SPX: Market has a bad brea(d)th

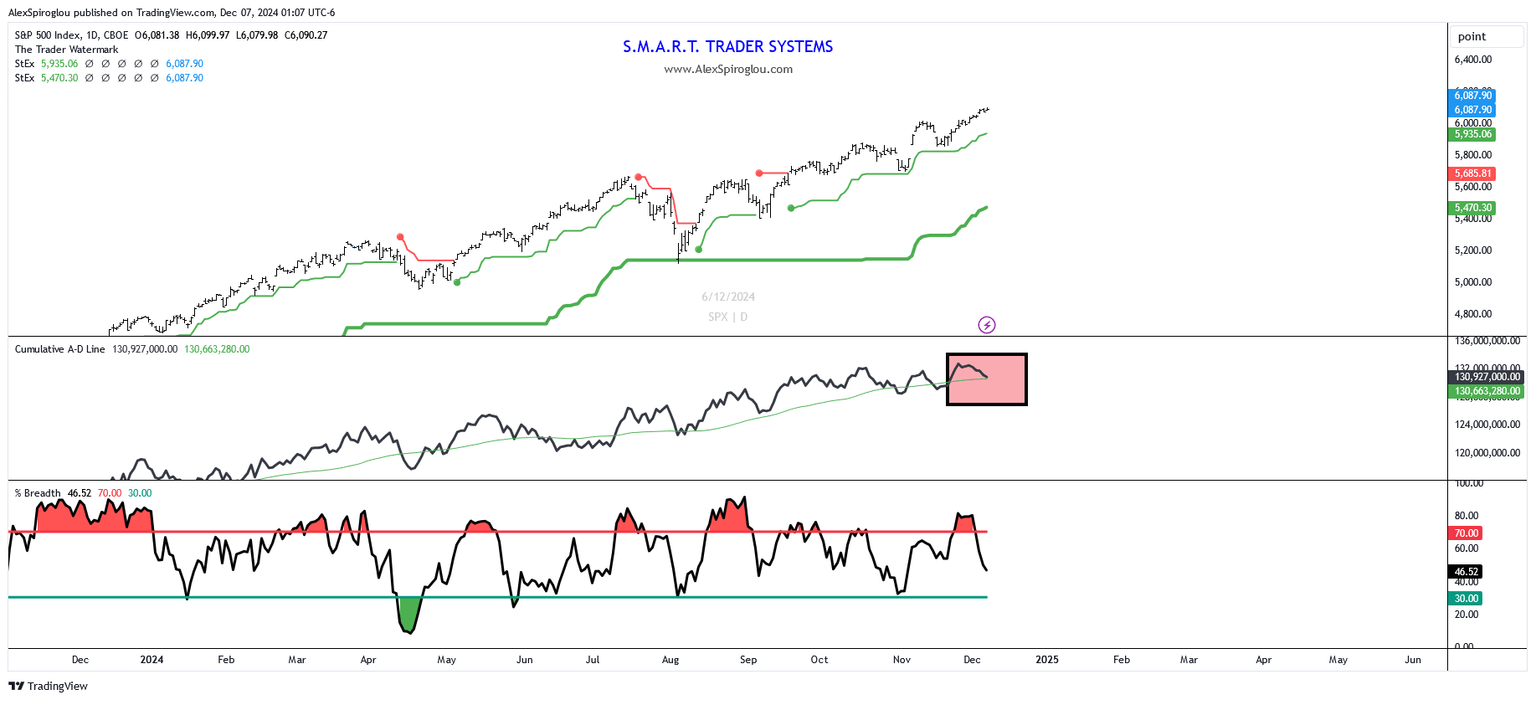

TOP PANEL: SPX & Volatility Stops

BOTTOM PANEL: % of SPX stocks > 20 MA , NYSE A/D line

Section 1: The market has bad brea(d)th

When it comes to the market’s foundation, things aren’t looking as strong as they seem.

The middle panel of the chart highlights the cumulative NYSE A/D line,

which tracks the net number of advancing vs. declining stocks on the NYSE.

Right now, it’s flashing a warning: despite the index hitting new highs,

the A/D line isn’t confirming this move (highlighted in red).

In the third panel, the percentage of SPX stocks trading above their 20-day EMA

(short term breadth) is also slightly concerning.

It recently hit overbought levels (>70) but is now declining,

another warning for the market’s strength.

Section 2: About the Indicators

- NYSE A/D Line: This measures market breadth by comparing advancing stocks to declining stocks. A rising line confirms broad participation, while a divergence signals fewer stocks driving the rally.

- % of SPX Stocks > 20 EMA: This indicator shows the percentage of SPX stocks trading above their 20-day exponential moving average. Readings above 70% suggest overbought conditions, while a decline signals weakening momentum.

Author

Alex Spiroglou, CFTe, DipTA (ATAA)

Independent Analyst

Alex Spiroglou is a quasi-systematic, cross-asset proprietary futures trader. His involvement with capital markets began in 1998, having worked for various proprietary trading and investment management firms in the UK and Greece.