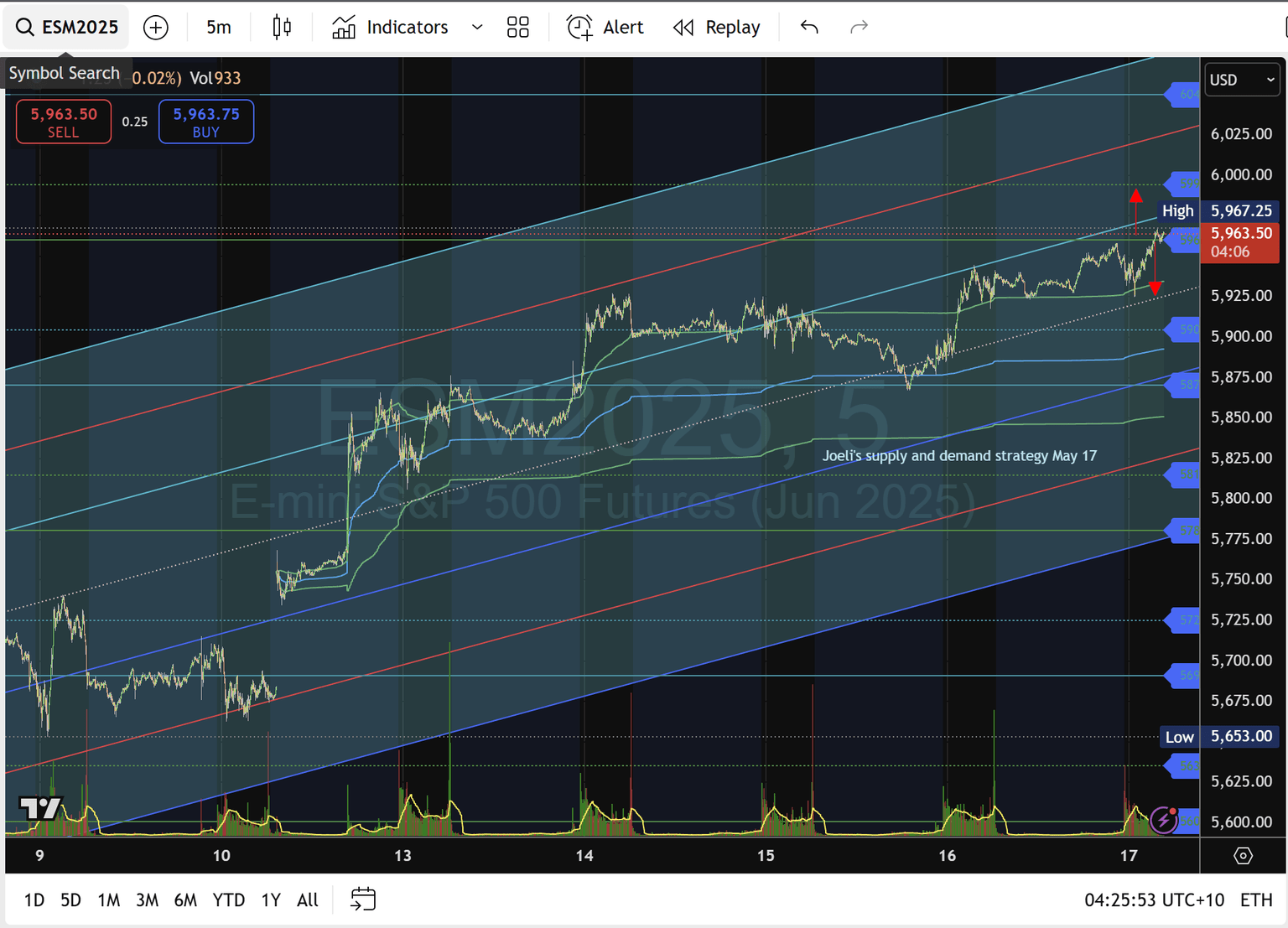

S&P 500 futures Monday playbook: Bulls eye 6,000 on 5,960 reclaim, bears target 5,904 POC break

EPM25 – Monday trading plan update.

