Tech vs luxury, why tech is coming out on top

- Could Europe’s stock market dominance be threatened by the resurgence of tech?

- Why European luxury is fragmenting.

- What’s up with LVMH.

As risk appetite returns to the market, the focus is on whether US stocks can play catch up with European stock indices, which have outperformed so far this year. European stocks had a staggeringly good start to the year, however, there has been one major laggard: LVMH.

The French luxury conglomerate has suffered from weak sales and problems at its drinks division, which has struggled with slow sales in the US and China. Once the jewel in Europe’s stock market crown, LVMH is now looking like a drag on the index.

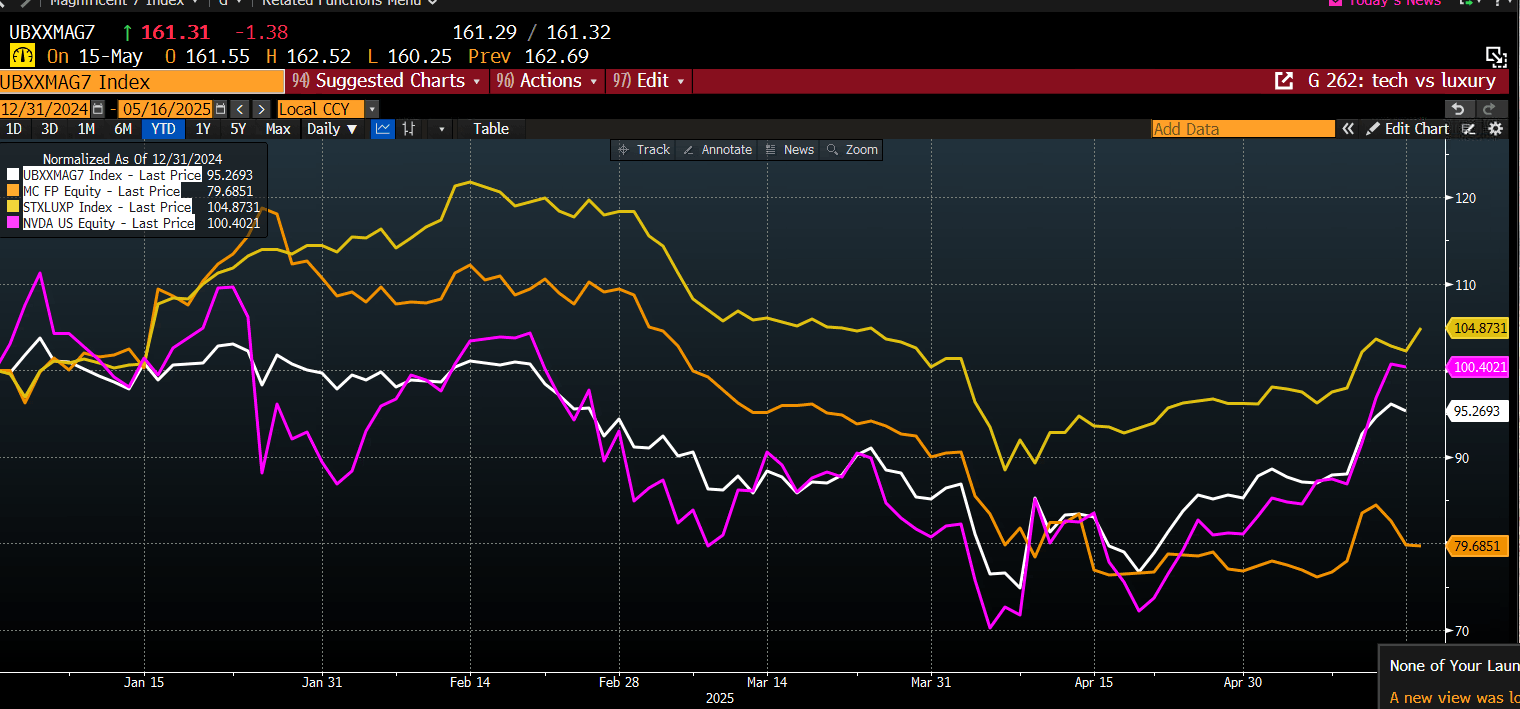

The chart below shows LVMH, the Eurostoxx luxury sector, the Magnificent 7 and Nvidia. This chart has been normalized to show how they have moved together YTD. Europe’s luxury sector has outperformed the Magnificent 7 for most of 2025, however, that has now stalled, and Nvidia’s surge higher in the past month threatens to overtake the performance of the luxury sector in Europe, as you can see below

Chart 1: European luxury vs. US tech

Source: XTB and Bloomberg

How important is luxury to Europe?

Luxury is a major player in European stock markets and is worth more than EUR 100bn. The luxury 10 index is higher by 5% so far this year, and in the past 5 years it has seen a return of 120%. The chart below shows the Eurostoxx 600 index, the STOXX luxury 10 index, the Eurostoxx banking sector and the Eurostoxx auto sector. Luxury is the best performing sector out of the three YTD, which highlights its importance in the European stock market space. If luxury falters, then it could limit the ability for European stocks to continue to outperform US stocks.

