Silver prints a fresh daily low and pulls-back into consolidation

- XAG/USD bulls have been denied a deeper correction as the greenback hardens.

- The US dollar has benefitted against a number of currencies of nations that have experienced a fresh wave of coronavirus outbreaks.

Silver prices are lower on Tuesday, losing over 1.2% with spot XAG/USD currently at $25.78 and have ranged between a low of $25.52 and a high of $26.12.

The precious market's nemesis of late, the greenback, has been proving problematic for the bulls that have been denied a deeper correction of the current daily bearish bias.

The US dollar has climbed to a one-week peak on Tuesday by posting its largest single daily gain in roughly two weeks.

In afternoon trading in New York, the dollar index DXY, a gauge of its value against six major currencies, rose 0.37% to 92.019, posting its biggest daily percentage gain since around mid-June.

The greenback has benefitted against a number of currencies of nations that have experienced a fresh wave of coronavirus outbreaks leading to a bout of risk-off across the financial and commodities markets.

Indonesia is grappling with record-high cases, while Malaysia is set to extend a lockdown and Thailand has announced new restrictions. Some states in Australia have also tightened movement curbs.

Meanwhile, the was a sharp rise in US June consumer confidence and positive assessment of the labour market outlook from Fed officials which has also benefitted the US dollar as they reinforced the US nation's positive growth outlook.

''Regional Fed Presidents Barkin and Kashkari both said that they expect to see strong labour market data over coming months – a view that probably encompasses an expanded vaccination programme, ongoing stimulus, and evidence of very strong labour demand,'' analysts at ANZ Bank explained.

''But with the outlook strong, it very much feels as if the parameters around tapering are forming,'' the analysts added.

''The Fed needs to see inflation sustainably at 2.0% which it is meeting at the moment and substantial jobs growth. Based on the labour market guidance, it would appear that a consensus may be forming at the FOMC that those conditions could be met in Q3.''

The analysts also note that it’s going to be all eyes on the June Non-Farm Payrolls data to gauge momentum and the starting point.

''The market is looking for a 700k gain, which would be a slight acceleration from May.''

The potential for a stronger jobs report this week could inhibit positive flows into precious metals for now.

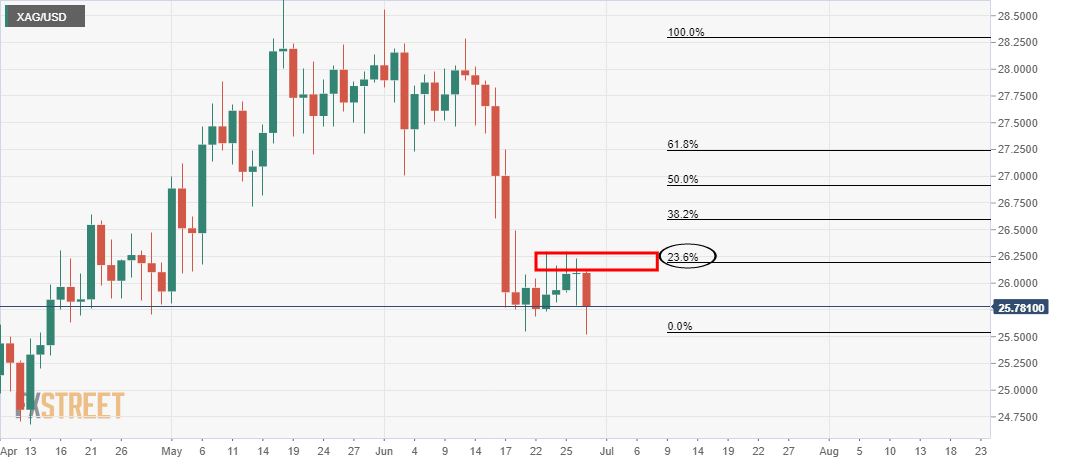

XAG/USD technical analysis

The bulls have been denied a fuller retracement to the 38.2% Fibonacci of the prior bearish impulse and instead, the price is now testing the lower levels of the consolidative period.

The price has made a fresh low in fact:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.