Stocks: Is this a major reversal?

The S&P 500 pulled back sharply from its new record - is the rally over?

The S&P 500 closed 0.37% lower on Thursday. While that may seem like a small move, the index retreated from a new all-time high of 6,427.02, erasing its earnings-driven advance. Today, the S&P 500 is expected to open 0.9% lower following monthly jobs data, with Nonfarm Payrolls coming in lower than expected at +73,000 (vs. +106,000).

Investor sentiment has improved slightly, as reflected in the Wednesday’s AAII Investor Sentiment Survey, which reported that 40.3% of individual investors are bullish, while 33.0% are bearish.

The S&P 500 pulled back from a new record yesterday, as shown on the daily chart.

Volatility breakout system update

My Volatility Breakout System reversed to a short position yesterday. The strategy gained 363.94 points on its long position since June 3, improving overall performance.

It is currently positioned short, with the next reversal trigger to be posted Monday after the market opens.

This systematic approach continues to identify key market turning points and has been particularly effective during this year's volatile conditions, outperforming S&P 500!

The system's strength lies in its ability to capture major market moves while avoiding the noise of day-to-day fluctuations. For those following this approach, the current position demonstrates how patience and systematic execution can lead to meaningful gains.

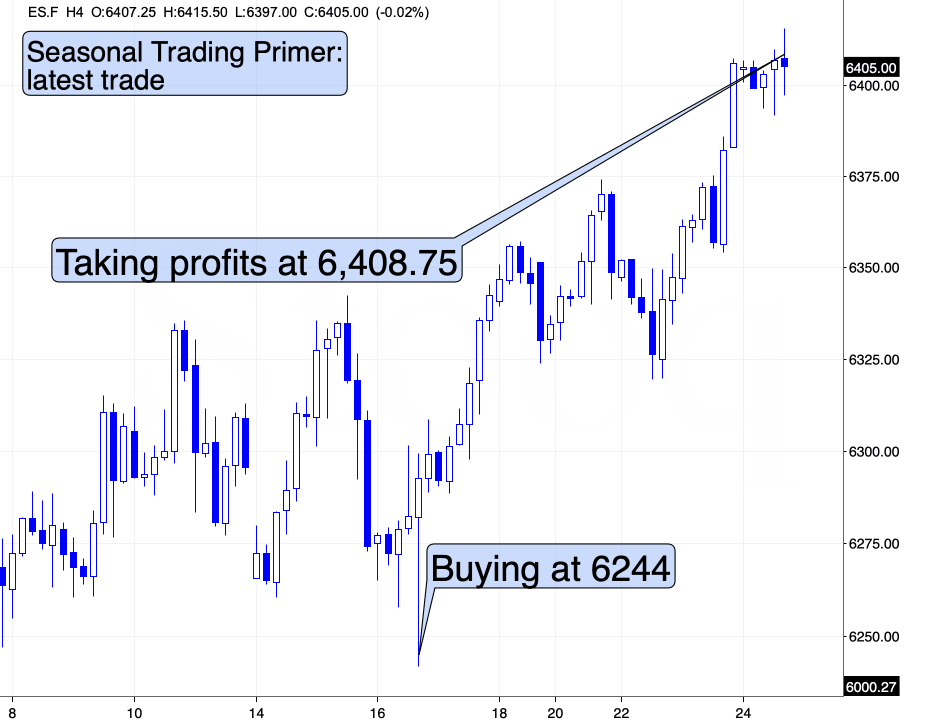

Seasonal trading signal suggested caution

Before the VBS reversal, an important warning signal came from Ryan Mitchell's Seasonal Trading Primer, which suggested that the market may be nearing the end of its short-term seasonal strength.

S&P 500 futures contract continues pulling back

This morning, the S&P 500 futures contract is trading just above 6,300 after touching a local low of 6,295. The index retraced this week’s gains and looks set for more volatility. Resistance is now around 6,350, with support at 6,250–6,300.

