Stocks: Continued sell-off on tariffs

Will the S&P 500 find a short-term bottom after opening much lower again?

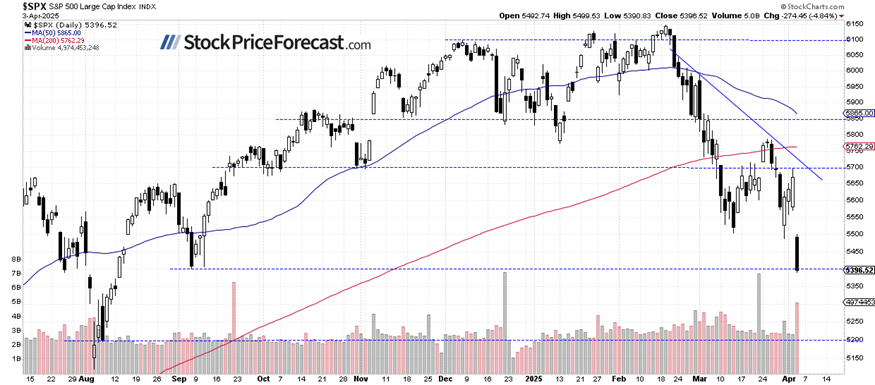

The S&P 500 plummeted 4.84% on Thursday, crashing below the 5,400 level as investors reacted to the Trump tariff announcement. The index is now trading at its lowest levels since August, with futures indicating another 2.7% drop at today's open following China's retaliatory tariff announcement. Technical damage has been severe, with multiple support levels violated.

This morning's higher-than-expected Nonfarm Payrolls release (+228,000) has had minimal impact on market sentiment amid the tariff concerns.

Investor sentiment has significantly worsened, as shown in the Wednesday’s AAII Investor Sentiment Survey, which reported that 21.8% of individual investors are bullish, while 61.9% of them are bearish.

The S&P 500 is expected further accelerate its sell-off, as we can see on the daily chart.

Nasdaq 100: Breaking below key supports

The tech-heavy Nasdaq 100 plunged 5.41% on Thursday, accelerating its downtrend toward the 18,500 level – its lowest point since early September. The index is expected to open 3.0% lower today, with the next support level around 18,000.

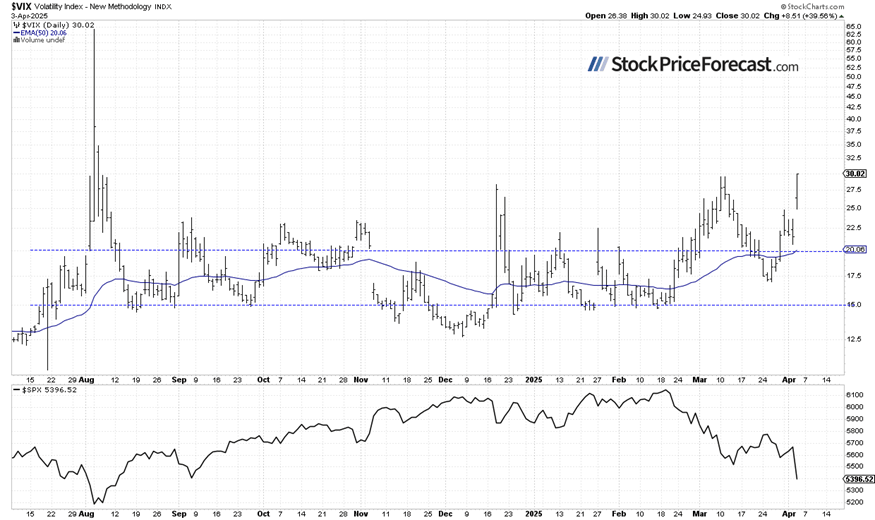

VIX spikes to 30

The VIX index surged to 30.02 yesterday, reflecting panic-level fear in the market.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

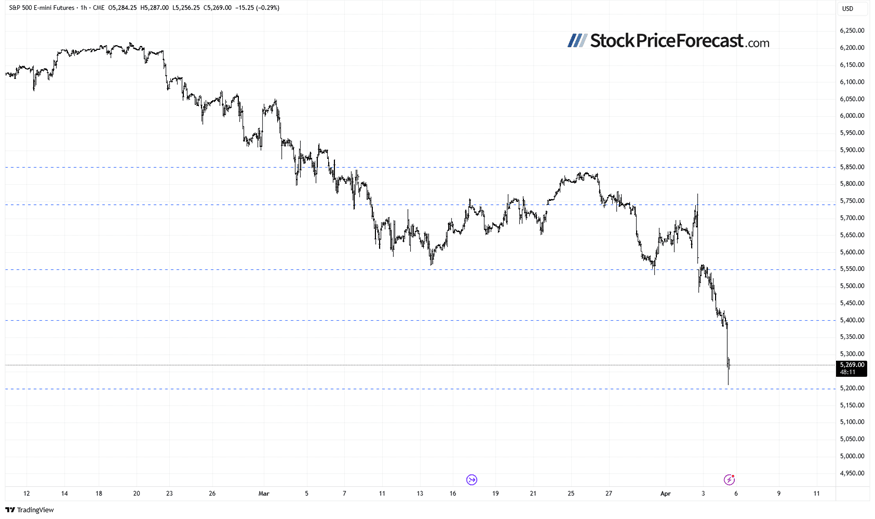

S&P 500 futures contract continues selling off

This morning, the S&P 500 futures contract is trading below the 5,300 level after extending its sell-off on China's tariff announcement. Current resistance is around 5,400, with potential support at 5,200.

Conclusion

The stock market has accelerated its downtrend significantly as investors price in the severe escalation in global trade tensions. Key support levels have been violated, confirming substantial technical damage across major indices. Despite this negative price action, the extreme bearish sentiment readings and VIX spike suggest we may be approaching a short-term bottom that could eventually lead to a relief rally.

Here’s the breakdown:

-

The S&P 500 continues its sharp sell-off following Trump's tariff announcement and China's retaliation.

-

While no positive signals are evident yet, stocks may be nearing a potential short-term bottom

-

In my opinion, the short-term outlook is neutral.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.