Tech giants lead market recovery despite tariff uncertainty: Critical levels investors must watch

Current market situation and fundamental drivers

The technology sector is driving a notable rebound in equity markets despite ongoing tariff uncertainties between the US and China. Optimism around potential tariff reductions, strong earnings from major tech companies, and dovish signals from the Federal Reserve have collectively fueled recent gains. However, substantial risks remain, and investors need a cautious approach.

Advantages (bullish factors)

- Optimistic tariff developments: Recent signals from the US administration indicate a willingness to significantly reduce tariffs imposed on China, potentially dropping tariffs from 145% down to around 50-60%. Such actions would alleviate market pressures and stimulate investor confidence.

- Strong earnings in the tech sector: Companies like Alphabet (GOOGL) and Nvidia (NVDA) reported impressive earnings, fueling optimism and significant share price increases, thereby driving broader sector gains.

- Fed's dovish monetary stance: The Federal Reserve hinted at potential interest rate cuts later in the year, improving liquidity prospects and supporting risk-on sentiment, crucial for growth-oriented tech stocks.

Disadvantages (bearish factors)

- Persistent tariff uncertainties: Despite recent optimism, no formal resolution has been reached in the US-China trade dispute, creating lingering uncertainty and potential volatility in tech stocks.

- Economic slowdown concerns: Consumer confidence recently hit its lowest point since the 1990 recession, with inflation fears and economic uncertainty tied directly to tariff impacts.

- Technical resistance ahead: Price structures indicate major resistance zones ahead, suggesting that recent gains might face significant selling pressure unless robust breakthroughs occur.

