AI industry. This could also have a positive ripple effect on the broader market, as investors assess the potential of AI-driven technologies to drive future economic growth.

Analysts are anticipating a strong performance from Nvidia in its upcoming Q2 earnings report. Forecasts suggest earnings of 64 cents per share and revenue of $28.65 billion.

Several professional analysts have expressed optimism over Nvidia's prospects. HSBC analyst Frank Lee has raised the price target for Nvidia's stock to $145, citing the underlying strength of AI GPU demand as a key driver for the company's continued success. Goldman Sachs analyst Toshiya Hari has also reiterated a "buy" rating with a $135 target, emphasising Nvidia's robust competitive position and strong demand for its products.

Salesforce Q2 earnings: Can AI drive growth?

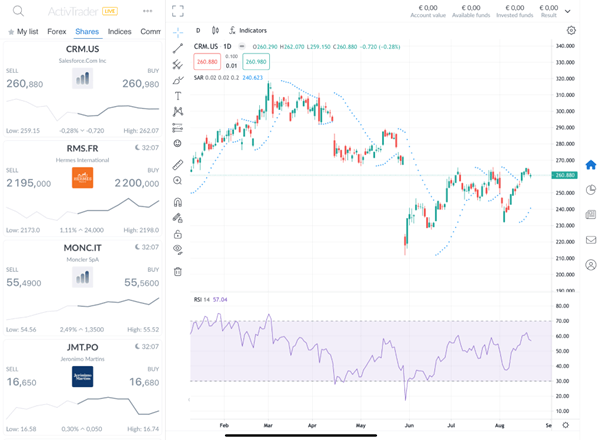

Salesforce, the leading cloud-based CRM platform, is set to report its second-quarter earnings for fiscal year 2025 on August 28th. Analysts are anticipating a solid performance, with projected year-over-year increases of 11% in EPS and 7% in revenue.

In the previous quarter (Q1 FY 2025), Salesforce delivered revenue growth of 11% to $9.13 billion and a substantial increase in free cash flow of 43% to $6.08 billion. However, the market reacted negatively to the report, as it fell short of expectations, leading to a flat stock price for 2024. This marked the first revenue miss for the company since 2006, attributed to budget scrutiny and extended deal cycles according to its CEO, Marc Benioff.

Salesforce Daily Chart - Source: ActivTrader

Despite the Q1 setback, Salesforce has maintained a positive outlook for the fiscal year. The company has raised its earnings forecast to $9.86-$9.94 per share, compared to the previous estimate of $9.68-$9.76.

The success of Salesforce's recently launched Einstein Copilot, a customizable AI assistant for CRM, will be a key area of focus for investors during the company's Q2 earnings report. This tool, and its ability to drive revenue growth through generative AI integration, is crucial for Salesforce's future.

Salesforce's overall growth hinges on the successful adoption of its AI products. These AI-powered business intelligence tools offer significant benefits to existing customers, including faster data insights, increased automation, and improved innovation and agility. However, unlocking these benefits requires two crucial elements: high-quality data and robust data strategies.

Beyond the potential of AI, Salesforce also faces a challenge. With the AI sector rapidly innovating, there's a risk that customers might shift resources towards new AI startups instead of investing in Salesforce's offerings.

Salesforce's Q2 earnings will be a critical indicator of their ability to capitalise on the AI boom. Investors will be looking for evidence of strong revenue growth driven by AI adoption, alongside strategies to mitigate the risk of customer distraction by competitors. The success of Einstein Copilot and their overall AI strategy will play a significant role in determining Salesforce's future performance.

Dell Technologies: Will AI server demand fail to impress again?

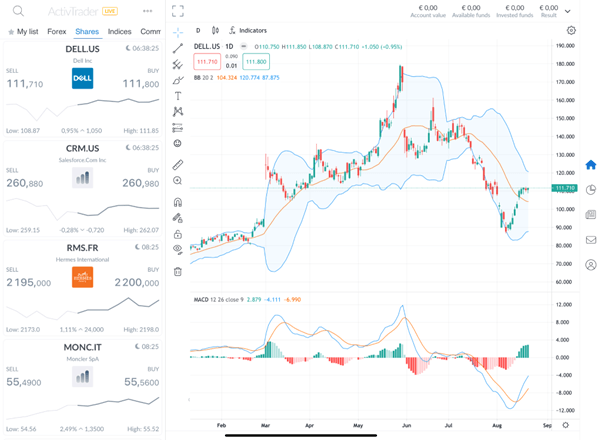

Dell Technologies has solidified its position as a leading vendor of AI-oriented servers, a market experiencing rapid growth as companies invest in infrastructure to support predictive analytics and generative AI. The company's strong performance in the first quarter of 2024, with earnings and sales exceeding analyst expectations, further cemented its leadership.

However, despite the surge in demand for AI servers, Dell's profitability in this segment remains a concern. While the company's overall sales have grown, operating profits from its server business have remained flat, raising questions about the margins associated with AI server sales. Bernstein analyst Toni Sacconaghi has highlighted this issue, suggesting that AI servers may be sold at near-zero margins.

This profitability challenge has had an impact on Dell's stock price. Despite a significant rally of over 141% since the beginning of the year until the earnings report at the end of May, the stock experienced a temporary pullback following the release of the first-quarter earnings report.

Dell Technologies Daily Chart - Source: ActivTrader

Investors may have been disappointed by the lack of substantial profit growth from the AI server business, leading to a short-term decline in the stock price. However, the stock has since rebounded, gaining over 20% since the earnings announcement.

Despite the short-term challenges associated with AI server profitability, Dell's strong market position and the potential for future improvements in this area could be driving investor confidence. As investors await Dell's next earnings release, they will be closely watching for signs of progress in addressing profitability concerns related to AI servers.

A demonstration of improved margins or a clear roadmap for achieving higher profitability in this segment could further bolster investor sentiment and drive the stock price higher.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.