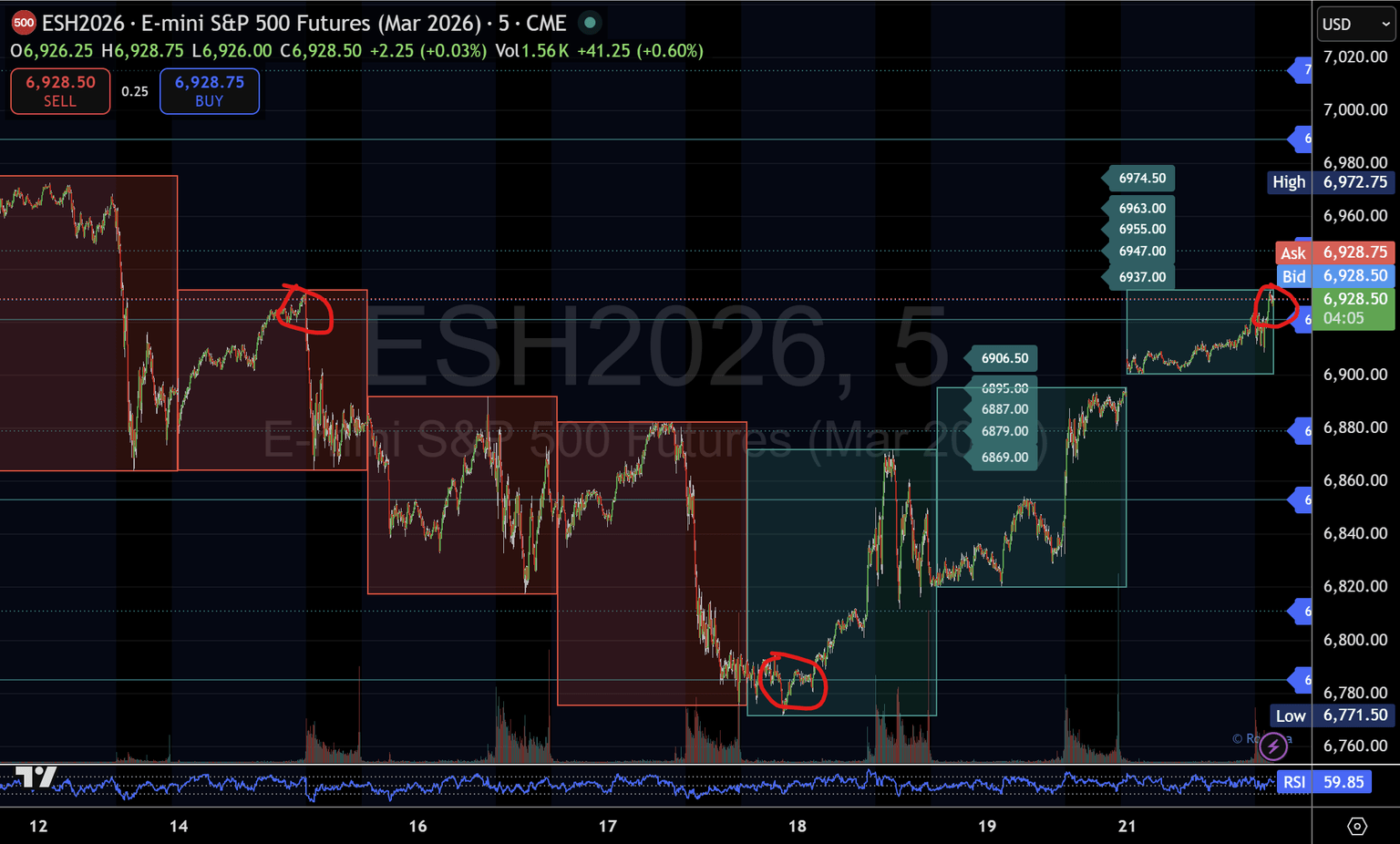

S&P 500 futures reclaim upper structure after demand-zone response

Structure reclaims the upper range as price responds around the 6,921 pivot.

Trade Desk Observation | December 22

The S&P 500 futures contract has rotated back into the upper structure following last week’s responsive move from the 6,785–6,811 demand zone. That base has now proven effective, with price progressing higher through the Asian session gap-up and extending the advance during the London session.

Into the New York open, price regained and held above the 6,921 central pivot, a level that had previously acted as a balance point between acceptance and rejection. This reclaim shifted short-term control back toward the upper structure and opened the path toward the next cluster of reference levels.

With price holding above 6,921, the structure supports continued rotation toward the 6,937–6,974 zone, where prior supply, short-term extensions, and participation are expected to be tested. This area represents the first meaningful checkpoint rather than a directional target.

From a structural standpoint, 6,921 remains the key decision level:

- Acceptance above this pivot keeps the current advance sequence intact and allows price to explore higher references.

- Failure back below the pivot would suggest a loss of acceptance and could trigger a rotation back toward the 6,906–6,869 region, where the market previously paused and consolidated.

At this stage, price behaviour around these reference points is more important than outcome. The structure is already defined; the task is to observe how price responds as it interacts with it.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.