This chart pattern just flashed a hidden demand signal – Is the market ready to rip higher? [Video]

![This chart pattern just flashed a hidden demand signal – Is the market ready to rip higher? [Video]](https://editorial.fxsstatic.com/images/i/General-Stocks_1_XtraLarge.png)

Watch the video from the WLGC session on 27 May 2025 to find out the following:

-

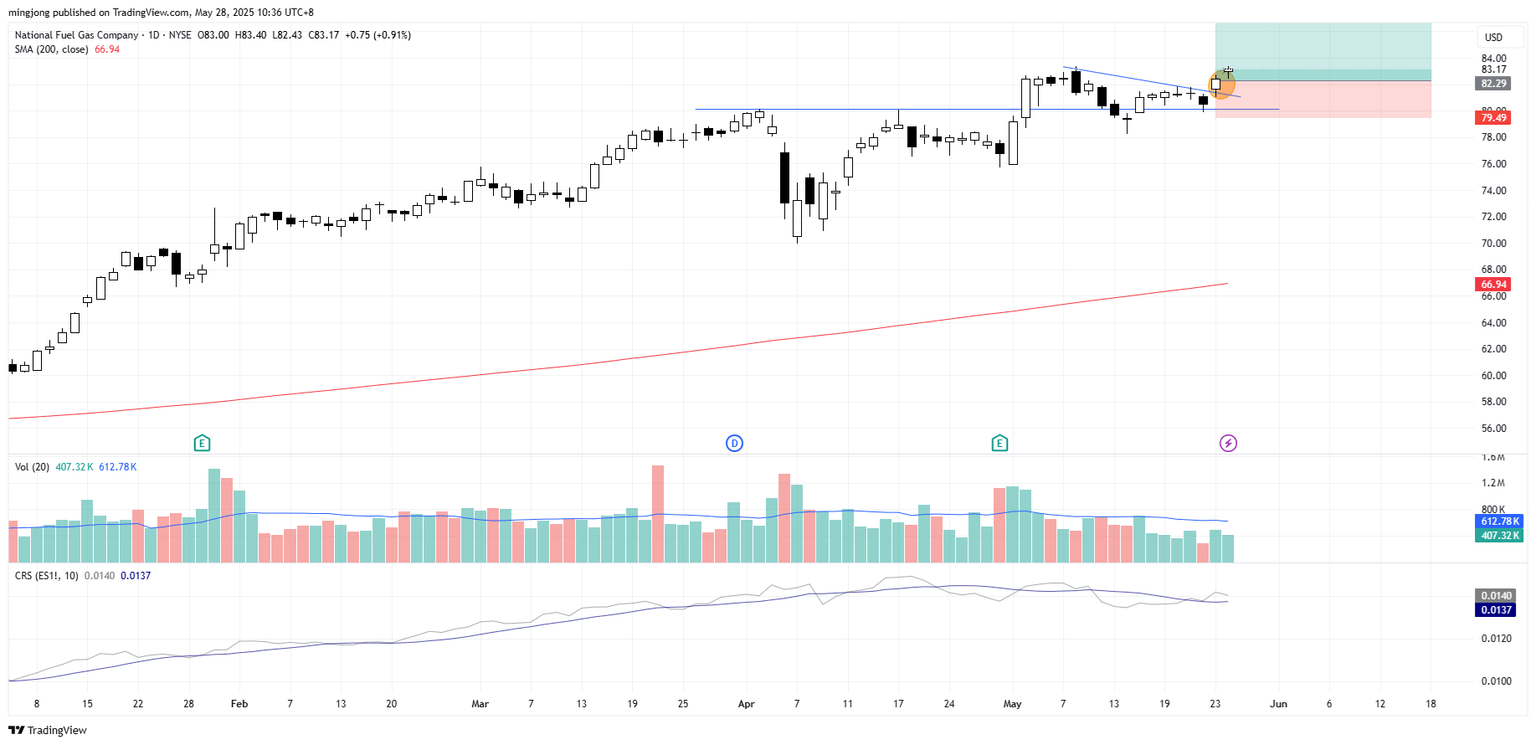

What does the hidden demand on Thursday and Friday really tell us about market direction?

-

Why is the gap-up bar (on 12 May 2025) so critical, and what happens if it holds??

-

What clues is volume giving us right now, and how should we trade it?

-

And a lot more.

Market environment

The bullish vs. bearish setup is 352 to 73 from the screenshot of my stock screener below.

Three stocks ready to soar

26 actionable setups such as GRND, SERV, NFG were discussed during the live session on 27 May 2025 before the market open (BMO).

Grindr (GRND)

Serve Robotics (SERV)

National Fuel Gas Company (NFG)

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.