The revival of GameStop (GME Stock) shows the power of the retail investment industry

When it comes to investment opportunities, the video game chain GameStop is unlikely to rank as a key stock to be included in a resourceful portfolio. Yet, for a short period of time at the start of the year, thanks to a huge coordinated effort from social media and Reddit users, GameStop became one of the hottest assets on Wall Street - showing that retail investors possess the power to influence the industry.

In January 2021, GameStop found itself at the centre of a battleground between retail investors and hedge funds. The company was $1.5 billion in debt at the time, and had lost around $2 billion over the course of the past three years, facing a significant threat to the brick and mortar network of shops it had thrived on before technology sent gaming online.

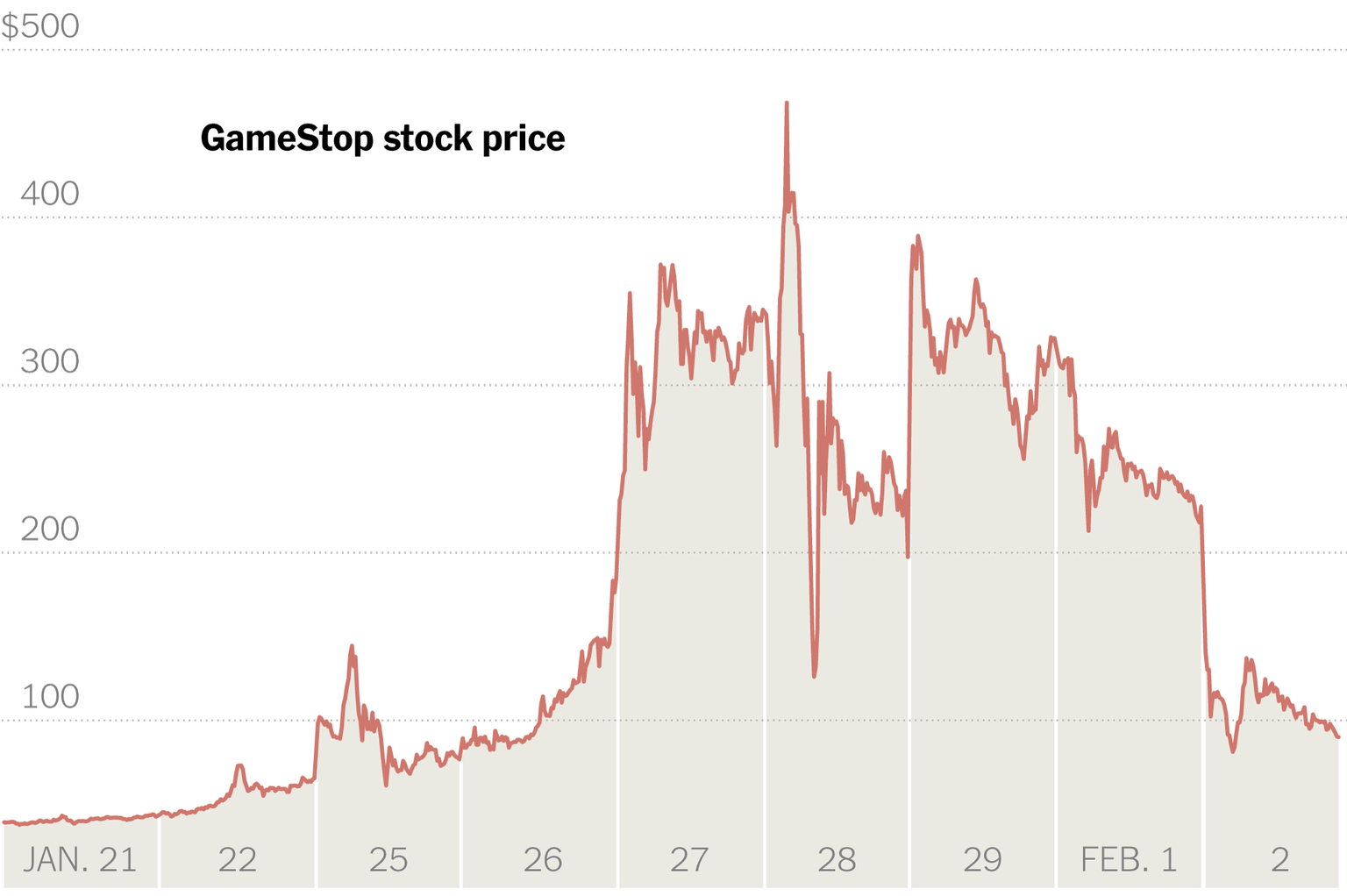

(Image: NY Times)

Despite the company’s difficult future, GameStop’s shares rocketed in late January - up to almost $500 per share at one stage before a significant correction took place at the beginning of February.

Through various platforms, including Reddit’s WallStreetBets, retail investors, with the guidance of social media, marshalled their resources in order to make what appears to be social proofed profits while giving short selling hedge funds a beating using fundamental analysis.