Detailed technical outlook

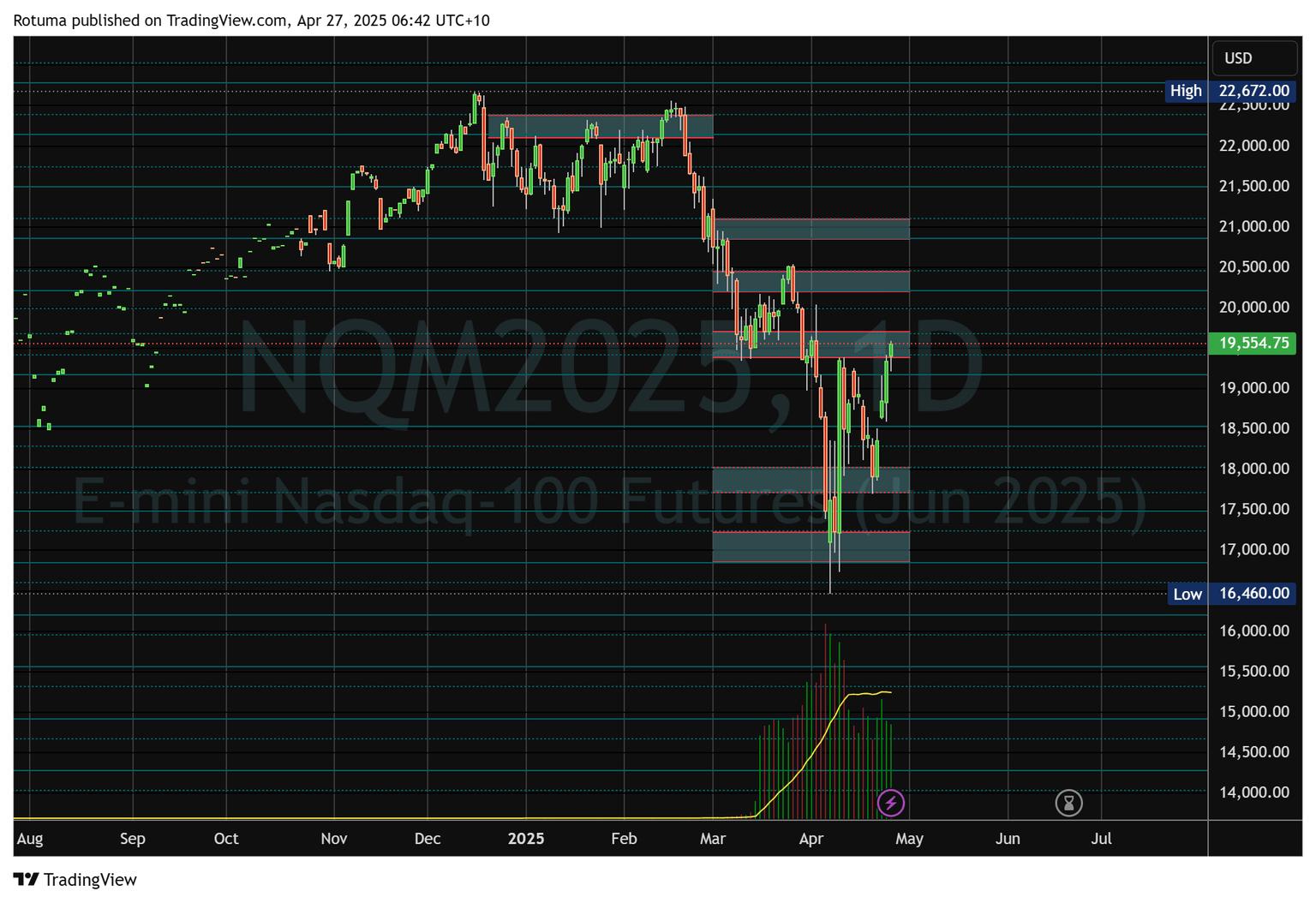

Nasdaq futures technical levels

Nasdaq futures recovered about 50% of the losses from the collapse at 22400, closing Friday's trades at 19554. Critical support lies at 19173, 18800, and 18530, while resistance is positioned at 19990, 20212, and, notably, 20458. A decisive breakout above 20458 could trigger moves to 20855 and 21100, whereas dropping below 19418 risks retesting lower supports.