Chart 2: Eurostoxx 600 index and sectors, including luxury (highlighted)

Source: XTB and Bloomberg

LVMH’s woes

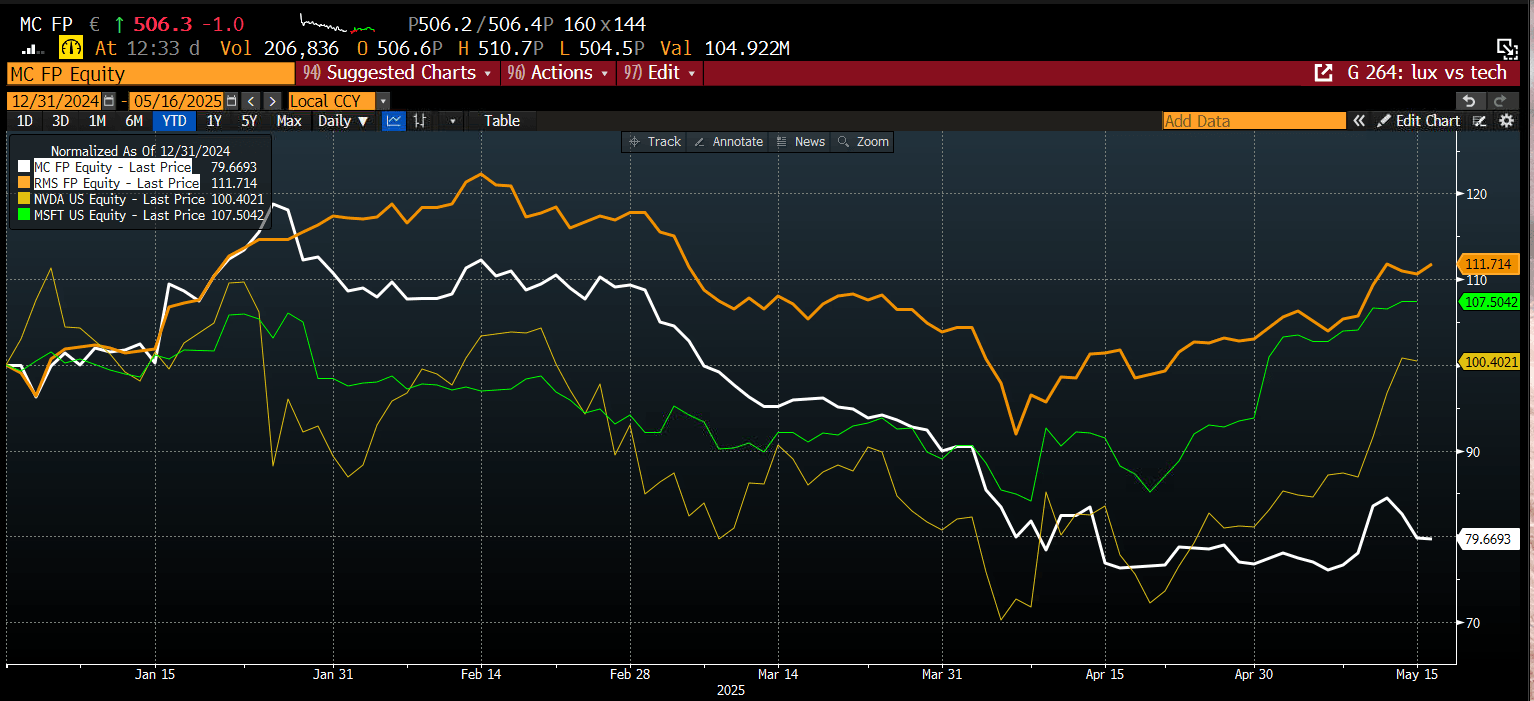

LVMH, once Europe’s highest valued company, has fallen from its top spot. Hermes now has a higher valuation. As you can see in the chart below, Nvidia and Microsoft are outperforming LVMH YTD, after a weak performance from the French luxury house since March.

Hermes is still the top performer and is outperforming both Nvidia and Microsoft so far in 2025, as it reported decent sales for Q1. Luxury is still an important segment of the market for Europe, as you can see by Hermes’ continued outperformance of the US tech giants this year. However, it does suggest that the luxury sector in Europe is fragmenting. Europe’s biggest luxury houses are no longer moving to the beat of the same drum and their earnings outlooks are diverging. As LVMH weakens, it suggests that Europe’s luxury sector is losing an important pillar of support as we move through Q2, which could hinder the ability of European indices to outperform US stocks, especially now that tech is in recovery mode.

Chart 3: LVMH, Hermes, Nvidia and Microsoft, normalized to show how they move together YTD

Source: XTB and Bloomberg

LVMH’s stock price is already down 20% in 2025, however, even with the extent of this sell off, the stock may struggle to recover. Earnings estimates are not supportive of a recovery in the stock price. Earnings growth for 2025 is expected to come in below the 2024 level, and earnings are not expected to rise above the 2023 high until 2028. There is a lot of uncertainty about the outlook for luxury. Weakness in LVMH’s Asian unit means that the company’s forecast for 3.5% sales growth for this year could be cut, after Asia ex Japan sales fell 11% in Q1. Gains in sales in Europe are not enough to offset weakness elsewhere, and even US demand only rose modestly. This bleak outlook compared with Nvidia, where earnings growth is expected to rise for the last quarter relative to the quarter before. Although analysts have revised down their estimates for Nvidia’s revenue and income in the last 4 weeks, the downgrades have been small, and Nvidia’s results have a habit of surprising to the upside.

Overall, Europe’s luxury sector is weighed down by problems and sluggish growth at LVMH, which erodes a pillar of support for the European index. US tech is on a charge higher, which threatens European stock market dominance as we move through Q2.

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.