Silver Price Forecast: XAG/USD eases as risk-on mood caps safe-haven flows

- Silver eases from 14-year high of $39.53 amid improved risk sentiment and firmer US Dollar.

- The spot price trades near $39.00, down 0.50% on the day but up over 2.30% for the week.

- Silver remains well above its rising 9-, 21-, and 50-day EMAs, maintaining a bullish technical structure.

Silver (XAG/USD) edges lower on Thursday after marking a fresh 14-year high of $39.53 on Wednesday, as improving global trade sentiment boosted risk appetite and dented demand for traditional safe-haven assets like precious metals. At the time of writing, the metal is hovering around $39.00, down nearly 0.50% on the day. The pullback comes amid broad-based stabilization in the US Dollar (USD) and global equities rallying on optimism surrounding a potential US-EU tariff agreement.

Despite the intraday pullback, Silver remains elevated near 14-year highs, hovering around levels last seen in September 2011, highlighting the strength of the prevailing uptrend. The metal is up nearly 2.36% this week, supported by sustained weakness in the Greenback.

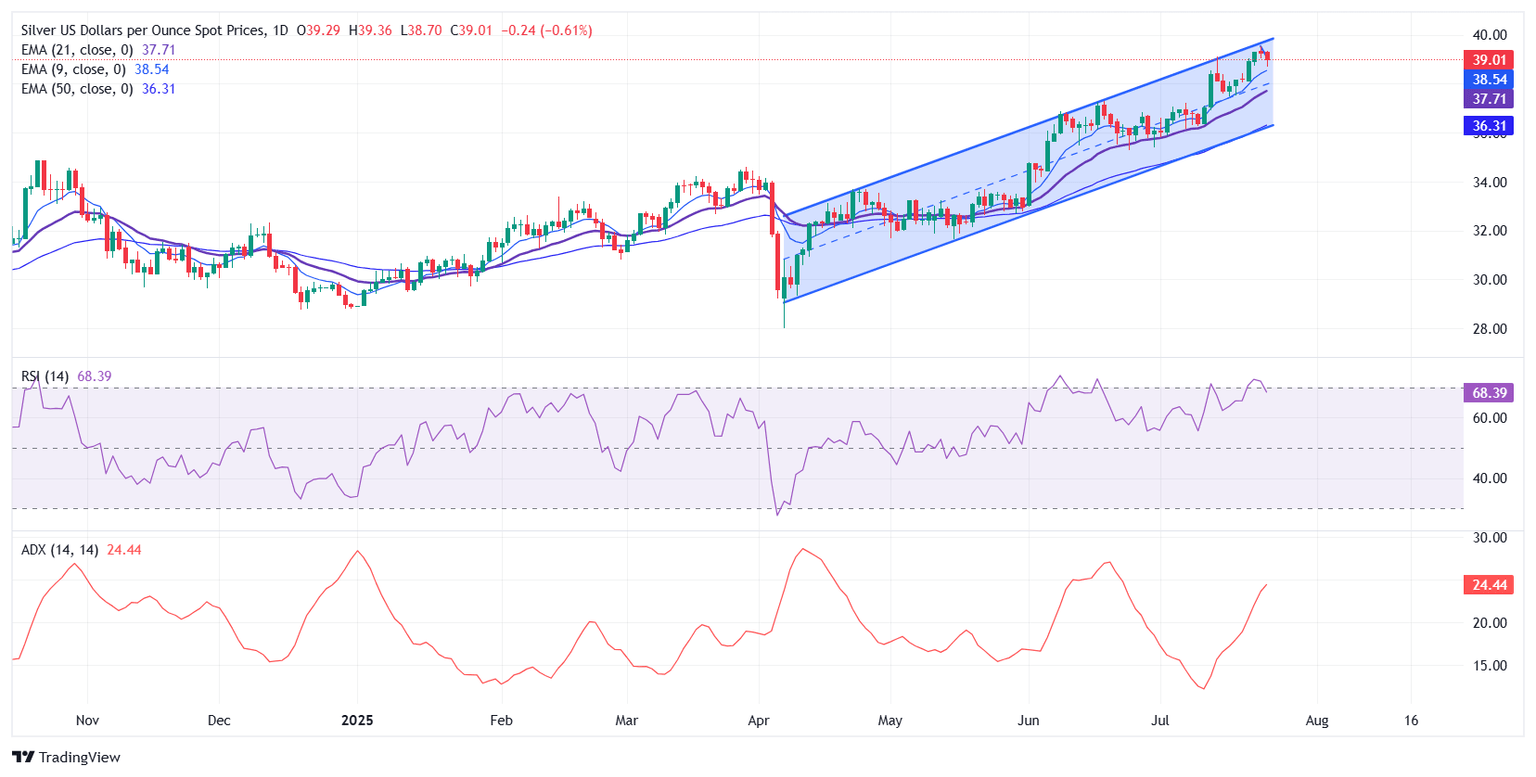

On the daily chart, Silver continues to track the upper boundary of a well-defined ascending channel that has guided price action since early April. The spot price remains well above the 9-, 21-, and 50-day Exponential Moving Averages (EMAs), all of which are trending higher and reinforcing the broader bullish structure.

Momentum indicators also support the ongoing uptrend. The Relative Strength Index (RSI) on the daily chart has eased modestly to 69 after briefly entering overbought territory, suggesting the rally is cooling without reversing. Meanwhile, the Average Directional Index (ADX) is pointing north at around 23.60, indicating that the underlying trend is not only intact but is also slowly gaining strength.

On the 1-hour chart, Silver recently broke out of a classic cup-and-handle formation, with the handle forming as a falling wedge — a bullish continuation pattern. However, the breakout has stalled near the $39.50 mark, as buyers struggle to sustain momentum. At the time of writing, the metal is trading just below the 21-period EMA, which has flattened around $39.09 and is currently acting as immediate resistance, capping intraday upside.

The RSI on the hourly chart has rebounded from oversold territory and now sits near 46, signaling recovering momentum but lacking strong follow-through. The ADX, meanwhile, is rising to around 35, indicating a firm underlying trend that continues to favor the bulls despite the current pause in price action.

With the broader technical structure still leaning bullish, immediate resistance is seen at $39.50, followed by the key psychological hurdle at $40.00. A decisive break above this zone could trigger fresh upside toward $42.00 and potentially $43.00 in the sessions ahead. On the flip side, initial support rests at $38.70 — the July 22 low — followed by the 21-day EMA at $37.70. The 50-day EMA, near $36.30, aligns with the lower boundary of the ascending channel, offering stronger support and maintaining the broader bullish trend intact.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.