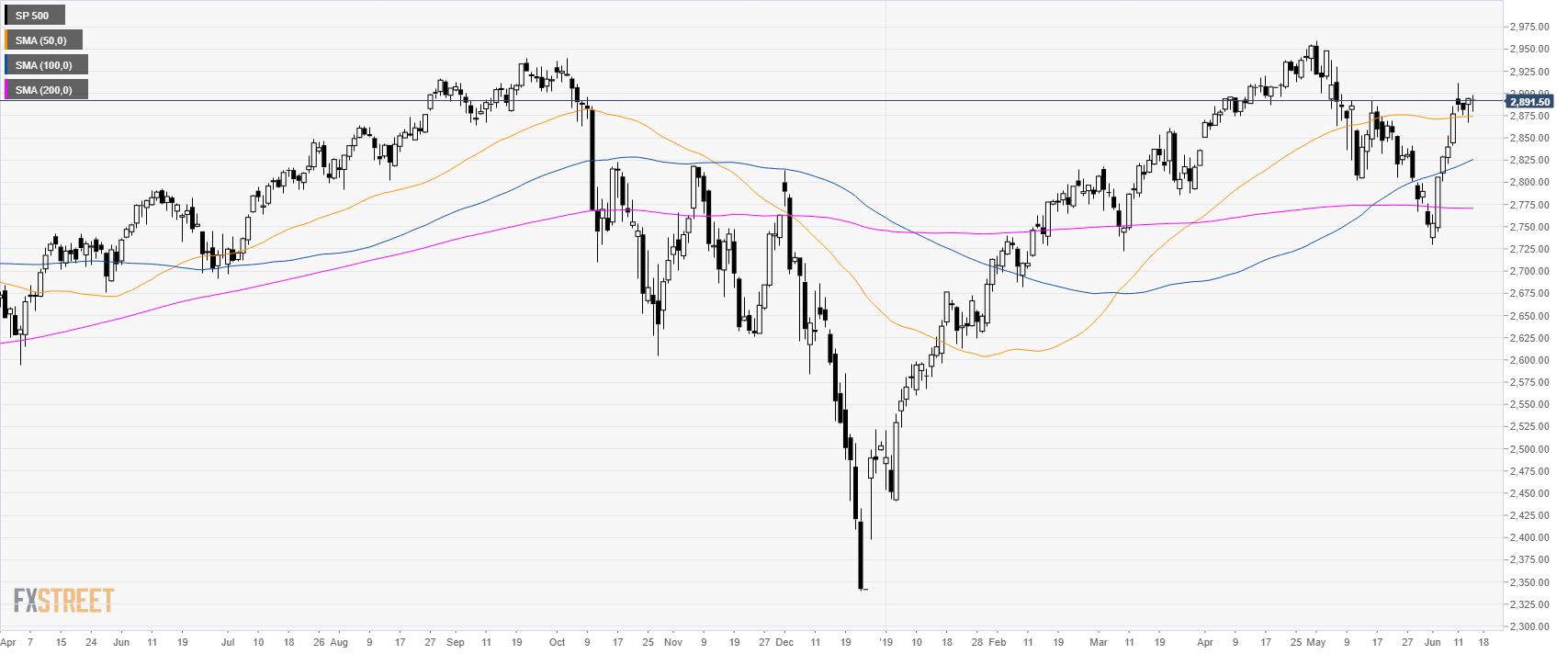

S&P500 technical analysis: Week-long consolidation sees 2,880.00 support holding

- The S&P500 spent the week in consolidation mode just above 2,880.00 support

- The level to beat for bulls is the 2,910.00 resistance.

S&P500 daily chart

The S&P500 Index is consolidating the gains of the last weeks below the 2,900.00 handle. The market remains bullish above its main daily simple moving averages (DSMAs).

The stock index is trading above its main SMAs suggesting bullish momentum in the medium term. Bulls are looking for a break above 2,910.00 to reach 2,940.00 and 2,960.00. Immediate support can be located at 2,880.00 and 2,840.00.

Author

Flavio Tosti

Independent Analyst