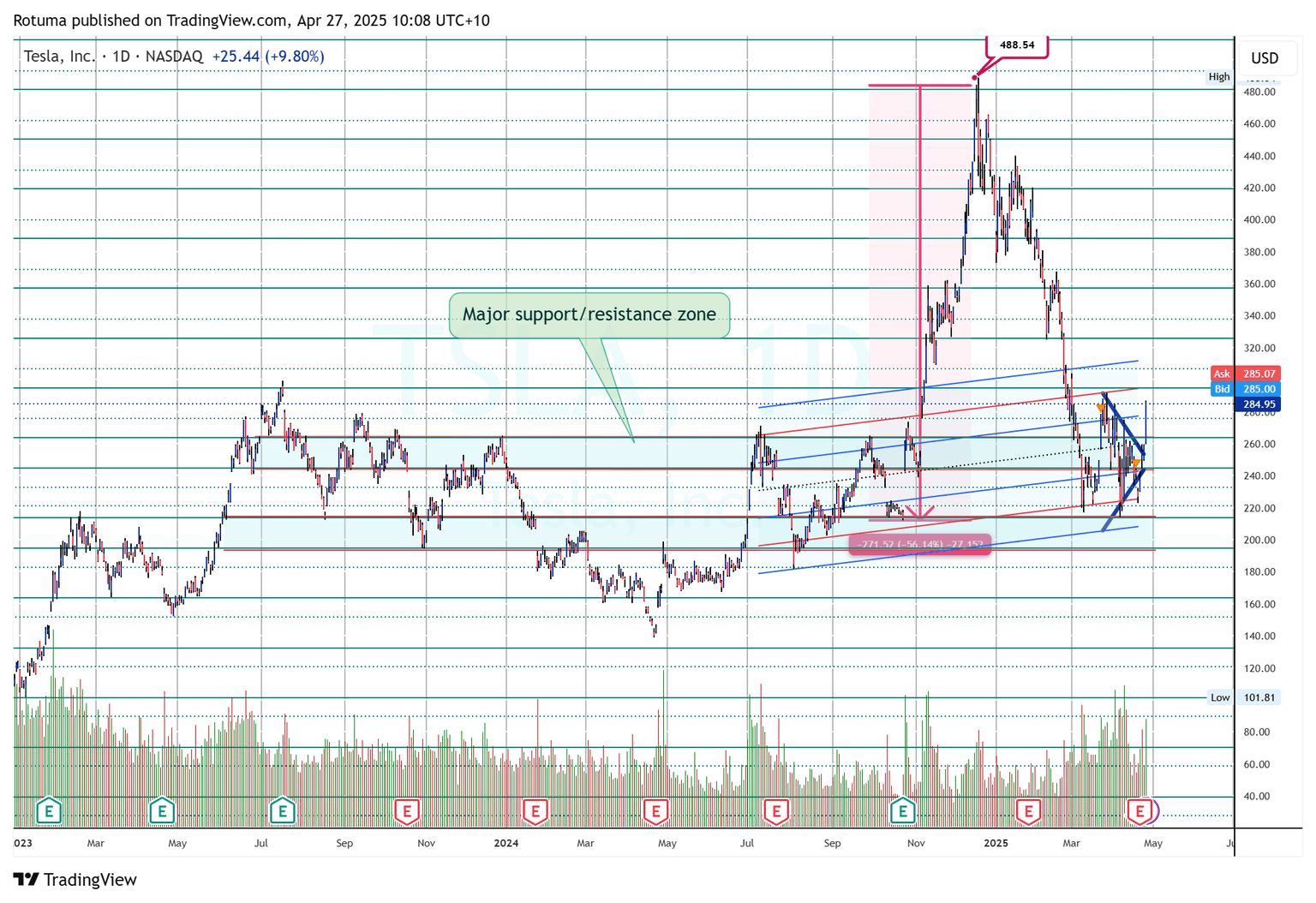

Tesla Inc. (TSLA)

Tesla surged approximately 27% due to CEO Elon Musk's planned focus shift back to Tesla, easing regulatory policies on autonomous vehicles, and anticipated robotaxi deployments. The stock reclaimed critical resistance at $244, breaking through $263 and $275. The next crucial resistance levels are $294 and $306. Failure to break these levels risks a reversal back to $275, $263, and potentially $244.