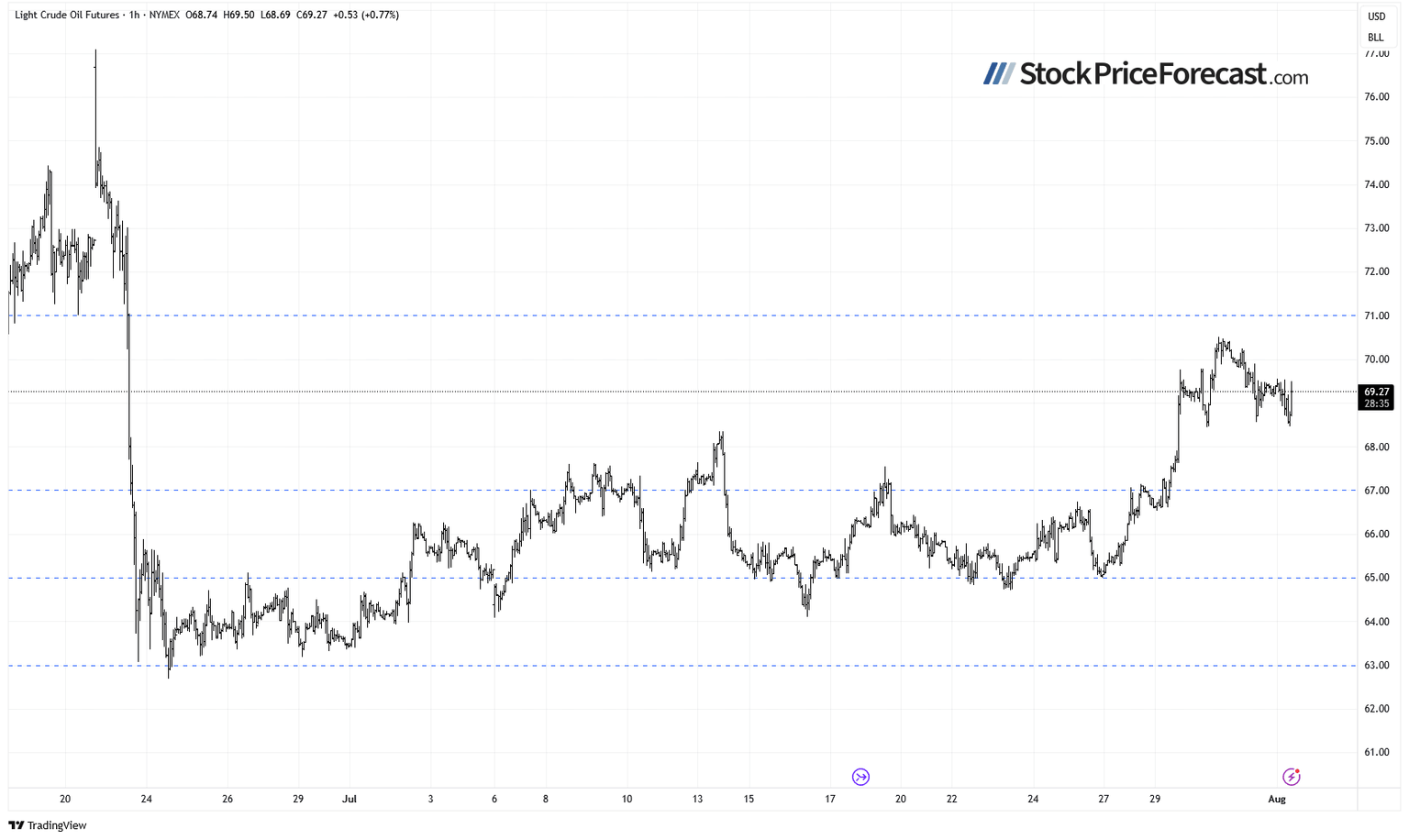

Crude Oil faces uncertainty at $70

Crude oil dropped 1.06% on Thursday, pulling back from the $70 level. Prices have turned sideways as investors digest tariff-related developments. Today, crude is another 0.6% lower, trading below $69.

As I'm writing in my Oil Trading Alerts, key developments worth monitoring include:

- Today, markets are weighing U.S. tariffs ranging from 10% to 41% on imports from countries like Canada, India, and Taiwan, while trade deals were secured with the EU, Japan, South Korea, and the UK.

- Recently, sentiment was supported by U.S. threats of 100% secondary tariffs on Russian crude buyers, which could disrupt up to 2.75M bpd of Russian exports. Analysts warned effective sanctions could push oil prices much higher given the difficulty of replacing Russian supply.

- Chevron reported Q2 profit above analyst expectations, supported by record oil and gas production and lower capital spending, despite an 11% drop in crude prices. Adjusted earnings came in at $3.1 billion ($1.77 per share) versus estimates of $1.70.

Market outlook: Thursday’s drop raised caution

The S&P 500 is set to open 0.9% lower this morning as sentiment weakens after yesterday’s pullback. While jobs data sparked a brief volatility, the market seems to be entering consolidation or possibly a deeper correction.

Here's what I think is most likely

- The S&P 500 continues to slide after retreating from a new record high.

- The rally has extended gains for those using systematic approaches like my Volatility Breakout System.

- There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point.

- A lack of strong bullish catalysts may limit further upside in the near term.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.