Tesla (TSLA) Stock Price and Forecast: Tesla falls on recall news

- Tesla (TSLA) stock falls for the third straight session on Thursday.

- Tesla (TSLA) closes at $1070.34 for a loss of 1.46%.

- Tesla (TSLA) shares still struggling with the resistance trendline.

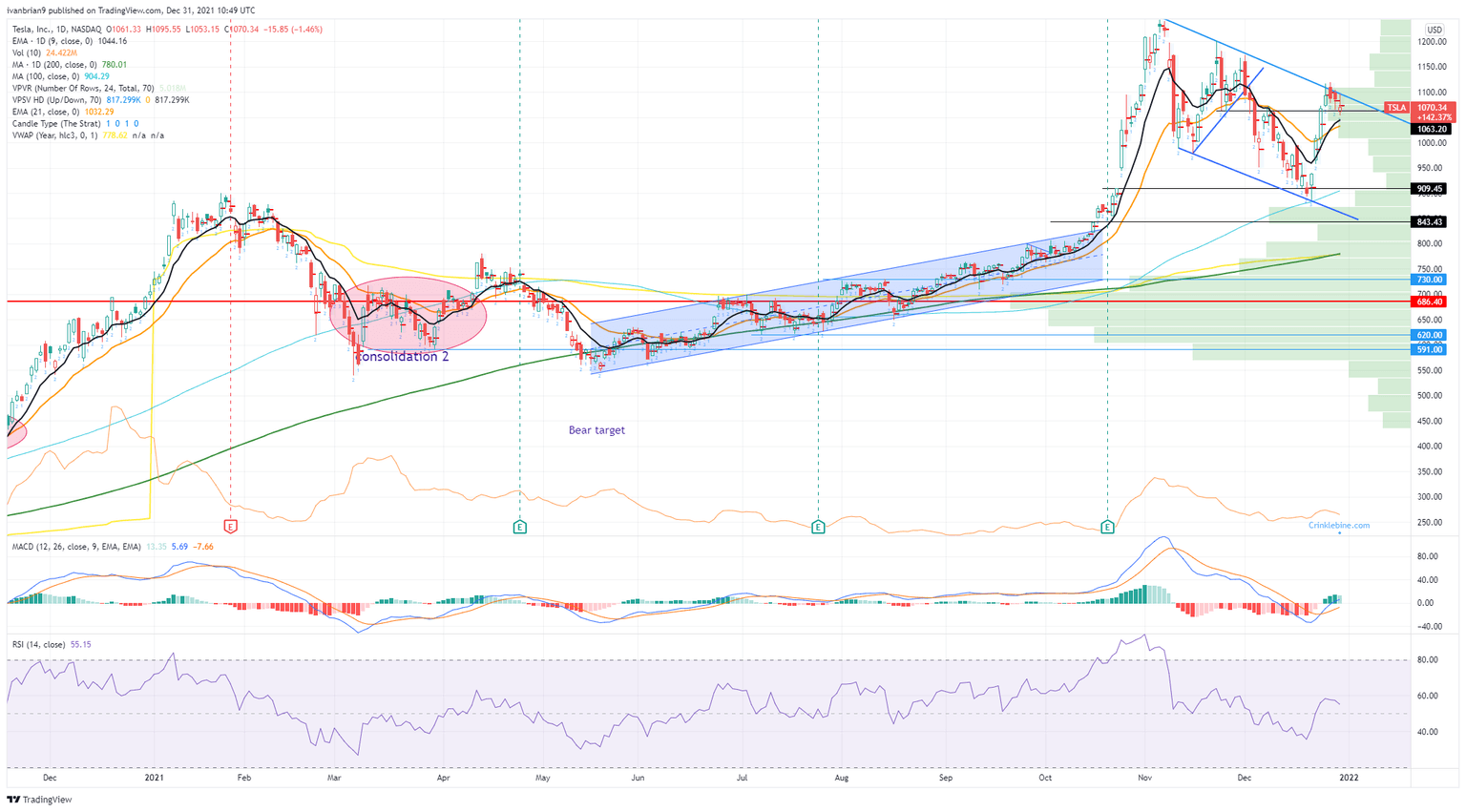

Tesla shares struggled on Thursday and are hobbling to the year-end finish line. The shares had caught a recent boost as it appears Elon Musk is done selling the stock but this rally has stalled at a key trendline as shown in our chart below. Momentum is needed and with volumes declining it is hard to charge this one up, for now.

Tesla (TSLA) stock news

This morning China's market regulators says Tesla is to recall 19,697 Model S vehicles, 35,836 imported Model 3's and 144,208 Chinese-made Model 3 vehicles from China. This is part of a wide-scale recall reported yesterday with the US National Highway Traffic Safety Administration (NHTSA) finding problems with the rearview camera which can be damaged when the trunk is shut. According to Reuters Tesla is to recall a total of 475,000 Model 3 and Model S cars as a result. Reuters reports that the years affected are from 2014 to 2021 and that the recall amount is nearly equivalent to last year's delivery numbers.

Tesla (TSLA) stock forecast

Thursdays move again failed at the trendline resistance and Tesla retraced back to the $1063 support line. This is the short-term pivot now in our view and is likely to be broken today as the recall story gains more traction, the 9-day moving average $1044 is the next support and once below there it really is plain sailing until $910. The lower end of the trend line is at $843 which fills the gap from October 15 to 18. Markets love to fill gaps.

Pivot moves to $1063 in our view, support at $1044, $1000, $910, $843. Resistance at $1091, $1201 and $1243.

Tesla chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.