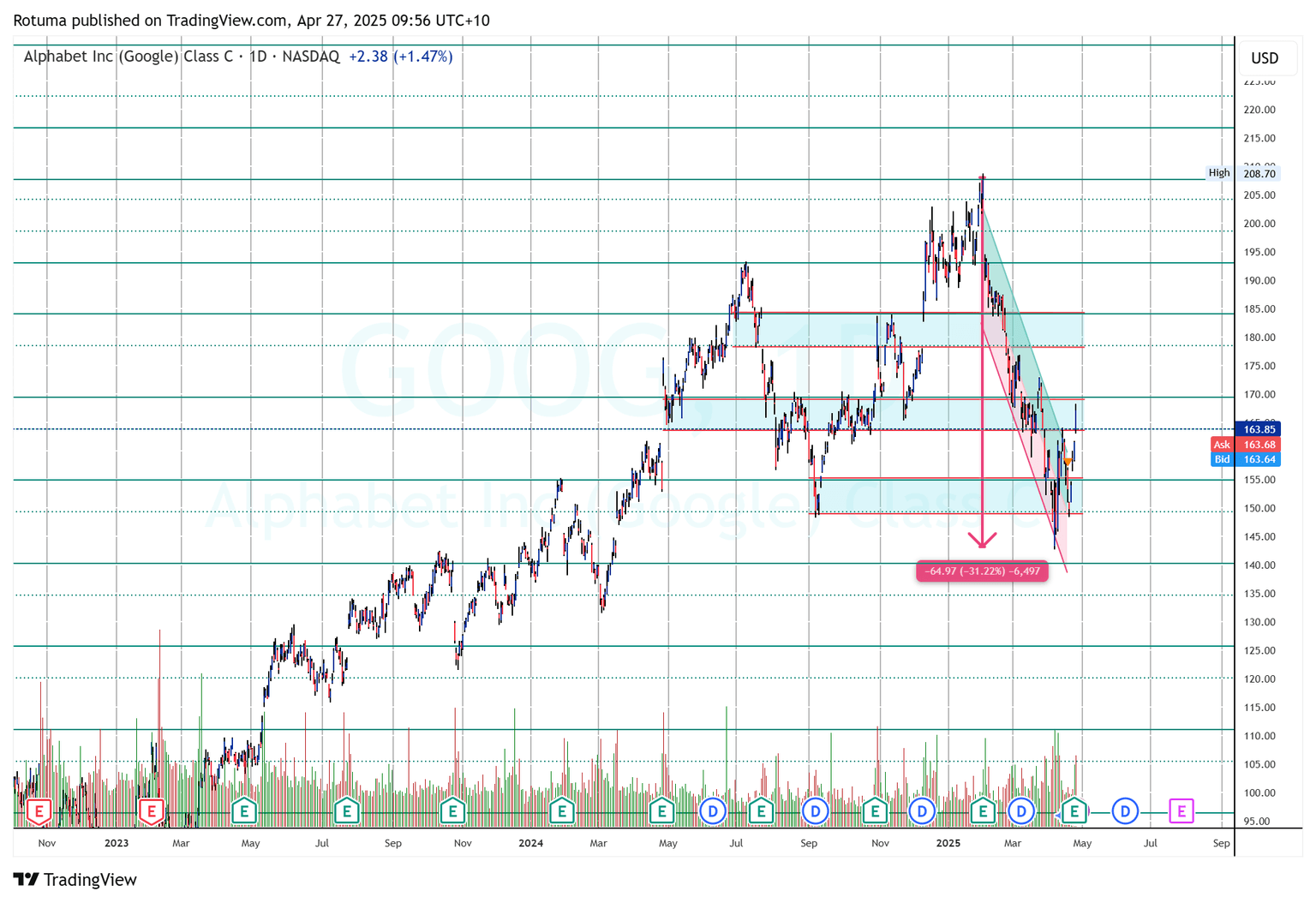

Alphabet Inc. (GOOGL)

Alphabet rallied over 9%, benefiting from better-than-expected Q1 earnings and revenue. It re-entered the critical $163-$169 support/resistance zone. Holding above $169 could propel the stock toward $175 and $178 while dropping below $163 risks declines to $158 and $154.

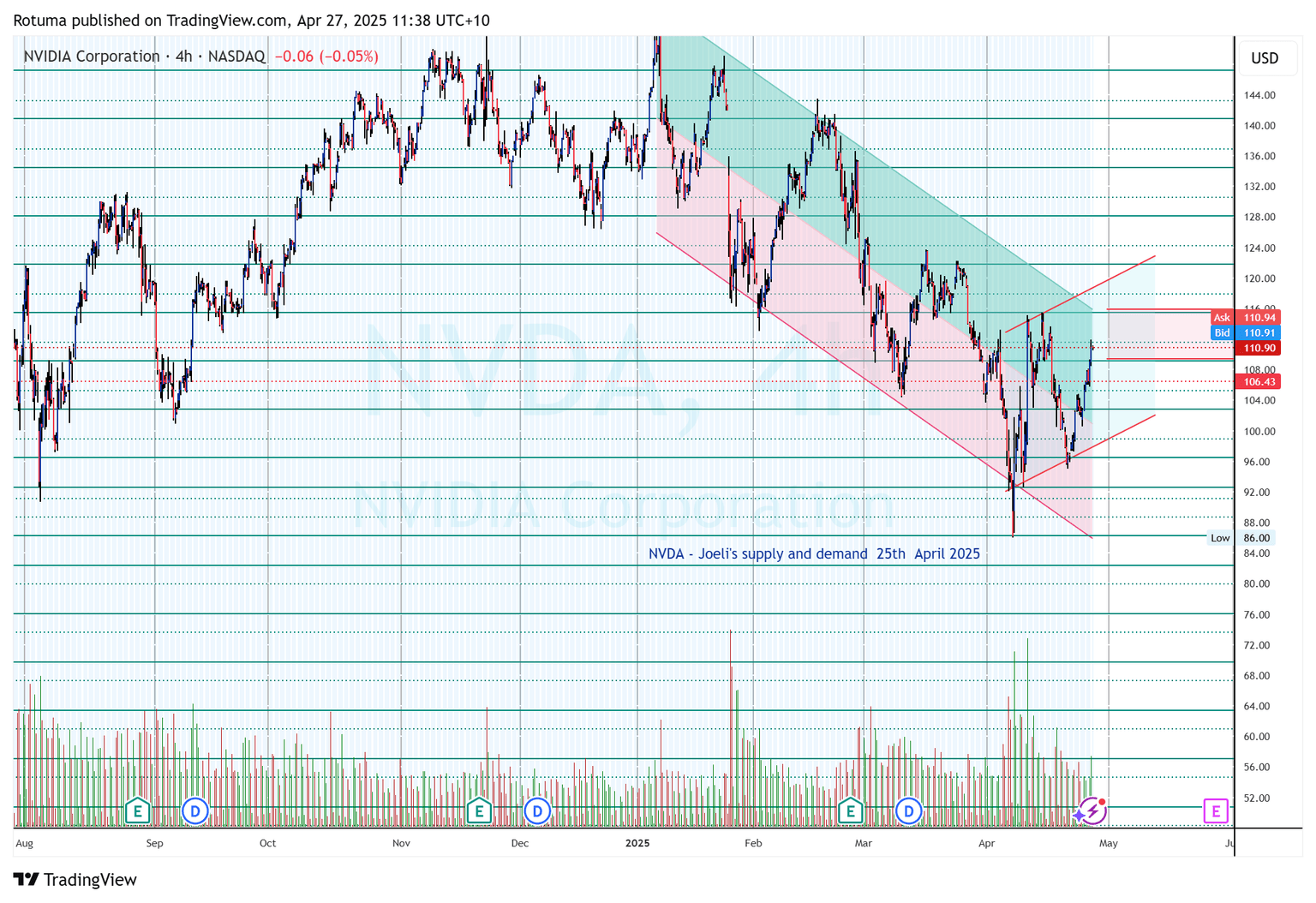

Nvidia Corporation (NVDA)

