Tesla Stock Price and Forecast: TSLA counteracts Nasdaq on Monday morning

- Tesla stock makes strong gains in a bullish market on Friday.

- Rising nickel prices are hitting margins and costs for EV makers.

- TSLA is currently 1% higher in Monday's premarket.

UPDATE: Tesla stock rode up as high as 4.1% in Monday morning trading to start the week. It fairly quickly subsided, however, and trades at $917, up 1.3%, at the time of writing. The Nasdaq seems uncertain to begin the week as it is down about 1% at the same time. Tesla has had to make a number of price increase announcements due to higher commodity costs recently, including to the Model X in China, so the fact that TSLA stock is trading above the Nasdaq on Monday should cheer up the bulls.

Tesla (TSLA) stock benefitted from the recent turnaround in markets as bearish sentiment was swept away by a tide of enthusiasm akin to last year's markets and not what we are used to so far in 2022. We need to determine if this is merely a dead cat bounce or something more significant. Certainly, times have changed and the macro background is less accommodative to rising stock prices. Commodities and oil prices are skyrocketing, inflation is out of control, and the Fed is tightening. We still have record levels of corporate buybacks and a near-record end of quarter rebalancing from bonds to equities, however, so this dead cat bounce may have more room to run.

Tesla Stock News

Tesla certainly has been feeling the pinch of rising nickel prices as it has been forced to raise prices several times in 2022 already. The latest price hike comes for the Model Y in China. China is the world's largest EV market and where Tesla has its key Shanghai gigafactory. That factory was shuttered last week due to a covid outbreak, and the two-day shutdown would mean a loss of about 4,000 vehicles in production. The plant is now back up and running. We also see Tesla taking steps to address the growing reseller market in China as it asks owners buying more than one Tesla in China to not resell them within a year. Used car prices rose globally during the pandemic due to shortages, and now with soaring oil prices used EVs are in some cases selling for more than the purchase price.

Separately, Tesla CEO Elon Musk outlines some details of his Master Plan 3 on Monday. The key ingredient is scaling up to extreme size.

Tesla Stock Forecast

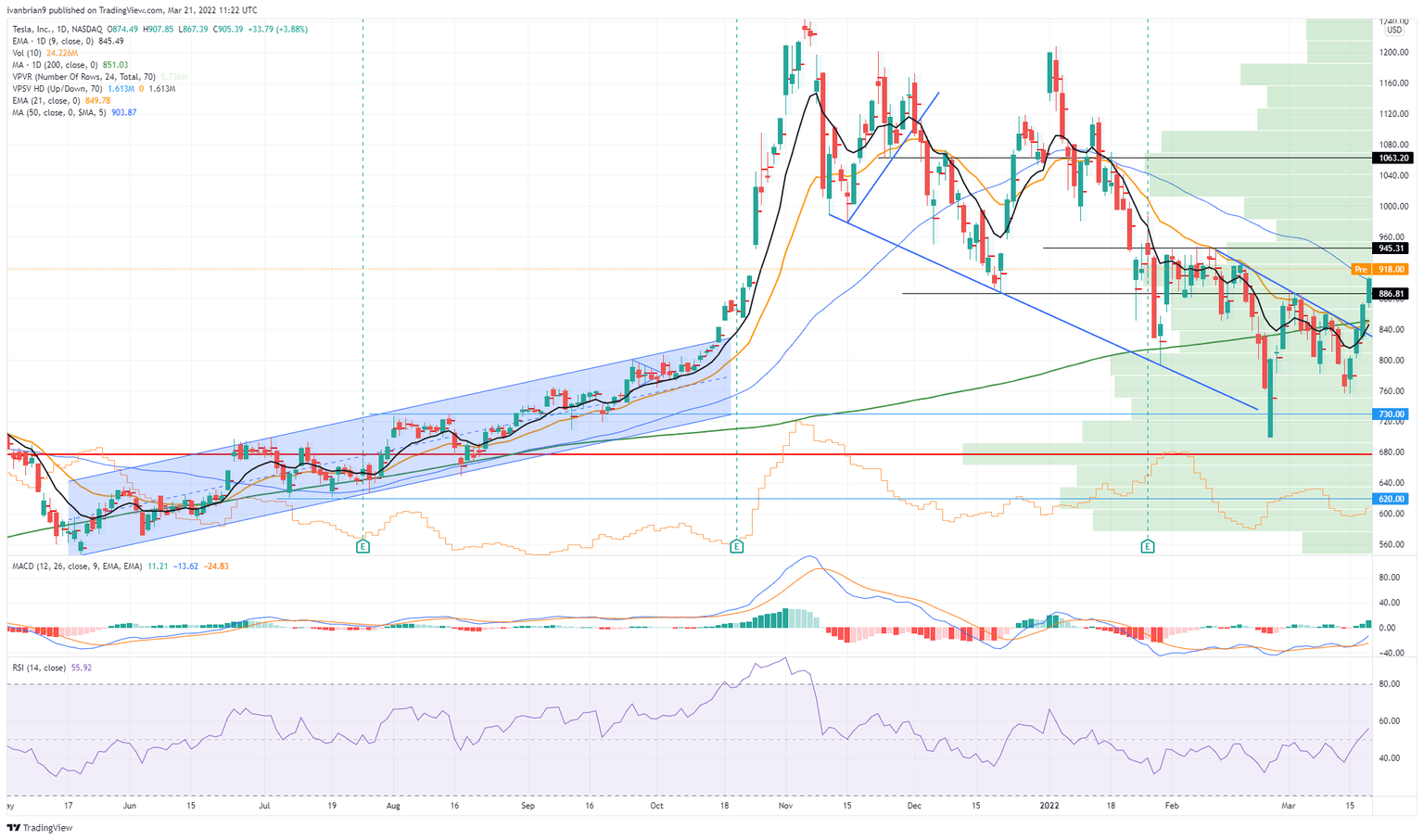

$886 has been recalled in an impressive move and now sets $945 as the next resistance. Tesla is also just at the 50-day moving average at $904. Breaking $945 puts Tesla back in a bullish formation, but for now it is in neutral. Below $886 Tesla is back in bearish mode and will target $700. The range from $886 to $945 took a long time to break down before, and this may see another period of choppy trading.

Tesla (TSLA) chart, daily

The author is short Tesla

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.