SPDR S&P 500 ETF Trust (SPY) News and Forecast: Is the rally over or taking a breather?

- SPY closed lower on Wednesday, down 0.7%.

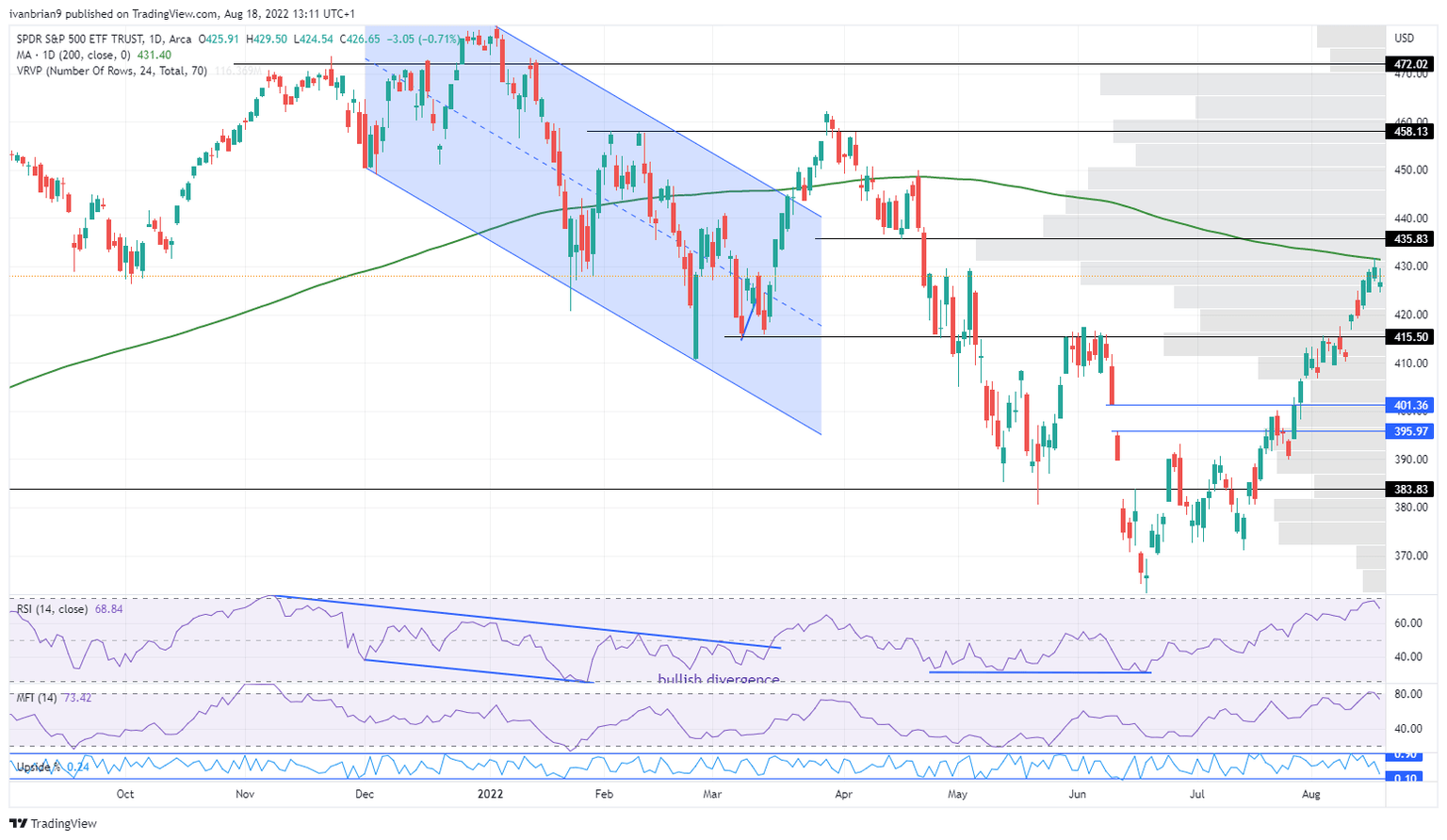

- SPY also fails to break the 200-day moving average.

- The equity rally may be closing as meme stock melt-up also fades.

The equity rally that has gone on for longer than most expected may be coming to an end. Wednesday saw some bets closed ahead of the Fed minutes, which were largely uninspiring. The minutes were broad enough that hawks and doves (or bears and bulls) could make an argument for either view. In the end, it just seems that fatigue is setting in.

SPY news

This rally may have just witnessed the last melt-up phase, that of retail traders storming back into the market. Meme stocks have soared this week with the likes of Bed Bath & Beyond (BBBY), AMC Entertainment (AMC) and others all posting strong gains. On Wednesday AMC fell on the back of Cinemark saying it was considering restructuring debt as it halved in value. Next up, talk of Ryan Cohen selling his BBBY stake has also put the brakes on that advance.

This rally was quite long in the tooth anyway with the Nasdaq rallying over 20% and Apple up a colossal 36% from June lows. So far the bond market has reacted calmly to the Fed minutes with yields not moving significantly. The VIX does look to have bottomed out though, and that may signal some stress ahead.

SPY forecast

Strong resistance remains in the $430 to $435 region from the 200-day moving average and April lows are at $435 as well. Volume is also high up here, meaning the rally will at least slow if not fall over. SPY is also showing as overbought on the Relative Strength Index (RSI) and the Money Flow Index (MFI). All that has led me to take a short position on the IUSA ETF – the European version of SPY. A break of $435 will end this bearish strategy. Market breadth has also been deteriorating all week despite the ongoing rally. That signals to me that momentum is beginning to slow.

SPY daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.