Nvidia posted a substantial 16% gain, driven by bullish sentiment in AI and data-centre markets. The recent breakout into the 109-111 resistance zone indicates confidence among traders. Successfully pushing beyond this critical resistance could target levels at 115 and 117. Falling below 109 would likely see a retracement towards supports at 105, 102, and potentially 98.

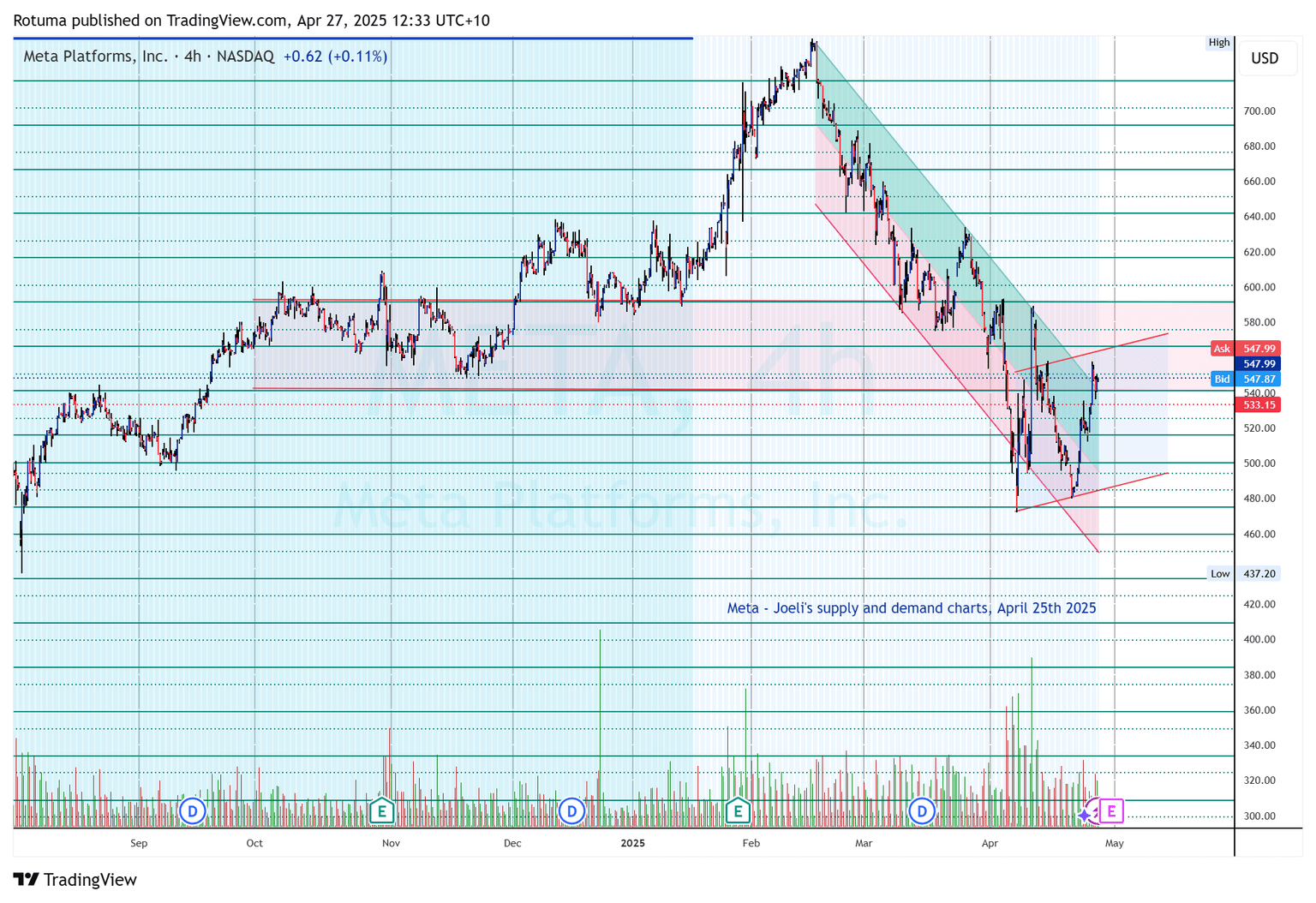

Meta Platforms (META)

Meta gained 13%, breaking out of a two-month descending channel. The current resistance is between $540 and $550. Breaking above this zone targets $565-$575, while dropping below $540 could lead to retracements towards $525, $515, and potentially $500.

