SPX: Strong momentum, but are risks building?

Section 1: Strong momentum of daily chart

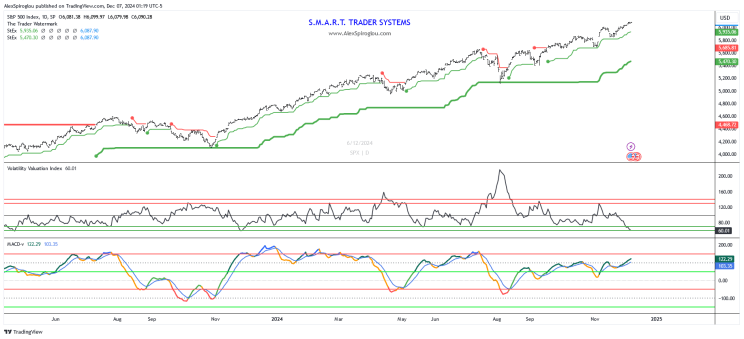

The SPX daily chart presents an interesting contrast between momentum and volatility —two indicators that often don’t move in sync.

Let’s break it down using our "Chart Checklist":

-

Trend: Stage 1 (Short-term and long-term trends are both up).

-

Momentum: Range 3 (Rallying, with MACD-v > 100 and hitting new highs).

-

Volatility: Range 1 (Complacency).

While momentum is undeniably strong, (MACD-v > 100 AND making new momentum highs) volatility is signaling something different.

As highlighted yesterday, the Volatility Valuation Index (VVI) suggests subtle complacency creeping into the market.

This divergence raises a question: can the market sustain such strong momentum, or is it setting up for a reversal / retracement ?

Perhaps the answer lies outside of the daily chart...

Section 2: Too strong momentum of monthly chart

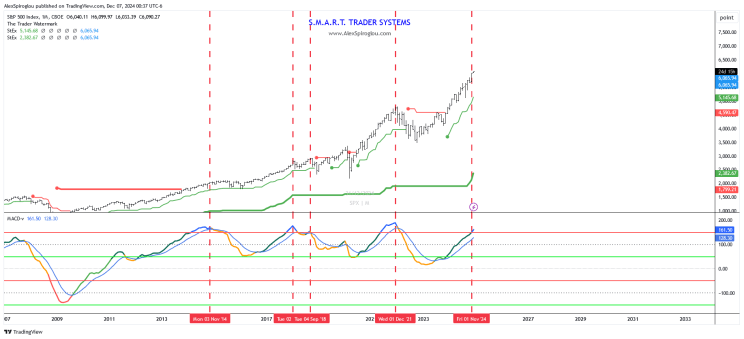

Zooming out to the monthly chart,

The MACD-v (12,26) shows momentum in the "Risk Range" (>150).

Historically, this level correlates with corrections, ranging from minor pullbacks to full-blown bear markets.

This signal doesn’t appear often, but when it does, it’s worth paying attention to.

Still, no indicator should be used in isolation— it’s all about combining factors like trend, momentum, and volatility, breadth, sentiment, etc for a clearer picture.

Author

Alex Spiroglou, CFTe, DipTA (ATAA)

Independent Analyst

Alex Spiroglou is a quasi-systematic, cross-asset proprietary futures trader. His involvement with capital markets began in 1998, having worked for various proprietary trading and investment management firms in the UK and Greece.