Stocks: Steady on trade talk optimism

Will the weekend trade talks push stocks to new highs?

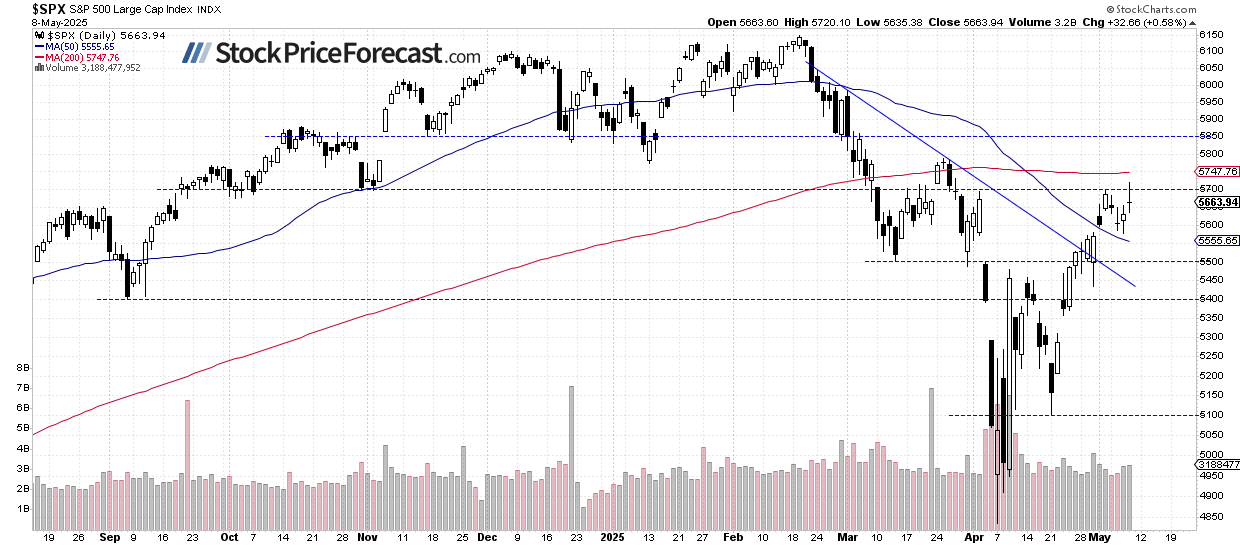

The S&P 500 gained 0.58% on Thursday, but closed below the important 5,700 resistance level following volatility triggered by tariff developments. This morning, futures slightly positive, with the S&P 500 expected to open 0.2% higher as investors maintain cautious optimism ahead of crucial U.S.-China trade talks scheduled for this weekend in Switzerland.

Markets are closely watching these upcoming negotiations between U.S. Treasury Secretary Scott Bessent and trade negotiator Jamieson Greer with their Chinese counterparts. Unlike the U.K., China was omitted from Trump's tariff pause and currently faces U.S. duties of at least 145%, with Beijing implementing reciprocal levies of 125%.

The investor sentiment has improved, as shown in the Wednesday’s AAII Investor Sentiment Survey, which reported that 29.4% of individual investors are bullish, while 51.5% are bearish.

The S&P 500 continues its short-term consolidation, likely a flat correction of the uptrend. Thursday's rally failed to push decisively through 5,700 resistance, suggesting some hesitation among buyers despite the positive U.S.-U.K. trade deal.

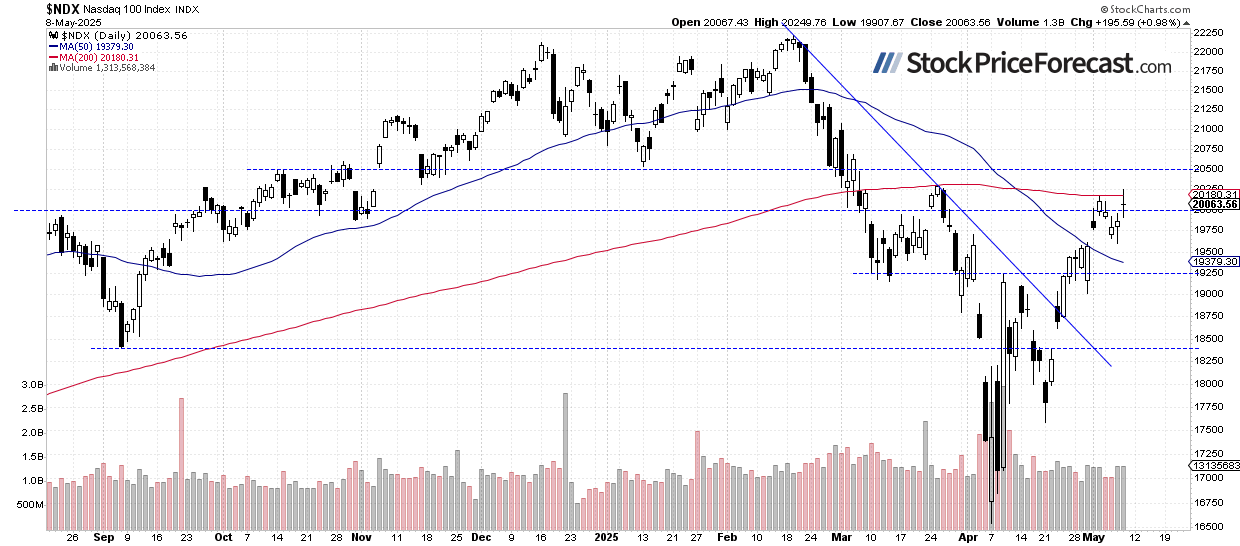

Nasdaq 100: Watching China talks closely

The tech-heavy Nasdaq is particularly sensitive to developments in U.S.-China relations, with many large-cap tech companies having significant exposure to the Chinese market.

Yesterday it gained 0.98%, moving back above the 20,000 level, and this morning it's likely to open 0.4% higher.

VIX dips to new local low

The volatility index dipped to a new local low of 21.88 yesterday, suggesting that the market continues to shrug off its early April panic mode.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

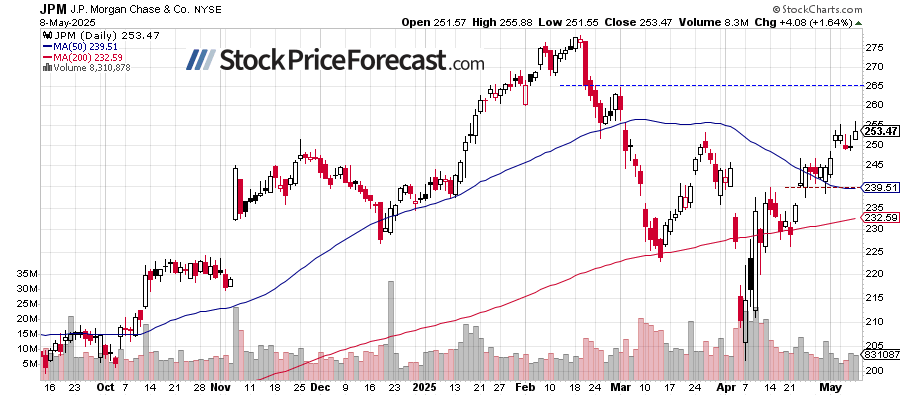

Stock trading idea – JPM

The long position in JPM stock opened on May 5th at $251.18 remains active and is currently in profit. The stop-loss level is at $240.00, and profit target is at $265.

The stock broke higher last Friday, which is a positive signal suggesting it's likely to continue its uptrend. Expected duration of the trade is 1-2 weeks; however, I'll keep you updated about any changes in the outlook.

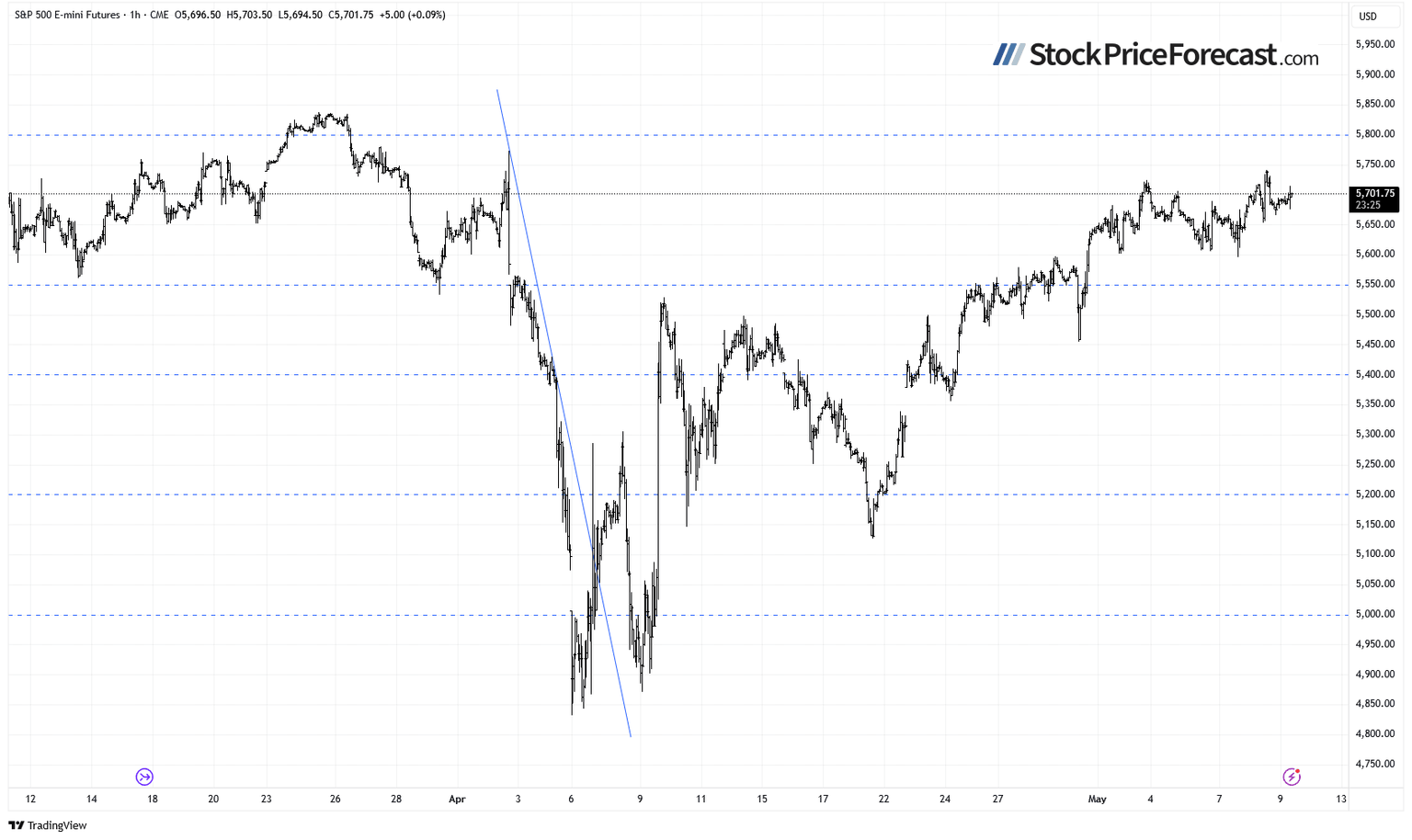

S&P 500 futures contract: Moving sideways

This morning, the S&P 500 futures contract is trading along the 5,700 level, extending its short-term consolidation.

The resistance remains around 5,700-5,720, while support is at 5,600, marked by the recent lows.

This sideways movement doesn't signal a weakness but rather a healthy ‘recalibration’ where early buyers take profits. These pauses often create good entry opportunities for those who missed the initial move, setting the stage for the next potential leg higher when the uptrend resumes.

Conclusion

The S&P 500 is expected to open slightly higher this morning, continuing to test the key 5,700 level. All eyes are on the upcoming U.S.-China trade talks this weekend, which could impact market direction next week.

Here’s the breakdown:

- S&P 500 gained 0.58% on Thursday but closed below the 5,700 resistance level.

- Futures indicate a modest 0.2% higher open today as markets adopt a wait-and-see approach ahead of weekend trade negotiations.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.