Subtle, yet important signal: Stocks shrug off the tariff cut

Today, we've got significant news regarding potential tariff reductions on China. President Trump suggested that "80% Tariff on China seems right" ahead of upcoming trade talks with Chinese officials. This would represent a substantial decrease from the current tariffs, which reach as high as 145%.

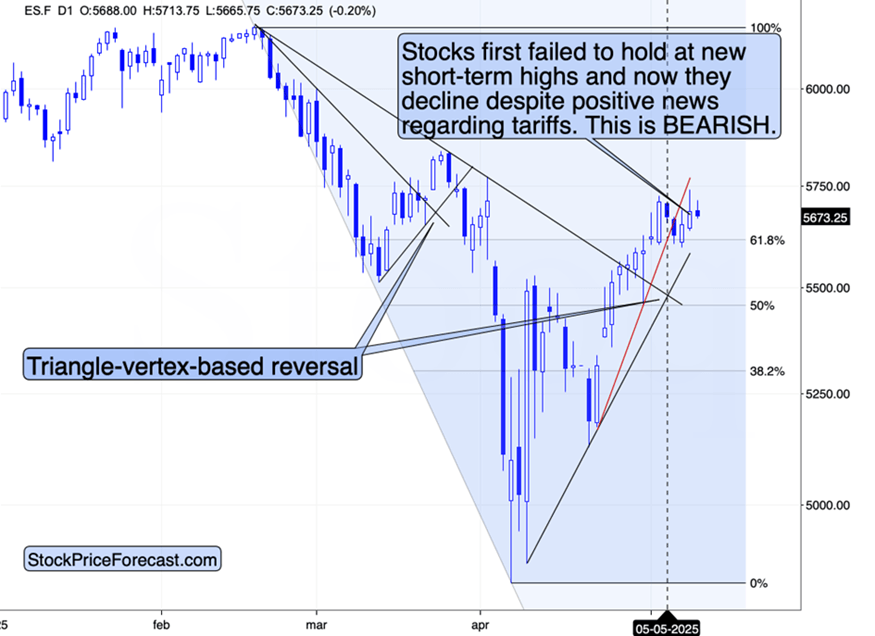

What's particularly interesting—and telling—is the stock market's tepid reaction to this news.

Despite what would typically be considered positive for the economy (lower tariffs), the stock market hasn't responded with enthusiasm. As of writing, stocks are slightly down, which suggests one of two things (or both):

1. The market doesn't believe these tariff reductions will materially improve the economic outlook, or

2. The market is primed to decline based on technical factors and sentiment, overwhelming what would normally be positive news.

This reaction aligns with what I've been discussing in recent alerts—markets don't always respond to news in direct ways, especially when technical conditions and market positioning are already pointing in a particular direction.

Bond market skeptical of trade boost

The bond market's reaction to this news provides additional context. Treasury yields haven't seen significant movement, suggesting fixed-income investors remain skeptical about the long-term economic impact of these potential tariff adjustments.

From a technical analysis perspective, today's price action further confirms what the charts have been telling us: the market is likely positioned for a meaningful decline regardless of news flow. When markets fail to rally on positive news, it's often a sign that selling pressure remains dominant. In other words, even though stocks’ move lower was small, the message is loud: stocks want to decline here.

This is profound, because stocks’ performance along with the one of the USD Index together provide key background for many markets, including commodities (like copper) and precious metals.