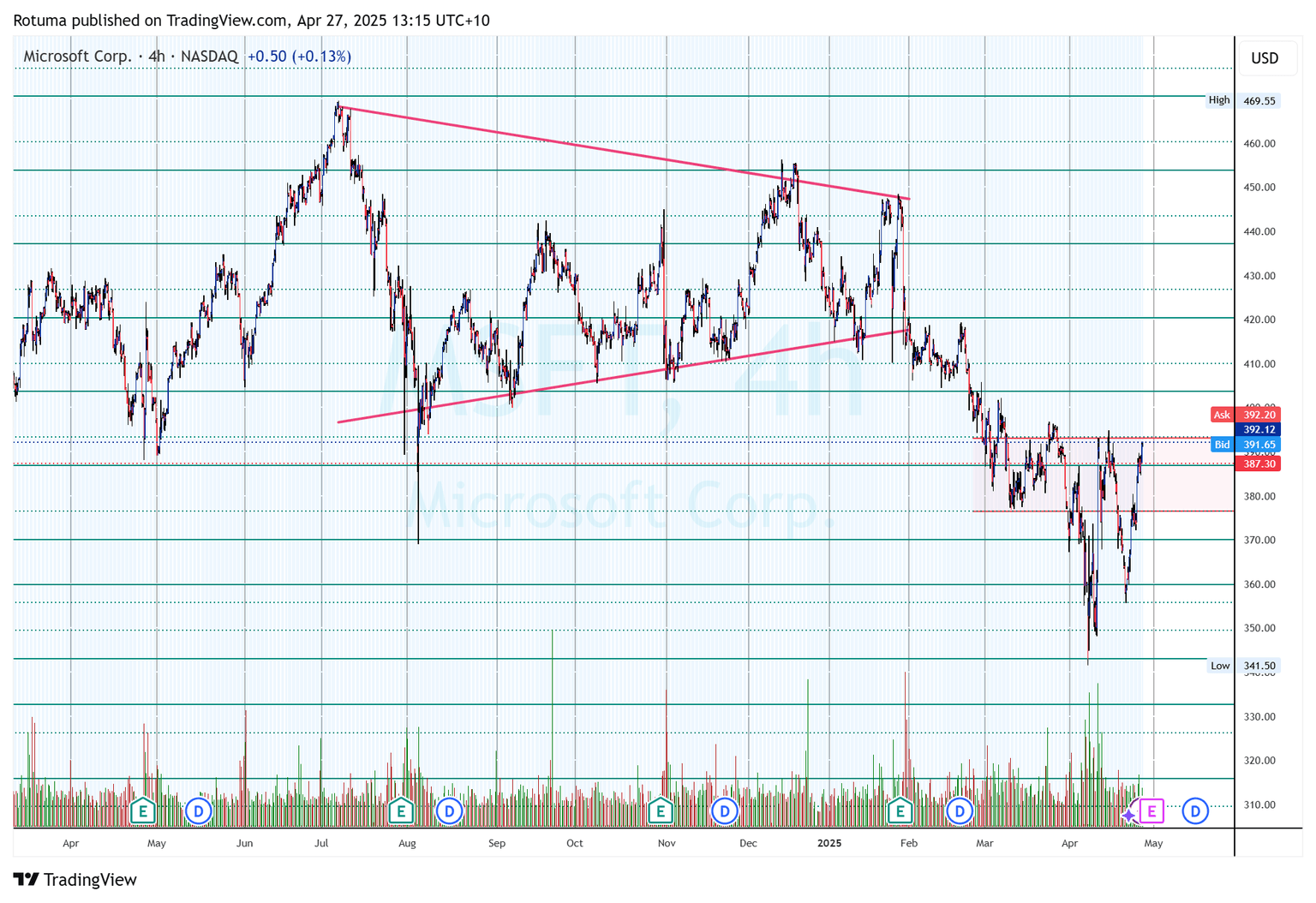

Microsoft Corporation (MSFT)

Microsoft's share price rose 10%, driven by optimistic sentiment ahead of Q1 earnings. Critical resistance is at $386-$393. A breakout above $393 targets $403, $410, and potentially $420, while failure could see a pullback to $376 and $369.

