S&P 500 Index opens modestly higher as tech stocks rebound

- Wall Street's main indexes trade mixed on Wednesday.

- Private sector employment continued to rise at a strong pace in April.

- S&P 500 Technology Index is up 0.8% after the opening bell.

Following Tuesday's drop, major equity indexes in the US started the day on a mixed note on Wednesday amid varying performances of major sectors. As of writing, the S&P 500 Index was up 0.3% at 4,177, the Nasdaq Composite was gaining 0.62% at 13,628 and the Dow Jones Industrial Average was posting small daily losses at 34,122.

The risk-sensitive S&P 500 Technology Index, which suffered heavy losses on Wednesday, is currently rising 0.8%, reflecting a positive shift in market mood. On the other hand, the defensive Real Estate and Utilities indexes both lose more than 0.5% after the opening bell.

Earlier in the day, the data published by the Automatic Data Processing (ADP) Research Institute showed that employment in the US private sector rose by 742,000 in April. This reading came in slightly worse than the market expectation of 800,000 but was the strongest monthly increase since September 2020.

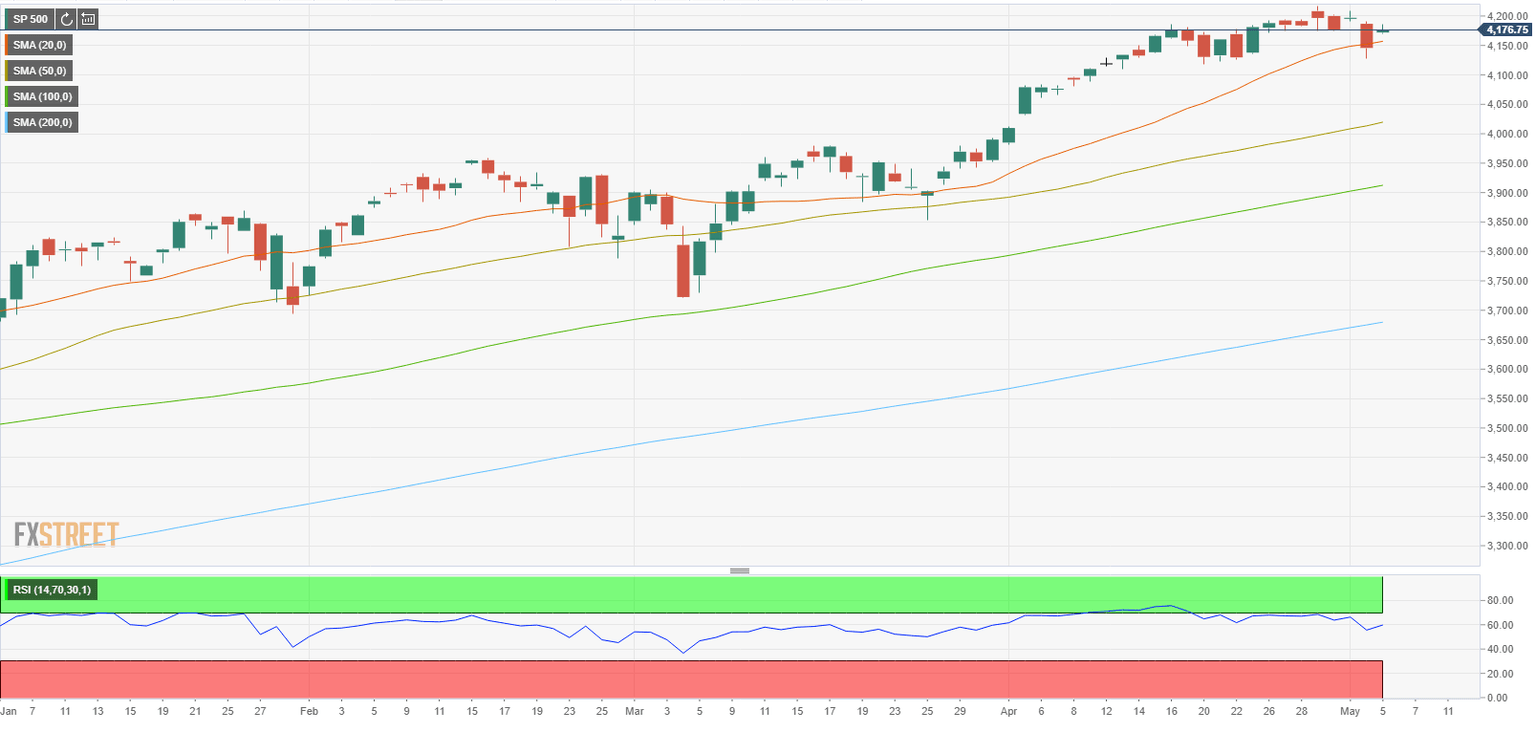

S&P 500 chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.