Tesla’s stock price surges, as new model launch excites the market

Everyone knew that Tesla earnings for Q1 would be bad, and indeed they were. Earnings per share, revenues and adjusted net income were all lower than expected. However, the market is forward-looking, and, so far, it is willing to trust Musk’s vision for the EV maker and the Tesla share price is higher by more than 11% in after-hours trading.

Tesla: The ultimate growth stock

The earnings report hinged on two factors. Firstly, gross margin for Q1 came in at 17.4% vs. 16.5% that analysts were expecting. This is lower than the 19.3% reported in Q1 2023, however, it is a welcome surprise after revenues and EPS levels plunged. Revenue in Q1 was $21.3bn, down 8.7% compared to a year earlier. Free cash flow was negative and capital expenditure was 34% higher than a year ago at $2.77bn. Tesla is the ultimate growth stock, and markets are rekindling their faith in Musk and the EV maker.

Investors warm to Musk’s recalibrated plan for the future

Tesla had flagged the expected lower growth rate in 2024, thus, the focus for this earnings report was margins and plans for the future. Musk delivered both of these. Other companies offer sweeteners to shareholders in the form of share buybacks and dividends, not Elon Musk. His sweetener for shareholders was the announcement of the acceleration of new more affordable models to get them into production before the second half of 2025. While the details are thin on the ground, this was a clever move by Musk, as it justifies the negative cash flow and the higher capital spend. Unlike many companies that are shrinking capital spend in the current environment, Tesla is going against the grain. This reinforces Tesla as the ultimate growth stock, and it also puts Tesla in a strong position as the EV market gets more competitive and price sensitivity increases.

Tesla moves targets the cost-sensitive consumer

Elon Musk was in a bullish mood when he posted on X earlier on Tuesday, he said that the Model 3 is faster than a Porsche 911, however, he followed this up with the claim that Tesla’s are the cheapest cars to maintain. He claims that the 1–5-year cost of running a Tesla is $580, compared with $1095 for a Volkswagen, and $1100 for a Ford. Tesla is no longer just for the EV evangelists; they are for the serious car buyer who is concerned about budgets and value for money. Tesla is changing its focus to meet consumer demand, and, hopefully, driving a new era of growth for the company.

Tesla’s future success firmly based in cheaper model

Investors are giving Musk’s shift to lower cost models the thumbs up, but they also like the speedier arrival of these new cars. It seems like Tesla will be able to deliver these new models earlier than originally planned because it will use aspects of the next gen platform alongside aspects of its current platform. This suggests that the much-touted next gen platform that Musk spoke about during the Q4 2023 earnings release may not be ready, or that Musk sees the folly in trying to create something completely new in the current market. If Tesla can produce a car in the $25k- $30k bracket, this would make it cheaper than 87% of cars sold in the US and could position it as a best seller. Also included in this earnings report was the expected news that Tesla’s energy storage business’s growth was faster than its EV business in Q1. It is also launching a new Ish robotaxi later this year. However, Tesla’s future fortune is firmly based on this cheaper new model.

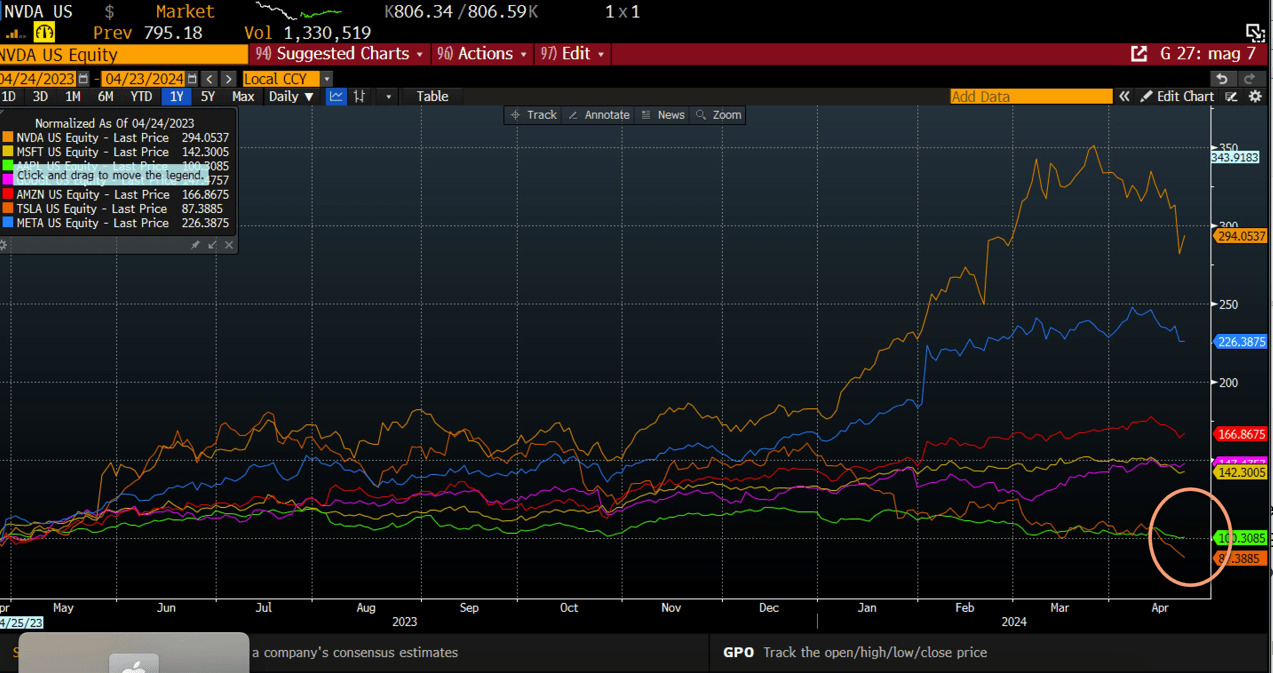

This is a dream start for the tech sector’s earnings season. After falling 42% since the start of this year, Tesla’s stock could make a recovery from here. It is worth noting that the average 1-day move after earnings in Tesla’s stock price in the past 8 quarters has been 9.76%. Thus, the surge in Tesla’s share price is a normal response to its earnings reports. We will be watching closely to see if this kick starts a deeper recovery for this stock and helps it to play catch up with its Magnificent 7 peers.

Chart one: The magnificent seven tech stocks, Tesla has underperformed its tech peers, along with Alphabet

Source: XTB and Bloomberg

Elsewhere, global stocks were higher on Tuesday as sovereign bond yields fell back and the Vix also retreated. Other Mag 7 stocks are rallying in after hours, Nvidia is higher by 1.5%, Meta, which releases earnings later on Wednesday, is also up by 1.6%. In a change of fortunes, it could be Tesla that lifts the rest of the Magnificent 7 in the coming days, as the market warms once more to the world’s ultimate growth stock.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.