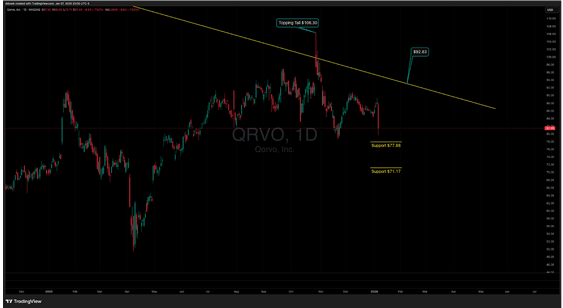

The $77.88 line in the sand: Why Qorvo’s long-term bull case is at risk

Qorvo, Inc. (QRVO), a company in radio frequency and power management solutions, had a rough outing Wednesday. The semiconductor specialist to everything from smartphones and defense to automotive tech saw a sharp 7.52% decline, closing out the session at $81.50.

From a technical standpoint, the move on Wednesday is significant because it marks the failure of a daily bull flag pattern that had been developing throughout most of December. In the world of technical analysis, when a pattern fails, it generally leads to an aggressive move in the opposite direction. We are seeing that play out now, and the immediate concern is whether price can be saved at the first major support level of $77.88. If $77.88 fails to hold, the door opens for a deeper slide toward the next support at $71.17.

Daily chart

It is worth noting that this downside momentum was actually foreshadowed back on October 28th, 2025, by a daily topping tail. That specific candle pierced a long-term declining trendline that stretches all the way back to 2021. While the price action on Wednesday is bearish, there is a silver lining for the long-term view: the next time QRVO attempts to clear that 2021 trendline, it will be the 4th hit. Historically, each subsequent hit weakens a resistance line, increasing the probability of an eventual breakthrough.

Looking at the weekly chart, the stock has been in a period of bullish consolidation since June 2025, all sitting just beneath that major declining trendline. This suggests that, despite today's drop, the stock has been building the energy necessary for a breakout. However, this makes the $77.88 support level even more critical; if price breaks below that mark, the entire bullish consolidation structure from June 2025 will be in jeopardy. Generally, longer-term patterns have more power. If this weekly pattern holds, QRVO could still be building momentum for a break through the declining trendline.

Weekly chart

Author

Drew Dosek

Verified Investing

Passionate technical and cycle analyst committed to empowering traders through data-driven insights.