SPDR S&P 500 ETF Trust (SPY) News and Forecast: Rally firmly established, so how far can it go?

- Equity markets look to continue bear market rally.

- S&P 500 closes up 2%, while Nasdaq finished up 3%.

- Futures markets are pricing in less aggressive Fed rate hikes.

Equities were stronger on Thursday as investors finally returned to some beaten-down sectors and interest rate markets grew more doveish. 86% of all stocks closed in the green, marking a broad-based advance. In terms of sectors, all bar real estate closed higher, with tech (XLK) and consumer (XLC) being the strongest sectors. No surprise given their noted underperformance this year.

S&P 500 (SPY) Stock News

Equities finally look to begin their much-anticipated rally after a strong showing on Thursday. Early morning sentiment was less than positive, but a positive earnings slate from retailers helped turn sentiment back toward risk assets. Macy's (M), Dollar Tree (DLTR) and Dollar General (DG) all performed exactly as we had anticipated in our preview note. The risk-reward was skewed to the upside after the shock and awe of Walmart (WMT) and Target (TGT). So it proved with all three stocks above posting double-digit gains on Thursday with Dollar Tree and Macy's both posting near 20% gains.

The mood was further helped by a strong performance from Alibaba (BABA), which led retail traders to wade back into meme stocks as GME soared 13% and other retail interest stocks also outperformed. Tesla (TSLA) took a boost from news of Elon Musk increasing his equity financing amount to $33.5 billion. This was enough to see the EV leader close nearly 7% higher. Twitter (TWTR) also gained, closing at $48.93 for a gain of 6%.

S&P 500 (SPY) Stock Forecast

We had been anticipating this rally, but the timing as with everything trading related was the hard part. Positioning among the fund community was underweight equities and sentiment indicators were so low that a sharp countertrend rally was always the more likely outcome. The retailers finally got this move going.

What we are more surprised about is the sudden dovishness in the interest rate market. This week has seen the interest rate market price 25 basis points out of the Fed hiking cycle. Are these investors thinking the Fed will act more benignly to save the equity market? Or is it a function of bond markets seeing a 2023 recession as inevitable and so pricing rates lower? Either way, this move looks curious but has allowed equities to rally.

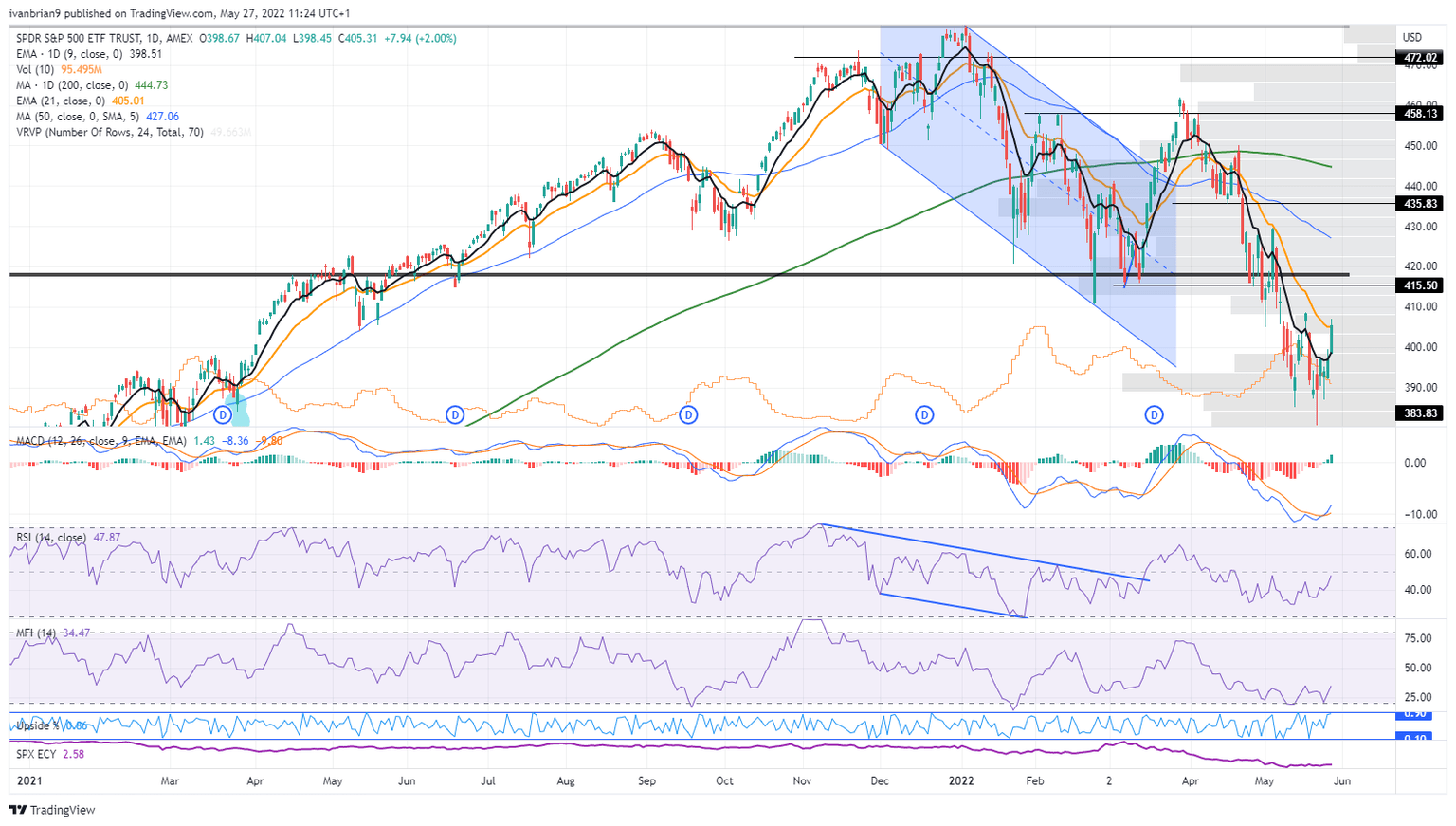

Chart resistance is at $408 from last week's high. That then leads to a move to $415. There is a lot of chop and uncertainty around $415, extending right up to $435. All that means is we do expect a test of $435, but it will be choppy and difficult. Below $408 we remain short-term bearish. We remain long-term bearish below $435-$440.

SPY chart, daily

The author is short Tesla and Twitter.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.