SNDL Stock News: Sundial Growers Inc gains as optimism buds on recent capital raise

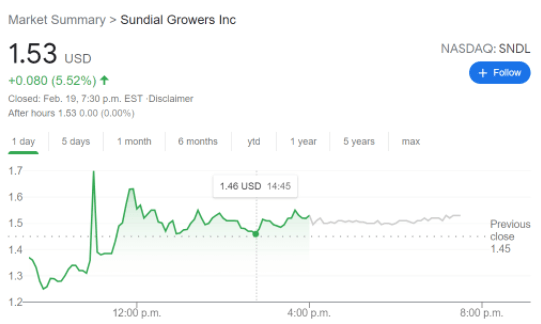

- NASDAQ:SNDL adds 5.52% amidst another turbulent day for the markets.

- Sundial has raised millions in capital during its recent surge, and investors are starting to like it.

- Sundial hopes to expand operations with its recent investment in Indiva.

NASDAQ:SNDL continued its tumultuous week on Friday, as the small-cap Canadian cannabis company continues to be a retail investor favourite, despite financials that are not too impressive. On Friday, Sundial added 5.52% after starting the morning in the red and closed the trading week at $1.53. Considering the stock is maintaining its current price levels for now, it is impressive to think that just a year ago, this stock could be had for just a few pennies per share.

The recent popularity of the stock has allowed management to continue to raise capital through stock offerings and other instruments. Investors seem to have come around on the offerings as long-term capital raising is usually beneficial for firms that are in rapid growth mode. The potential for organic growth and even targeting smaller players as acquisitions can really bolster a company’s outlook, especially in an industry like cannabis that has near unlimited potential in the long-term. The Canadian cannabis sector is about to get a bit of a shakeup as well when industry giants Tilray (NASDAQ:TLRY) and Aphria (NASDAQ:APHA) merge in the second quarter of 2021. How this will affect smaller firms like Sundial is yet to be seen.

SNDL stock forecast

Sundial has already scaled up on its acquisitions as it recently acquired a small Canadian edibles company called Indiva. This gives Sundial just another foot in the rapidly expanding edibles market, where products such as candies, gummies, chocolate, and other food products are infused with CBD, THC, or sometimes even both.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet