Silver Price Forecast: XAG/USD rebounds and trims losses, eyes 24.00

- Metals stabilized after sharp slide, DXY hits monthly highs above 94.00.

- The strong US dollar keeps metals under pressure ahead of next week’s FOMC meeting.

- XAG/USD falls for the fourth day, but moves off lows.

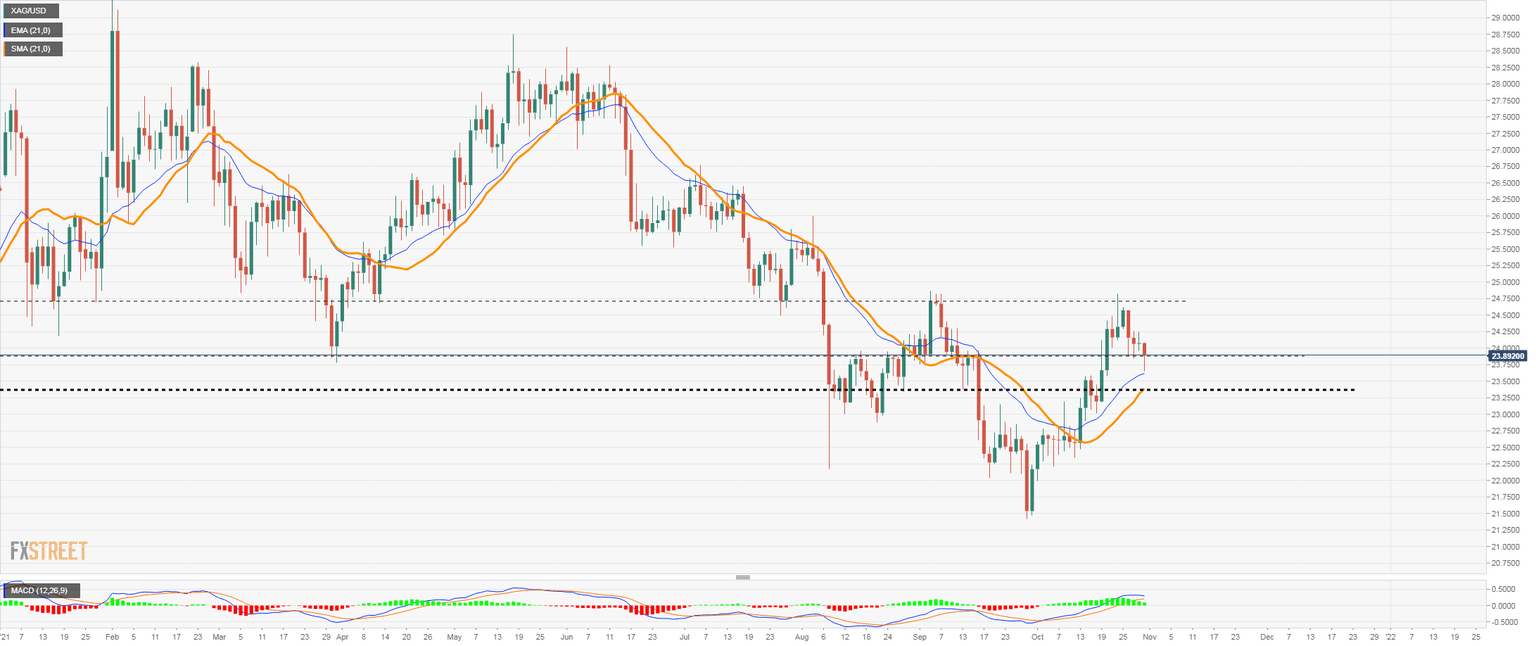

Silver and gold are falling sharply on Friday. A rally of the US dollar pushed XAG/USD to 23.68$, the lowest level in a week. During the last hours, silver recovered ground and rose to 23.90$ It is about to end the week lower, after finding resistance at the 20-week moving average around 24.40.

The DXY is up by 0.90% on Friday, trading at monthly highs at 94.20, boosted amid end-of-month flows and ahead of next week’s FOMC meeting. The Federal Reserve is expected to announce a tapering of its QE program. The latest round of economic data, including today’s Core CPE did not alter market expectations.

US stocks are modestly higher. Not even risk appetite is avoiding the rally of the greenback. For metals, a pullback in US yields favoured a consolidation.

The bias in the daily chart in XAG/USD still shows some bullish arguments, with price above key moving averages. The move off lows on Friday is another fact. Now silver needs initially to recover 24.25$ to gain momentum, and then break the key 24.75$ resistance to clear the way to more gains. A slide below 23.50$ on the contrary would increase the negative pressure.

Silver daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.