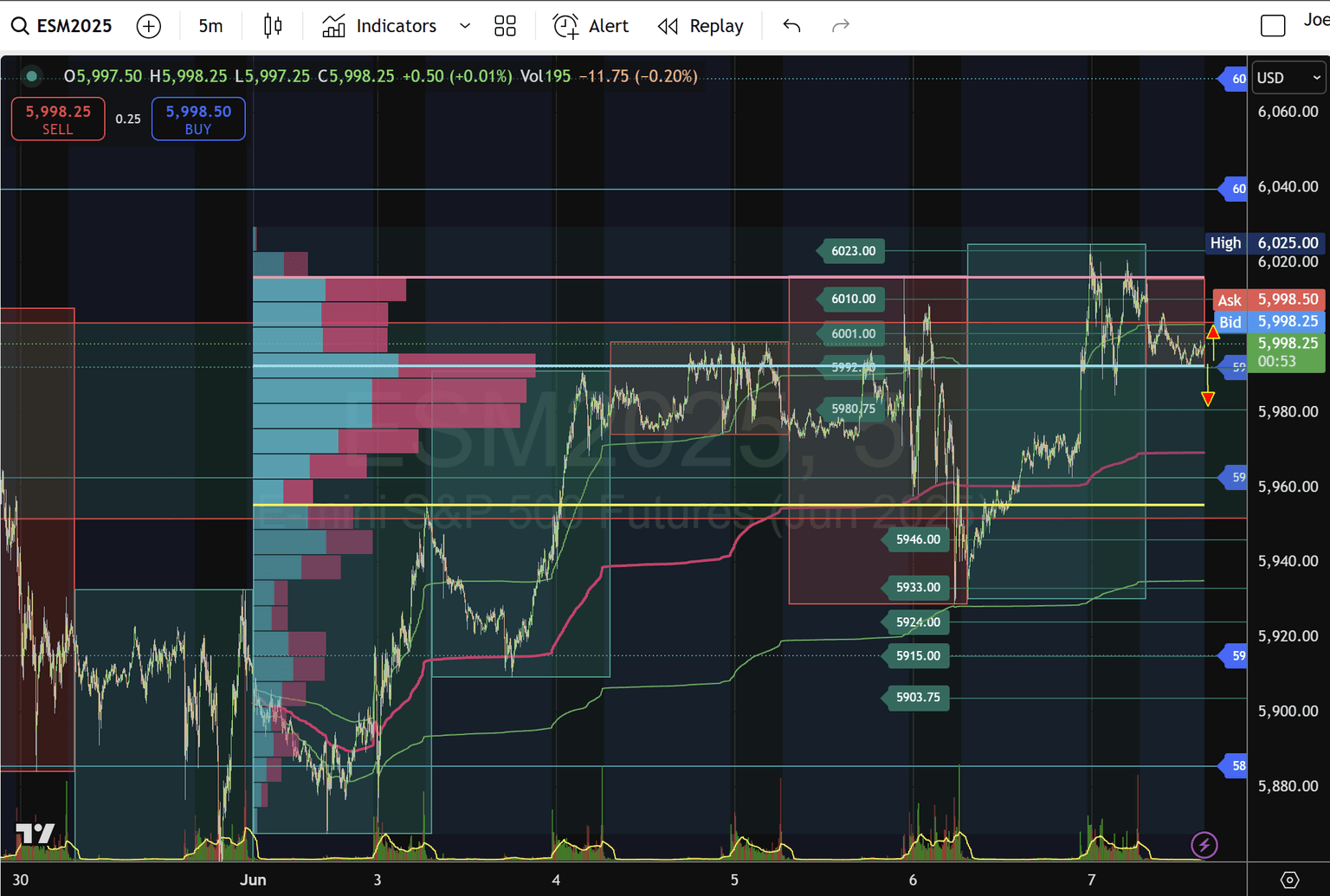

S&P 500 futures aim to hold 5,992 POC – Defend or test 5,962/5,980 June 9 London-New York sessions

Friday's 5,933–6,023 range anchors today's playbook. Watch 5,992 as the pivot for upside targets at 6,000, 6,010, and 6,023 or downside probes into 5,980.75, 5,962.50, and below.

1. Daily context

-

Range reminder: Friday's high at 6,023 and low at 5,933 define the key weekly bracket.

-

Trend bias: Still within an overall uptrend from June 3 lows, but short-term momentum has stalled just under 6,000.

2. Key levels to watch

Level type significance

6,023 - Friday High - First resistance; range cap.

6,010 - Minor High - Short-term target if 5,992 holds.

6,000 - Round Number - Psychological barrier.

5,992 - Friday POC (light blue)- Pivot: hold for bullish bias.

5,980.75 - Support - Volume-profile support from Friday.

5,962.50 - VWAP Mid (red) & Daily VAH (yellow)- Major intra-day support.

5,946 - Friday VAH low - First sell-off target if a breakdown occurs.

5,933 - Friday Low - Full range test; new longs only on hold.

3. Bullish scenario

-

Hold 5,992 POC in London open.

-

Target 6,000 area for initial profit-taking.

-

Extension to 6,010 & 6,023 if buying pressure sustains.

-

Breakout above 6,039 (daily upper bound) opens run to 6,070+.

Entry: Aggressive longs off 5,992–5,980.75 zone.

Stops: Just below 5,980.75.

4. Bearish scenario

-

Failure under 5,992—rollover signals.

-

First support test at 5,980.75.

-

Deeper pullback into 5,962.50 (VWAP mid / VAH).

-

Break below 5,962.50 targets 5,946, then 5,933.

Entry: Short triggers under fresh 5,992 breach.

Stops: Above 5,992

5. Session flow and execution

-

London session: Assess strength at POC (5,992).

-

NY open: Confirm break or hold—use higher-timeframe VWAP and volume clusters for conviction.

-

Daily close: Monitor reaction into 5,962.50: hold bullish case; reject signals deeper correction.

Bottom line

Maintaining Friday's range puts 5,992 at the Focal point of today's directional bias. Hold it, and look to revisit 6,000–6,023; lose it and expect a slide toward 5,962.50 and below. Ride the pivot and manage risk around these defined levels.

(This analysis is for informational and educational purposes only and does not constitute financial advice. Always conduct your own due diligence before trading.).

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.