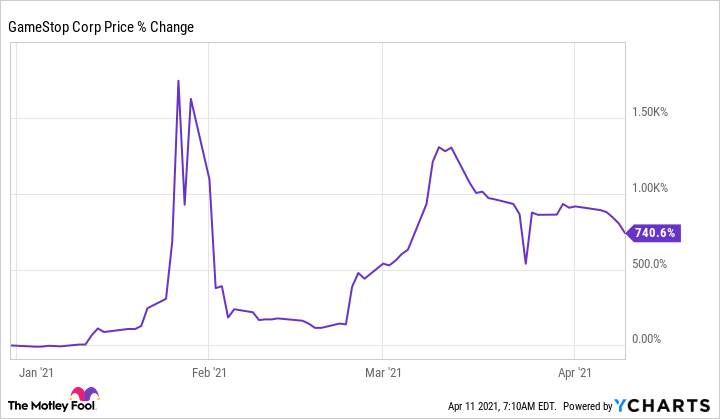

Although GameStop’s price corrected sharply from its lofty peak, more than three months later shares in the company are still trading for as much as 10-times that of their value at the beginning of 2021 - indicating that the power of sentiment can be very strong in the world of retail investing.

(Image: Freedom24)

Does the case with GameStop show that retail investors have the social coordination needed to take on hedge funds toe to toe and inherit Wall Street? Let’s look into what GameStop really means for the influence of the retail investment industry:

“A Statement as Much as an Investment”

Reddit’s involvement in the GameStop pump shows that markets need to adapt to a world where retail investors are gaining greater levels of power and influence in a way that only large financial firms have commanded in the past.

Alexis Ohanian, co-founder of Reddit spoke of the events in January as something of a retail revolt against the established institutions: “This is something, I think, for a lot of people, that was a statement as much as an investment,” Ohanian explained. “I’d equate it to folks voting with their dollars in order to get back at or make a statement towards big finance.”

Reddit was central to gathering the volume of retail investors needed to create a monumental rally for GameStop. The social network’s WallStreetBets forum was an active facet in sending the stocks surging in late January before some online brokerages limited the movements of traders.

Ohanian also labelled moves by Robinhood and other online brokerages to curb trading in GameStop shares “pretty shocking” before calling the outcry against Robinhood “a very justified outrage.”

However, despite widespread finger-pointing at the likes of Robinhood and other cheap investing platforms, Maxim Manturov, Head of Investment Research at Freedom Finance Europe dismissed the actions of online brokers in limiting traders as nothing short of an issue with liquidity - rather than anything more serious.

“It was because of those limits that many investors were dissatisfied and filed complaints and claims against Robinhood; the company, however, denies any involvement in assisting third parties, as nobody outside the company influenced the decision on the limits,” Manturov stated. “It is more likely that these restrictions are only about a technical need to provide liquidity, and the company needed to take a break to raise cash in order to cover the cost of transactions and pay off investors who wanted to cash out.”

While a retail revolution may bring greater investment insights for more casual users, GameStop has also shown that there’s currently an unequal playing field in terms of infrastructure that will need to be addressed. With Robinhood failing to provide the liquidity needed to facilitate more investments this may need to be bridged if retail investors intend to become more influential over market movements.

This brave new world of social investing also needs to quickly learn how to deal with fraudulent activity and market hype. When asked if internet forums could lead to misinformation and unjust hype, Ohanian retorted that the same issues are currently prevalent in the world of politics before concluding that it’s “a question for the decade.”

What the rise of Retail means for Wall Street

Today, the performance of GameStop is holding so strong that stock prices managed to recover to $264.50 in mid-March. This shows that coordinated retail investing means more than just pump and dump sessions. In GameStop, we’ve seen a company with weaker fundamentals perform breach values of $100 for the first time this century and consistently stay there.

(Image: Motley Fool)

This Reddit-based statement of intent may also lead to more long-term changes to how Wall Street operates. For instance, there’s mounting speculation that hedge funds may soon be banned from shorting more than 100% of a company’s outstanding shares in a bid to avoid future sages unfolding in similar ways.

We may also see hedge funds becoming more reactive to the whims of Reddit-based retail investors, with the Financial Times claiming that several organisations are now monitoring r/WallStreetBets in a bid to watch out for online trading discussion boards and retail investor sentiment.

Although the case of GameStop was the perfect cocktail of chaos in which retail investors could flourish, it’s hard to see future cases of the same sorts of mass stock purchases being timed to perfection by assembled users. However, with hedge funds actively tracking the next moves of online retail investor groups, it’s clear to see that individual investors are finally a force to be reckoned with on Wall Street.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dmytro Spilka

Solvid

Dmytro is a tech, blockchain and crypto writer based in London. Founder and CEO at Solvid. Founder of Pridicto, an AI-powered web analytics SaaS.