The VanEck Merk Gold ETF delivers, literally

While other exchange traded gold products had outflows for several months, OUNZ - we refer to the VanEck Merk Gold ETF by its ticker symbol - bucked the trend, gathering more gold. I created OUNZ in 2014 in response to criticism in the blogosphere about the large exchange traded gold products then in the market. Recently, the gold held by OUNZ exceeded US$1 billion - I couldn't be prouder of my team and our relationship with VanEck. Let me explain why OUNZ is different and, in my humble, admittedly biased opinion, a better way to hold gold.

Ultimately, the beauty of physical gold is that it doesn't have counter-party risk; except, you introduce risk the moment you touch it. Even when you buy a gold coin, you introduce counter-party risk, namely yourself as you could lose it. And once you own the physical coin, you may worry about theft. For smaller gold holdings, a coin under the pillow might do, but what about if you want to hold larger amounts? I created OUNZ to provide a vehicle to allow investors to hold gold cost effectively while allowing the flexibility to request delivery at any time. I always eat my own cooking when it comes to investment products and personally own several thousand ounces of gold through OUNZ.

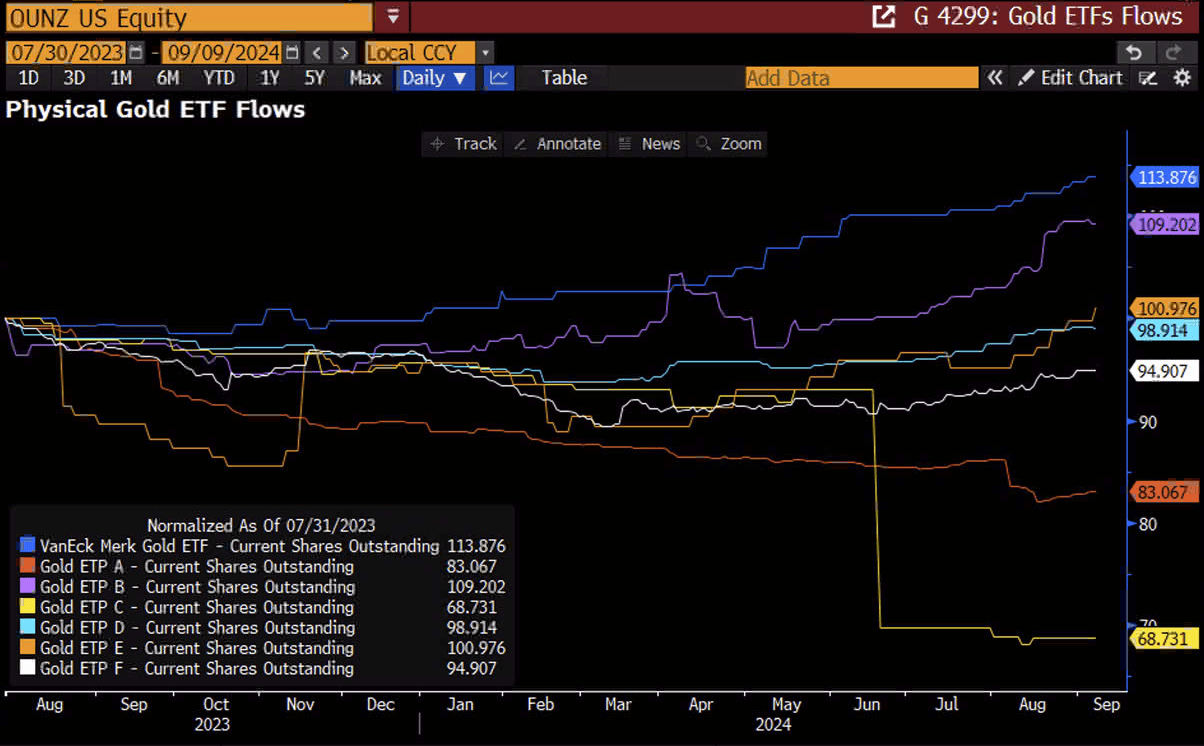

But I get ahead of myself. Below is the growth in shares outstanding of U.S. exchange traded gold products over $500 million over the past year. OUNZ, in blue, is on top:[1].

Noteworthy during this period is that physical gold buying has been in the news - even Costco got involved - while exchange-traded products only had a lukewarm reception, with several experiencing outflows. Which gets me to what may be the most important differentiator between OUNZ and the rest of the pack: investors in OUNZ have the option to request delivery of the gold they own. This positions OUNZ in the realm of physical gold in the minds of many investors. While most investors elect not to take delivery of the physical gold, they appreciate the optionality. It has the side effect that, in our experience, OUNZ tends to attract the more long-term oriented investor with an appreciation for physical gold rather than the speculator looking for an instrument to bet on the price of gold short-term. A few tidbits you may not be aware of:

-

OUNZ's delivery feature is not merely theoretical, OUNZ literally delivers. Year-to-date, OUNZ has delivered 383 ounces of gold.

-

Retail investors generally do not have an interest in taking delivery of the so-called London bars OUNZ holds. Those are the large "James Bond" looking bars held by institutions. As a result, we built a unique, patented interface, to allow for the exchange of the London bars held by OUNZ into other coins and bars.

-

Taking delivery of gold is not a taxable event because you merely take delivery of what you own through OUNZ.[2].

-

We applied for and were granted a patent because we devised a process that's scalable. Our process allows us to efficiently process applications should there be a surge for deliveries.

-

When you request delivery, you pay the premium of the coin over the spot price of gold. We offer deliverability as a service, not a separate profit center. As such, those who have done the math (see merkgold.com/fees) may notice that is often less expensive to get gold through us than a coin dealer if it's more than just a few ounces.

-

While investors may always request London Bars, other coins and bars are available based on inventory at our dealer. During the pandemic, when inventory for coins was tight, some investors purchased OUNZ to lock in the price of gold, wait, and then request delivery when premiums were more in line with historic levels.

Another reason why OUNZ has been popular with some investors of late may be that, a year ago, we eliminated a historic quirk in the industry: whereas our competitors value their gold based on the price of gold in London in the afternoon (and then only when the UK is not on holiday), we price OUNZ’s gold based on the closing price of gold at the New York Stock Exchange. To facilitate this, we work with index provider, Solactive, which created the Solactive Gold Spot Index. As a result, the Net Asset Value premium or discount over the past 12 months, on a closing basis, is near zero for OUNZ (source: Bloomberg).

At Merk, for what it’s worth, we think in terms of ounces more so than dollars. Did I mention that at OUNZ, our management fee is paid in shares of OUNZ? As such, we get paid in gold and no gold needs to be sold to pay Merk. Merk, in turn, pays OUNZ’s ordinary expenses which, again, means OUNZ does not need to sell any gold.

Which reminds me to clarify another misconception: what happens if demand for OUNZ is high and there’s no gold available at the vault to issue new shares? One of the principles of OUNZ is that shares must not be issued unless the custodian confirms that gold has been delivered and allocated. That’s right, we never buy gold; in the unlikely scenario that there would be no gold available, but there would be demand for OUNZ, we would not issue any shares. In this context, if you look closely, you may have noticed that, unlike our competitors, it’s only OUNZ’s secondary objective to track the price of gold. The “primary objective is to provide investors with an opportunity to invest in gold through the Shares and be able to take delivery of physical gold bullion (physical gold) in exchange for their Shares.”

Author

Axel Merk

Merk Hard Currency Fund

Axel Merk is the Founder and President of Merk Investments. Merk is an expert on macro trends, hard money, international investing and on building sustainable wealth.