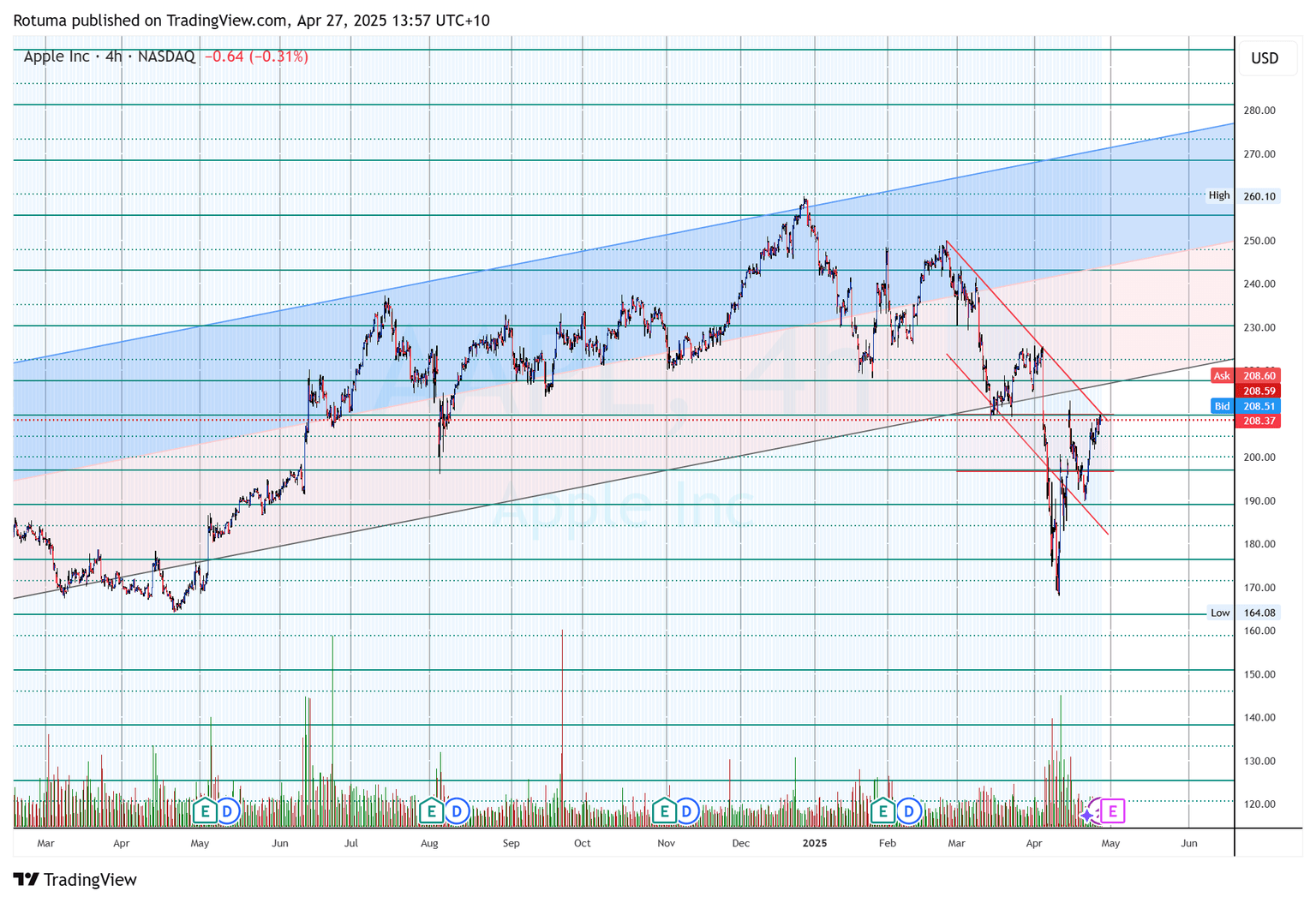

Apple Inc. (AAPL)

Apple rallied 10%, approaching resistance at $210. A breakout above $210 could target $217, $222, and $230, while failure risks pulling back to support levels at $204, $200, and, in the worst case, $190.

