The US stock market: What happens after DeepSeek and Trump’s tariffs?

The US stock market has taken a few knocks so far in 2025. After riding high in 2024, US blue chip stock indices underperformed European indices in January, DeepSeek weighed heavily on US chip stocks last week, and now President Trump’s trade wars are also weighing on market sentiment.

The great tech rotation of 2025

Nvidia is down 13% YTD and has been knocked off the top spot as the world’s most valuable company. The overall tech sector in the US lost more than 2% last month, and the semiconductor index, which was the jewel in the S&P 500’s crown last year, is down nearly 10% YTD.

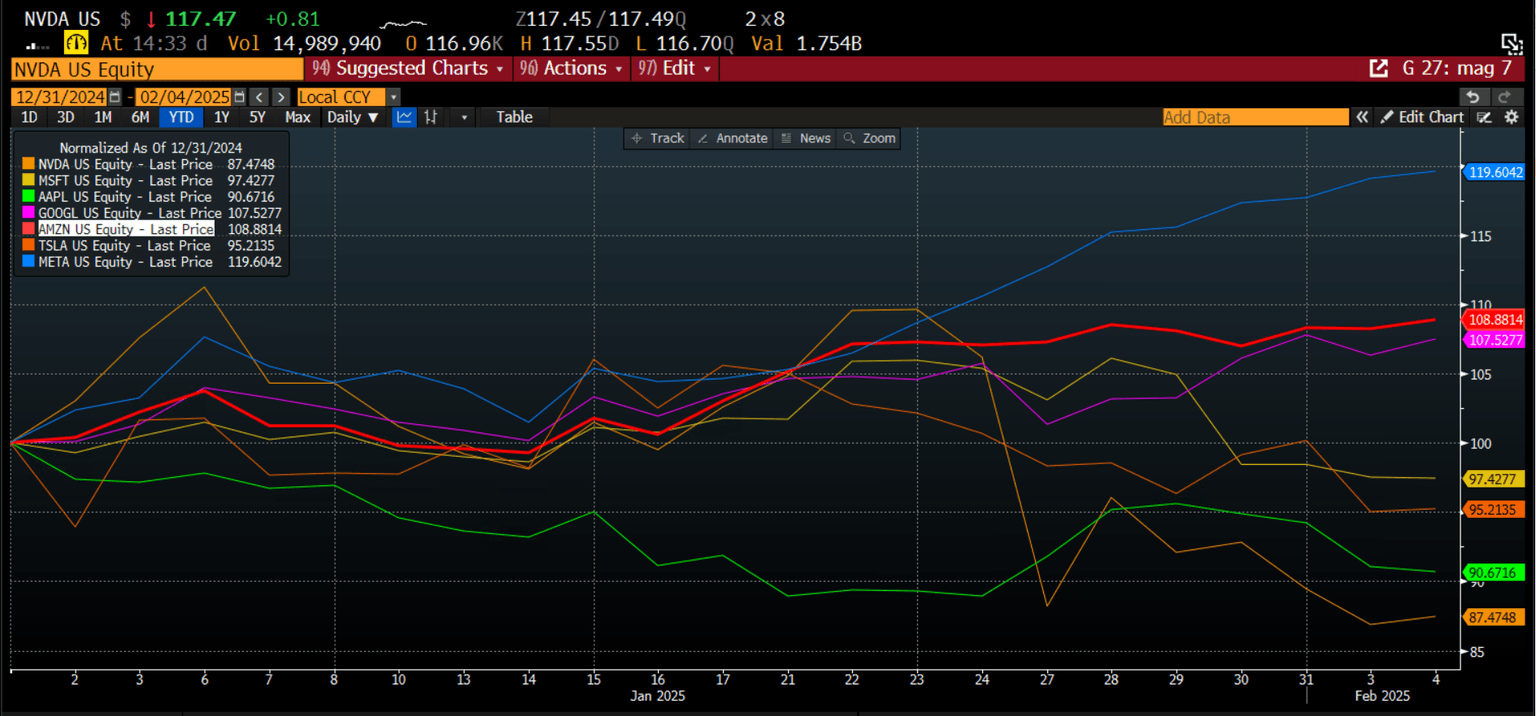

This suggests a few things. Firstly, that there is a rotation going on, with tech, especially hardware producers and chip manufacturers falling out of fashion, while the gold sector, media companies, steel and healthcare attract the bulk of investor flows so far this year. Secondly, there is also a rotation going on within tech. As you can see below, things are also changing for the Magnificent 7. Nvidia, Apple and Tesla are the weakest performers so far this year, while Meta is far and away the best performer. This is also a reversal since 2024.

Chart 1: Magnificent 7, normalized to show how they move together since the start of 2025.