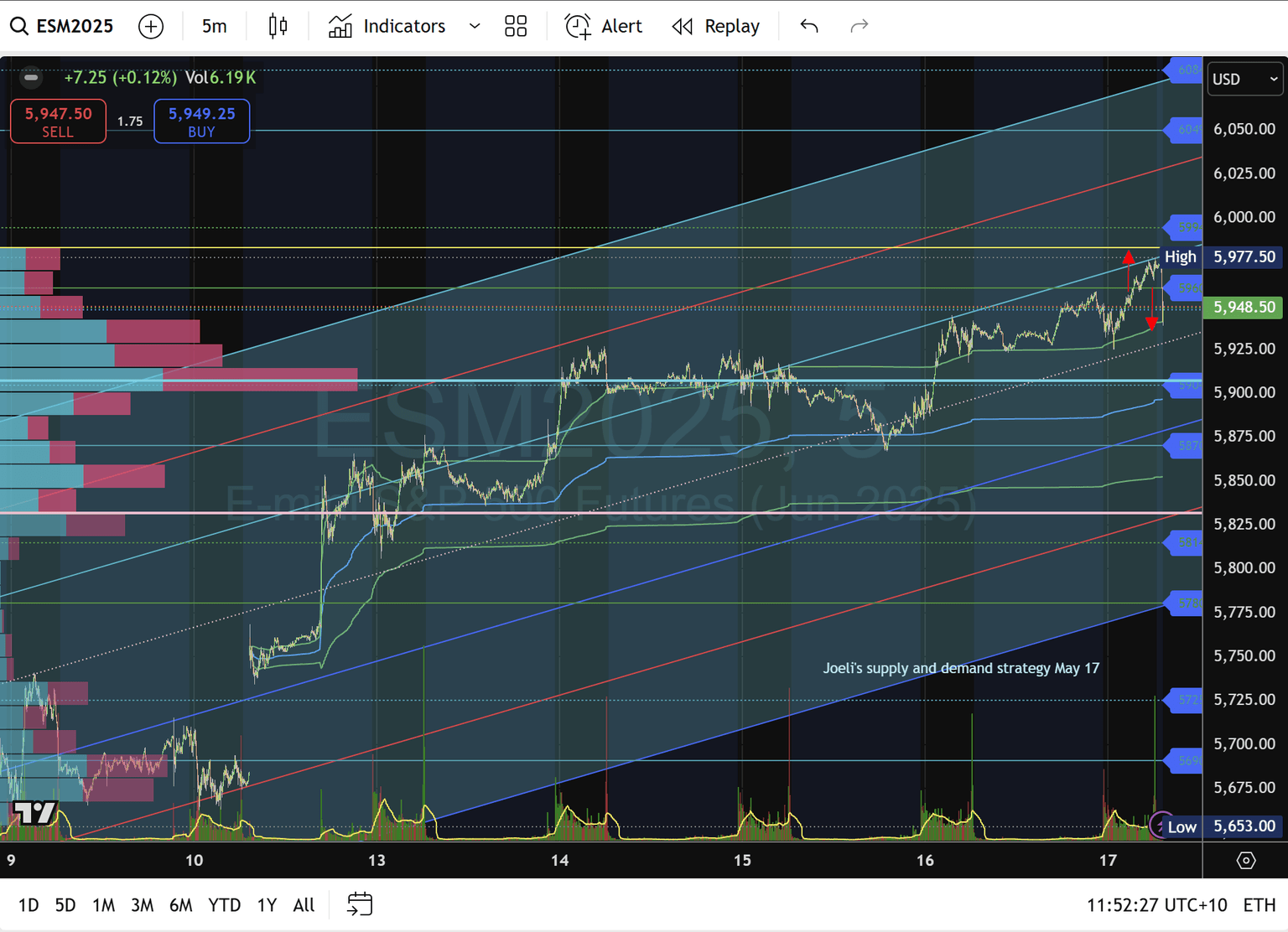

Based on the May 17 end-of-week chart with supply and demand projection, Volume Profile & VWAP.

1. Key levels to watch

Resistance zone 5,969–5,977, 50% Fib of today's range just under VAH.

Major resistance 6,000 Round number, May 14–15 swing high.

Short-term pivot 5,960 Yesterday's breakout/remedy level.

Immediate support 5,932 38.2% Fib of today's mini-swing.

Secondary support 5,917 50% Fib of today's swing.

POC / VWAP mid-line (cyan) ~5,904 Volume-Weighted control point.

Lower support 5,870 Rising channel base & Yesterday's low.

VAL (pink) ~5,850 Value-Area-Low on Volume Profile.

2. Market context and bias

-

Uptrend intact: Despite the pullback from 5,969–5,977, price has held above both the VWAP mid-line and the channel's mid-pitch.

-

Volume profile: POC sits at ~5,904. Holding above reinforces the bullish order flow; a drop below undermines it.

-

End-of-week pullback: Failure to sustain above 5,969 suggests profit-taking into the close, setting up a Monday test of POC/VWAP.

3. Bullish scenario (Longs)

-

Reclaim & hold 5,960:

-

Entry: On a clean push back above 5,960 with a 1–2-bar retest.

-

Targets: 5,969 → 5,977 → 6,000.

-

Stop: Below 5,940 (just under 38.2% Fib at 5,932).

-

-

POC bounce:

-

Entry: Bounce off 5,904 (POC/VWAP mid-line) on increased volume.

-

Targets: 5,932 → 5,969.

-

Stop: 5,890 (beneath the rising VWAP band).

-

4. Bearish scenario (Shorts)

-

Failure at 5,969–5,977:

-

Entry: Rejection in that zone, fading back below 5,960.

-

Targets: 5,932 → 5,904.

-

Stop: Above 5,980.

-

-

Break Below POC (5,904):

-

Entry: Close below VWAP/POC on a 5-min close.

-

Targets: 5,870 → 5,850 (VAL) → 5,814

-

Stop: Above 5,920 (just above the POC)

-

US mid session May 17

US session end of trades may 17

5. Risk management and notes

-

Position sizing: Keep risk ≤ 1% of account on any single trade.

-

Volume confirmation: Favour entries when volume spikes at your level.

-

Channel context: If price returns to the lower channel rail (5,870) and holds, look for reversal longs into Tuesday.

-

Overnight risk: Be aware of any geopolitical headlines after hours that could gap the Sunday/ Monday open.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.