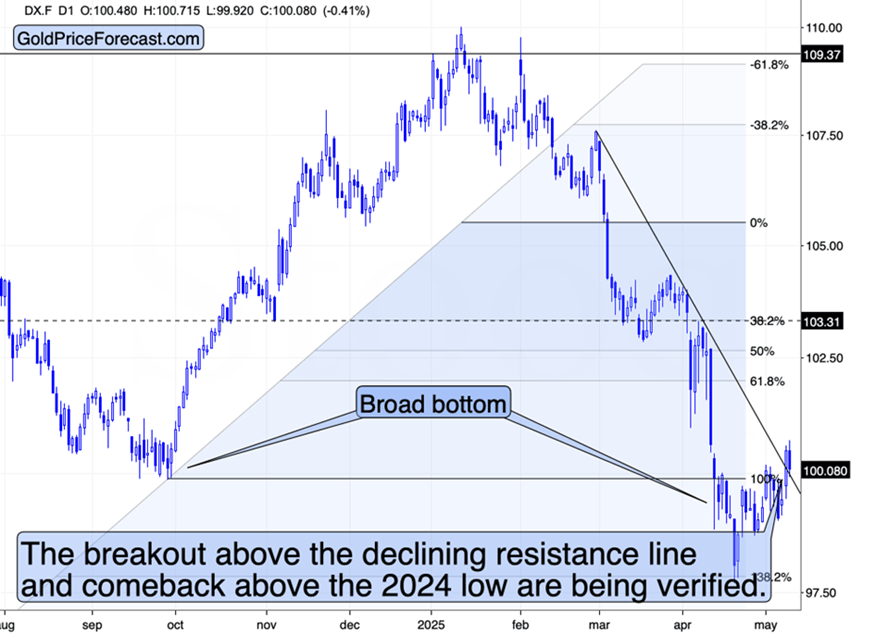

And the latter has also done something truly remarkable (and in tune with what I’ve been writing about for many days now). Namely, it soared back above its 2024 low and the declining resistance line.

Yesterday, before the rally, I commented on the above chart in the following way:

“On a short-term basis, we see that the USDX is on the verge of breaking above its steep, declining resistance line. At the same time, a rally above this line will also take the USD back above its last year’s lows, thus invalidating the breakdown.

This is the most likely way forward, and when it happens, it will become clear to many market participants that the trend has reversed.

That’s when the declines in the precious metals market will become much bigger.”

Indeed, the USDX soared, and gold declined. Today, the USD Index is correcting this rally, while gold is correcting its downswing.

Given USD’s breakout, this is completely normal, and since the declining resistance line held – it was verified as support. This is a bullish set-up for the USD Index.

The verification of the breakout above the short-term resistance line as well as the invalidation of the move below the 2024 low confirms the very bullish outlook. This is particularly the case, since so many investors out there are still bearish on the U.S. currency. (reverse Asian financial crisis, anyone?)

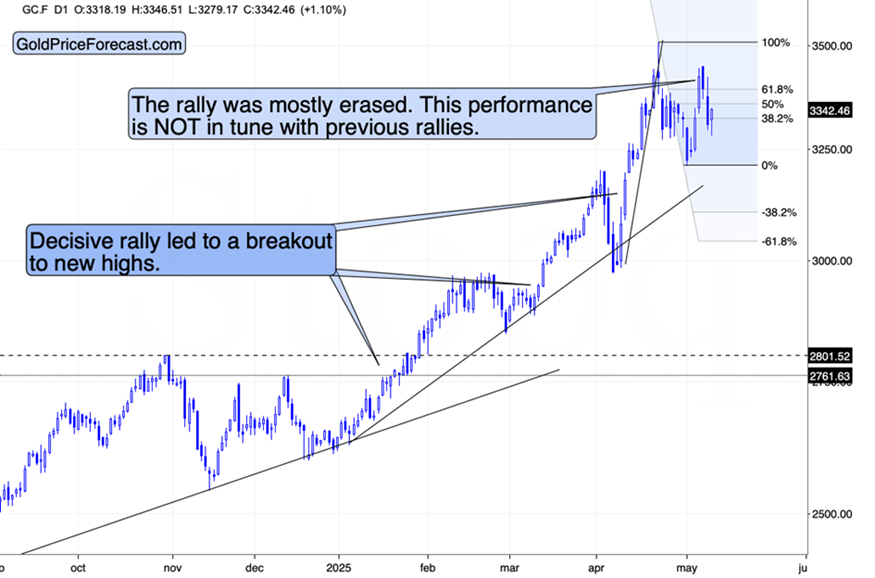

Consequently, today’s move higher in gold is of little consequence. The same goes for silver and mining stocks.

Bearish momentum builds in Gold

What IS of consequence is that gold’s recent price performance is clearly different from what we saw earlier this year, when gold was approaching its previous highs. The rally was temporary, just like I had warned.

Gold used to move to the previous highs in a steady manner and then break above them. There was once a tiny pause after the breakout, but there were no corrections before the breakout, let alone significant ones.

The fact that we saw gold’s significant decline this week and a move back below the 38.2% Fibonacci retracement (yesterday’s close) clearly proves that the previous bullish pattern was broken.

Now, as the USDX verifies its breakout, the odds for gold’s decline in the following days/weeks continue to increase. This translates into the same outlook for silver and mining stocks.

And if stocks decline – and they are likely to do that – the decline in silver and miners are likely to be magnified.

Also, since the tariffs are now moving back down, gold’s tariff- and uncertainty-based appeal is going to decrease. At the same time, the tariffs are likely to stay high enough to still cause economic damage to world economies, supporting declines in stock markets and commodity prices. Of course, there are ways to profit on this situation.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any