Tesla Stock News and Forecast: TSLA CEO Musk discloses 9% stake in Twitter

- Tesla CEO Musk owns nearly 1/10 of Twitter.

- Twitter stock soars 20% in premarket.

- Tesla stock is up by 1% in premakret.

Tesla (TSLA) CEO Elon Musk disclosed early on Monday that he had taken a 9.2% stake in Twitter. Elon Musk of course is one of the most-followed people on Twitter with over 80 million followers. Now he has put his money where his mouth is and taken a decent stake in the social media company.

Tesla Stock News

TSLA stock has not reacted to the news but is 1% higher in Monday's premarket. Tesla closed last week after having gained over 7% as the recovery in global stock markets continued. Over the weekend Tesla released delivery data for the first quarter and that was a record number at 310,000. The number was slightly short of analyst estimates despite being a record. Analysts had feared that ongoing supply chain issues might hit deliveries, but this number should at least give comfort in that regard. Tesla said it had managed despite supply chain issues and a factory shutdown. This is referring to China, which is battling an outbreak of the Omicron strand of covid and has introduced multiple city lockdowns that have affected manufacturing sites across China. Tesla has also announced that its first quarter earnings will be released on April 20.

Tesla Stock Forecast

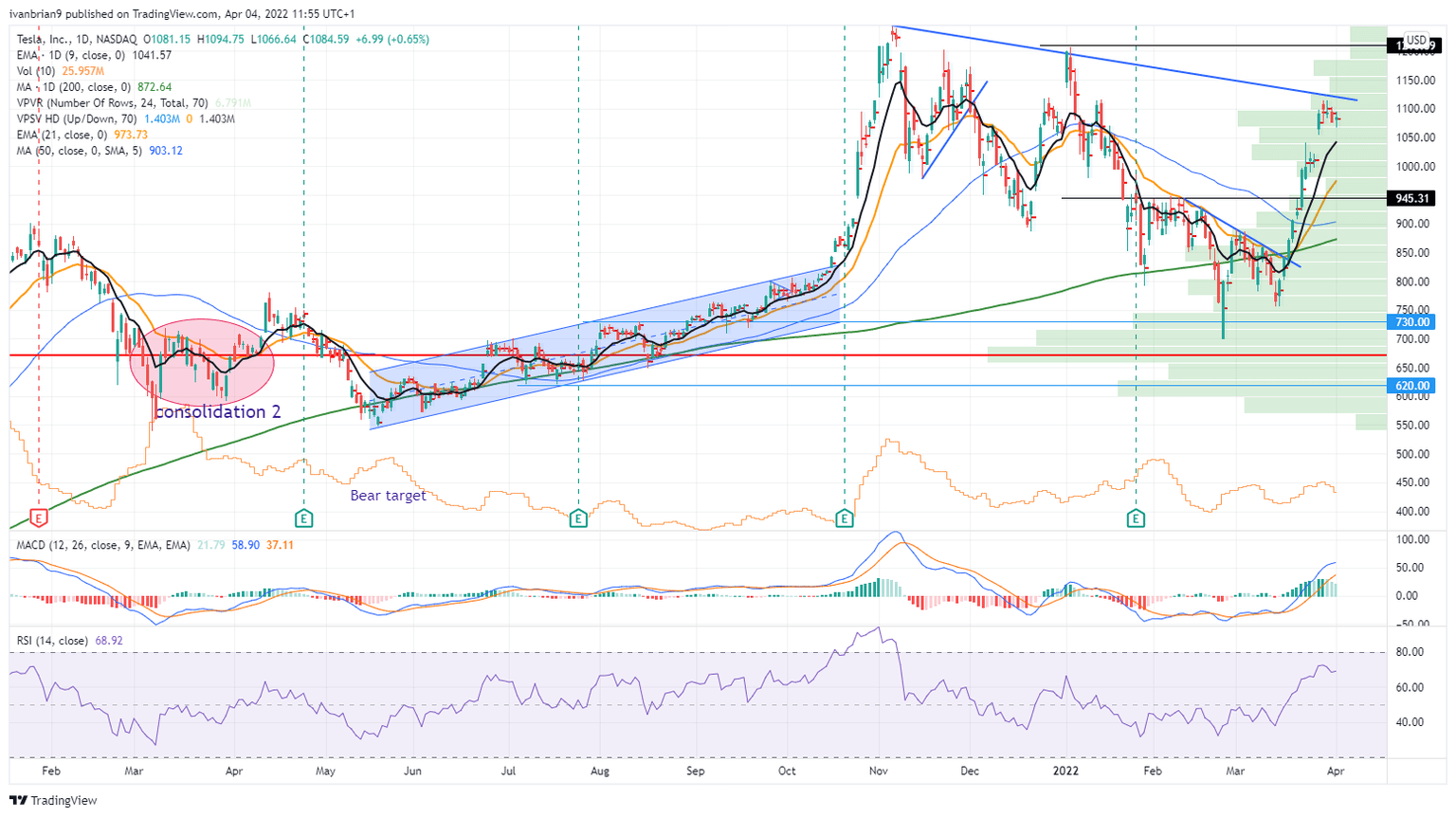

Tesla stock has made a strong recovery from the Ukraine lows and like most stocks has rallied significantly. Breaking $945 was key, and now the momentum is behind the stock. The delivery numbers should underpin recent gains. The next big resistance comes at $1,210. Note the Relative Strength Index (RSI) getting close to overbought.

Tesla (TSLA) stock chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.