Silver Price Forecast: XAG/USD pulls back from YTD highs, hovers around $27.00

- Silver price could meet the major support of $26.50 level.

- Technical analysis suggests confirmation of the bullish sentiment.

- The immediate resistance zone appears around the year-to-date high of $27.33, the highest level since June 2021, and the major level of $27.50.

Silver price (XAG/USD) attempts to snap its five-day winning streak, retreating from the year-to-date highs and trading near $27.00 per troy ounce during early European hours on Thursday. The price of the Silver received upward support as the US Dollar lost ground due to the dovish sentiment surrounding the Federal Reserve’s (Fed) interest rates trajectory.

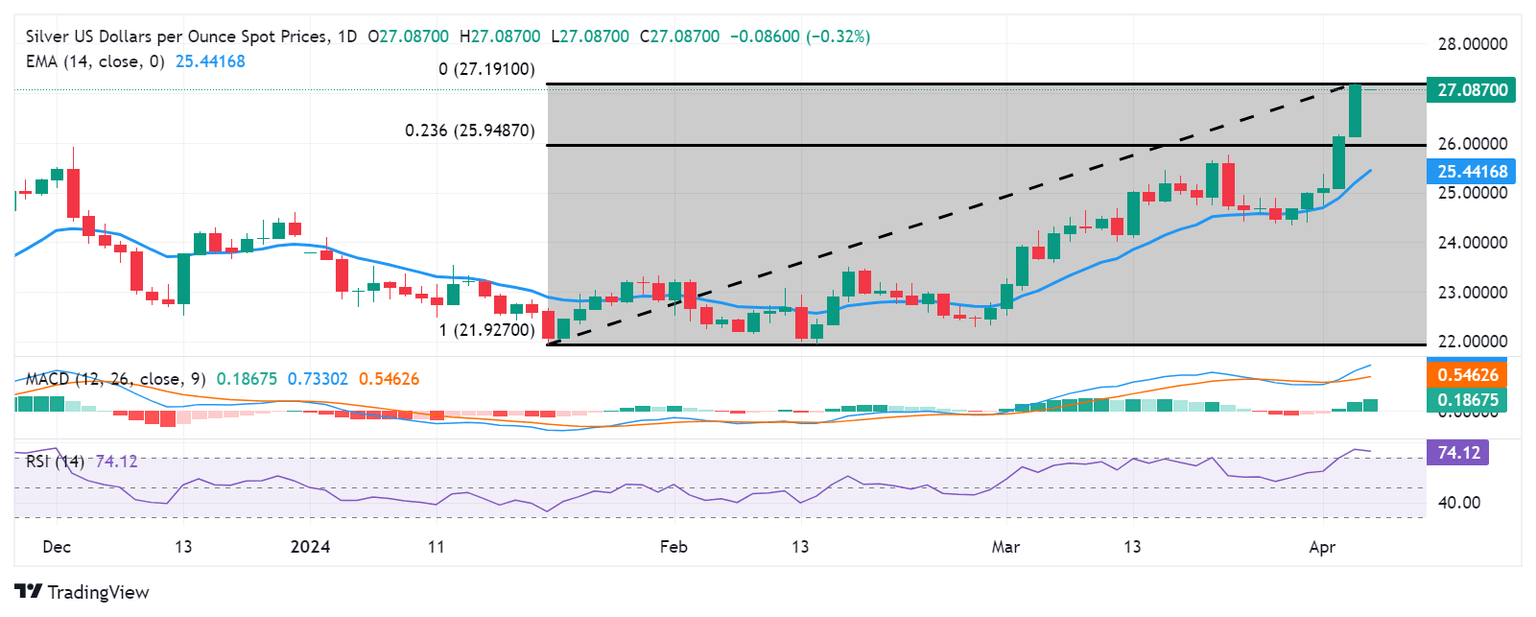

Silver price could find key support around the major level of $26.50, following the psychological level of $26.00, in conjunction with the 23.6% Fibonacci retracement level at $25.94. A break below this level could exert downward pressure on navigating the region around a major support level at $25.50 and the 14-Exponential Moving Average (EMA) at $25.43.

Technical analysis suggests a bullish confirmation for the Silver price. The 14-day Relative Strength Index (RSI) is positioned above the 50 mark, indicating strength in buying momentum. Additionally, the Moving Average Convergence Divergence (MACD) shows a divergence above the signal line and remains above the centerline.

On the upside, the year-to-date high of $27.33 could act as an immediate resistance, followed by the major level at $27.50. A breakthrough above the latter could lead the Silver price to explore the region around the psychological level of $28.00.

XAG/USD: Daily Chart

(This story was corrected on April 4 at 09:35 GMT to say that the immediate resistance zone is around the year-to-date high of $27.33, not an all-time high. It was also corrected to say that $27.5 is a major level, not a support level)

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.