Stocks survive PCE and consumer data – FOMC too?

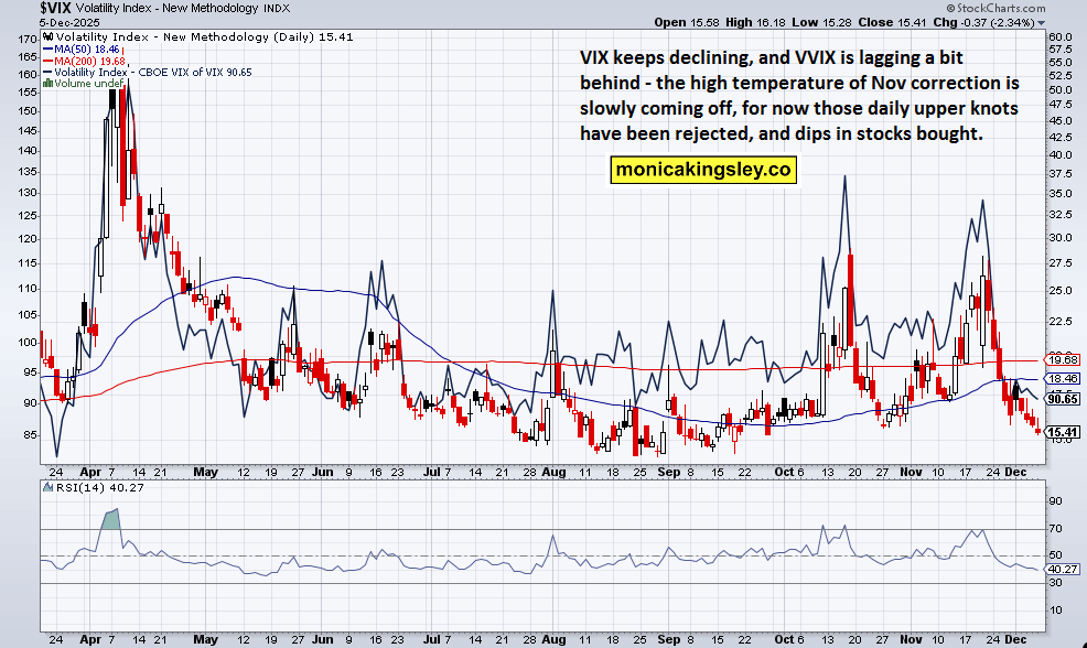

S&P 500 took a dive 75min before the opening bell, retail enthusiastically bought into PCE and UoM data release, and prices then settled little changed on the pre-flush level. What‘s apparent from checking the hourly on both ES and NDX this week? A series of higher highs and higher lows – remarkable resilience in a week that started with BTC selloff early Monday.

Friday was a bad day for crypto too, yet Nasdaq held considerably better once again. Mag 7 stocks are acting less uniform as a group, and the yearly winners (NVDA and earlier discussed GOOGL) clearly show up – I would highlight further discussed banking sectors too.

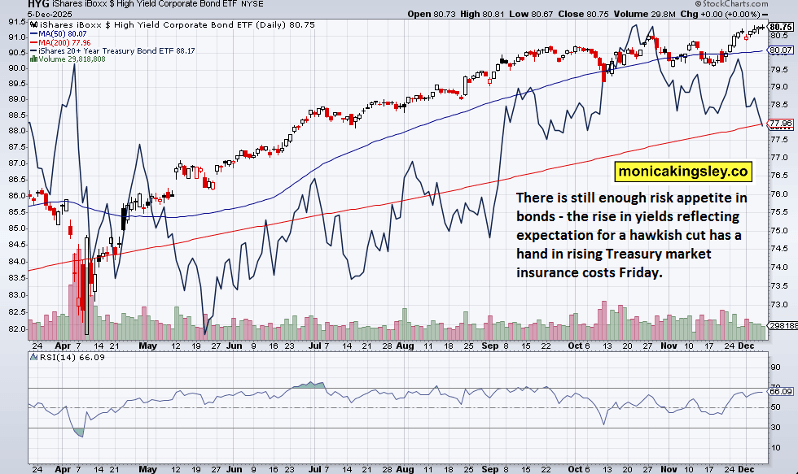

With the traditional Santa Claus rally expectation, we must ask whether there is sufficient breadth in the market to support such a feat – and whether Powell next week giving us a widely expected hawkish cut, will be enough for stocks to go on… look at ORCL and AVGO earnings too.

Friday‘s dynamic to highlight is the poor data expectation, so readily bought, and when the data came, they weren‘t nearly enough that bad to sink the 500-strong index.

Look also at retailers‘ performance, check out also DG, and UoM data – with leading indicators for services being better than for manufacturing, that tells us as much as there is to say about that recession risk… or for the „contagion“ of rising Japanese yields that were unable to sink Nikkei, let alone stocks around the world… nuff said.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.