Source: XTB and Bloomberg

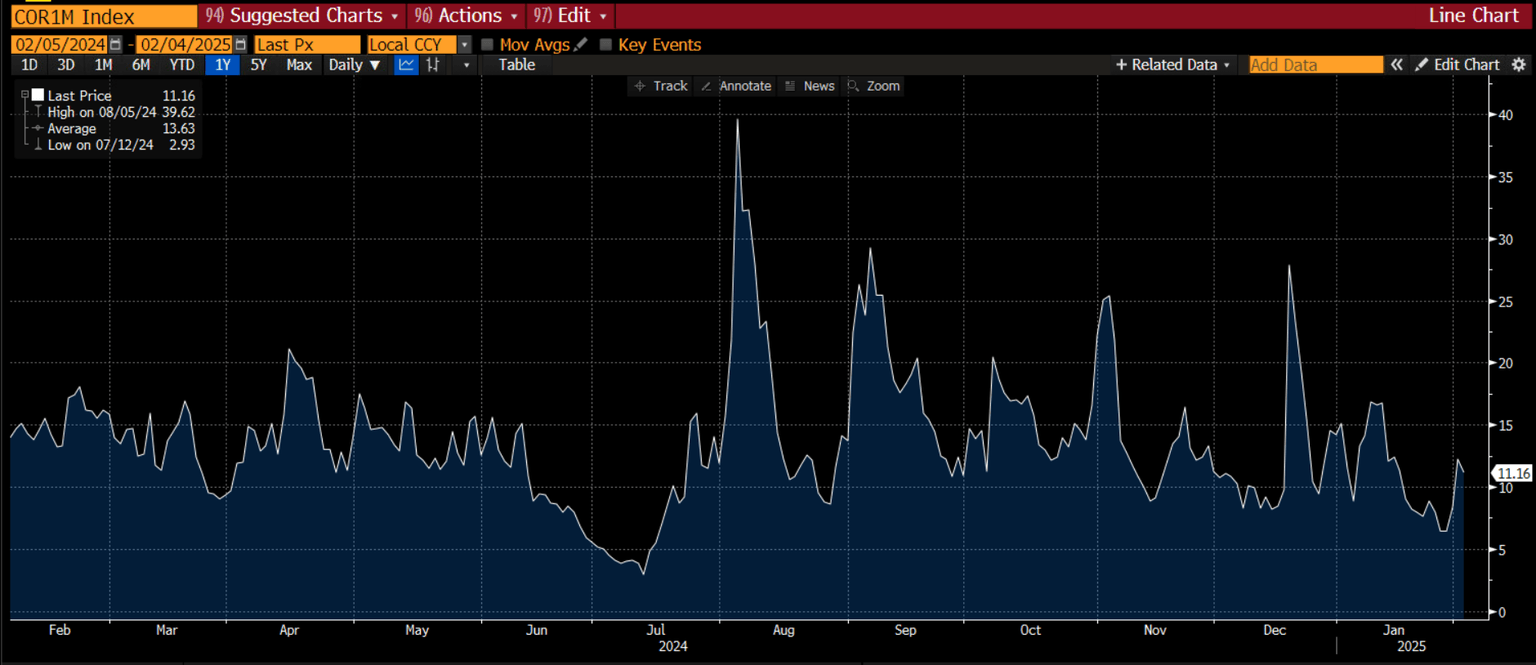

There was some concern that if Nvidia weakened, it would drag down the entire index, however, that may not be the case. Below, you can see the implied 1-month correlation of the top 50 stocks in the S&P 500. As you can see, the implied correlation has moved higher, but it has not moved to the extreme levels that we saw in 2024. This suggests that if some stocks plunge, other are rallying, which keeps the implied correlation stable. Investors do not think that this will change in the coming weeks.

Chart 2: CBOE 1-month implied correlation in the S&P 500

Source: XTB and Bloomberg

Market rewards EPS positive surprises

Earnings data is also playing a big part in the resilience of the index, as some stocks are better able to withstand the market noise due to the strength of their earnings reports and their outlooks. So far, 36% of the S&P 500 have announced their earnings. Of these, 77% have reported Earnings per Share above estimates, according to FactSet. Although this is above the 10-year average, earnings have exceeded estimates by a smaller margin than average, at 5%, which is below the 5-year average of 8.5%. However, the market is rewarding companies that exceed earnings estimates by more than usual. For example, companies that have reported positive earnings for Q4 2024 have seen their share price rise by 1.5% for 2-days before the release until 2 days after the release. FactSet uses Netflix as an example. It smashed earnings expectations and reported EPS of $4.27 vs $4.21. Its share price rose by more than 14% between January 17th and January 23rd.

Palantir surges on strong forward guidance

Likewise, Palantir, the US software firm that provides platform for data analytics, reported revenues that were 36% higher than expected, with US revenue rising rapidly at more than 60% YoY. Future revenues also exceeded forecasts as the company continues to see strong AI demand. The share price surged 23% early on Tuesday, on the back of this news, This suggests that stock markets are not moving in unison and are being driven by individual factors.

Palantir is an AI company, but it may be more resilient to DeepSeek compared to others, like Nvidia. This is because its biggest customers include the US defense service and the US intelligence service, which are unlikely to switch to Chinese software any time soon. Thus, DeepSeek is not an existential threat to all US AI-related companies.

Stock markets

So far, this is not having a detrimental effect on the S&P 500 index as a whole: as some stocks fall, others rise. However, it has halted the stock market rally from 2024.

Stock picking is notoriously difficult, but it may pay off in this market. However, if you prefer to stick to index trading, the mild increase in the positive correlation between the S&P 500’s largest companies so far is good news, as it suggests that Donald Trump’s tariffs are not the only driver of US indices, even if they are stealing the media limelight.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.