Temporary pause, tactical opportunity: IONQ ABC setup in focus

n this technical blog, we will look at the IONQ recent price action. The company deals in quantum computing, specializes in developing and manufacturing quantum computers. The stock made a rally higher as highlighted in last September 2025 update here. Rally higher took place took place in another 5 waves structure and made a pullback, which ends up entering into previous wave I territory. Thus suggested that it’s no longer wave (III) taking place. We will explain the latest forecast below:

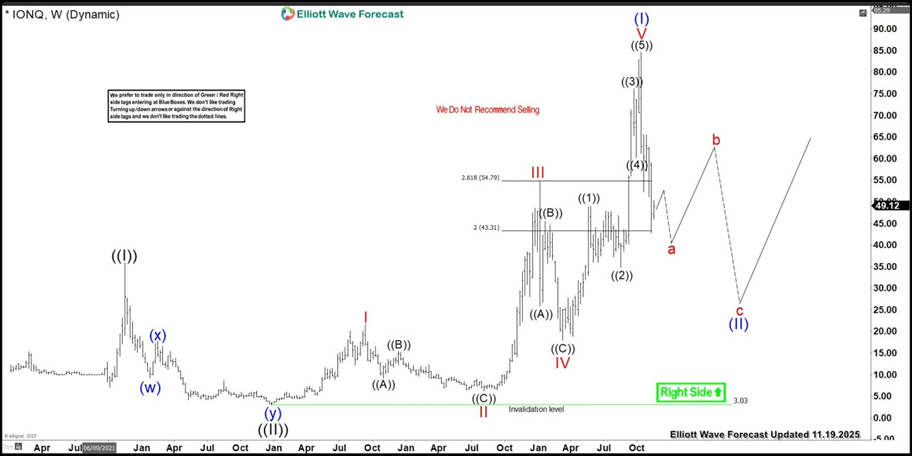

IONQ latest Elliott Wave chart from 11.19.2025

This is the latest Elliott wave chart from 11.19.2025 update. In which, the main cycle from all time low still 3 waves rally higher taking place. While the rally from December 2022 low unfolded in a diagonal 5 waves structure where wave I ended at $21.60 high. Wave II pullback ended at $6.22 low, wave III ended at $54.74 high, wave IV pullback ended at $17.88 low. Up from there, the stock made a rally into new high towards $84.64 high and ended wave V thus completed wave (I).

Down from there, the stock is probably doing a 3 wave pullback to correct the cycle from December 2022 low within wave (II) pullback. Whereas current leg of the pullback can end in between $$33.38- $25.77 area. Subsequently, can see at least 3 wave reaction higher. Don’t like selling it and swing traders should watch out for clear A-B-C setup from the peak.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com