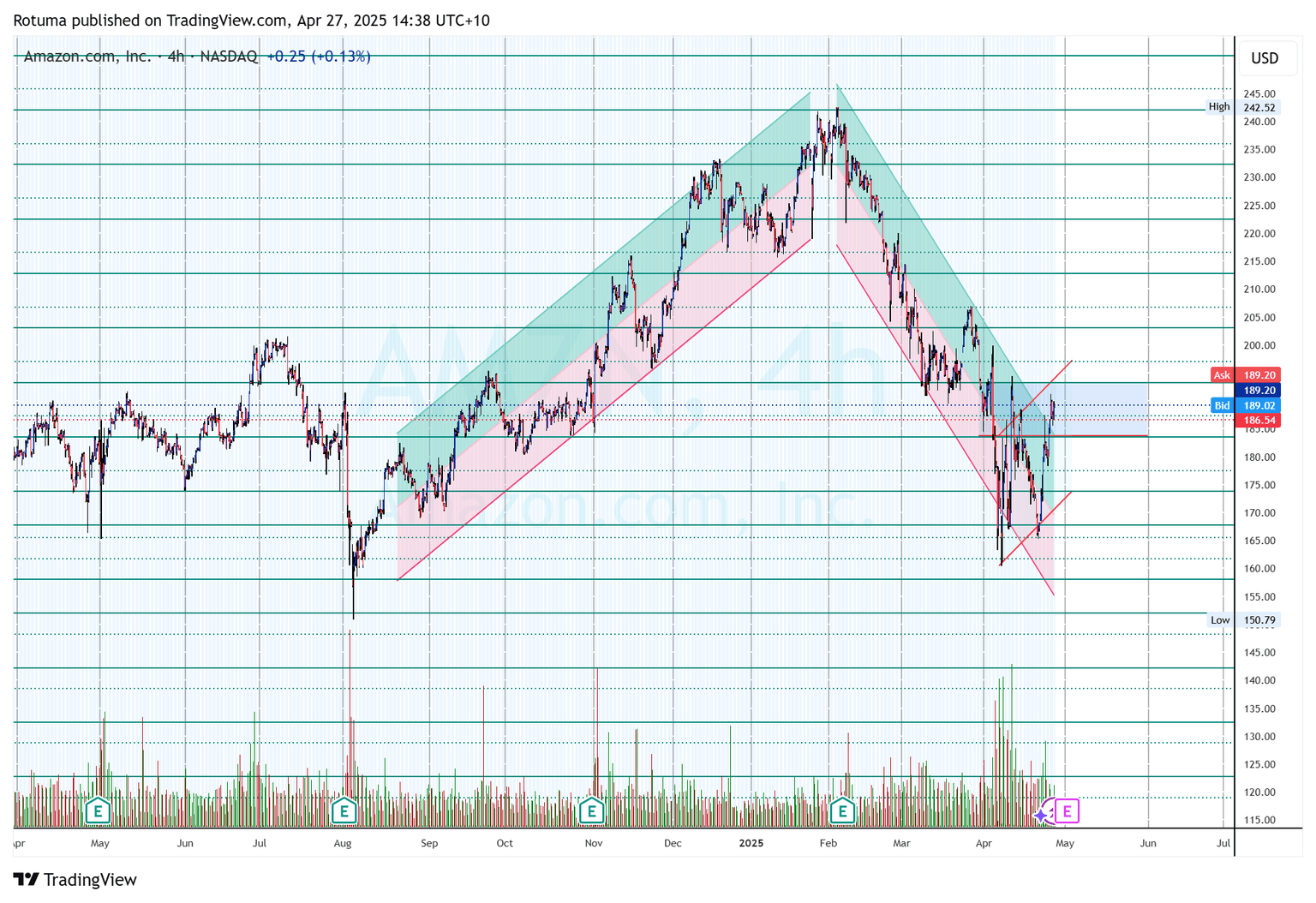

Amazon.com Inc. (AMZN)

Amazon posted a robust 14% gain, breaking through resistance levels as optimism builds ahead of earnings. Resistance is set at the $183-$187 zone. Breaking above $187 could target $193, $197, and $203. Failure to maintain above $183 might reverse the price to support levels at $177 and $173.

Strategic outlook for traders and investors

Investors and traders should closely monitor critical resistance and support levels detailed above. While fundamentals currently support bullish sentiment, unresolved tariffs and technical resistance suggest that traders and investors should be prepared for volatility, which is crucial. Position sizing and risk management remain essential in navigating this uncertain market landscape.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.