Silver Price Forecast: XAG/USD consolidates above $40.50 after breakout to 14-year highs

- Silver extends rally to fresh 14-year highs, breaking above the key $40.00 level last seen in September 2011.

- Fed rate cut bets, weak US Dollar, and safe-haven demand continue to fuel bullish momentum

- Technical breakout confirmed above the July peak of $39.53, with XAG/USD holding firmly above short-term moving averages.

Silver (XAG/USD) kicks off the week on a strong footing, with spot prices extending their rally for a fifth consecutive session, breaking above the $40.00 mark to hit fresh 14-year highs — levels last seen in September 2011. At the time of writing, the metal is consolidating around $40.70, as thin trading conditions prevail due to the US Labor Day holiday.

The sustained rally in Silver comes on the back of broad US Dollar (USD) weakness and firm expectations of a Federal Reserve (Fed) interest rate cut in September, which continues to support demand for non-yielding assets. Market sentiment remains firmly bullish despite overbought technical signals, as traders weigh safe-haven demand amid mounting global uncertainty. A federal appeals court ruling on Friday declared most of US President Donald Trump’s global tariffs unlawful, casting fresh doubt over the future of US trade policy. Concerns over the Fed’s independence are also adding to market anxiety, further supporting the case for precious metals.

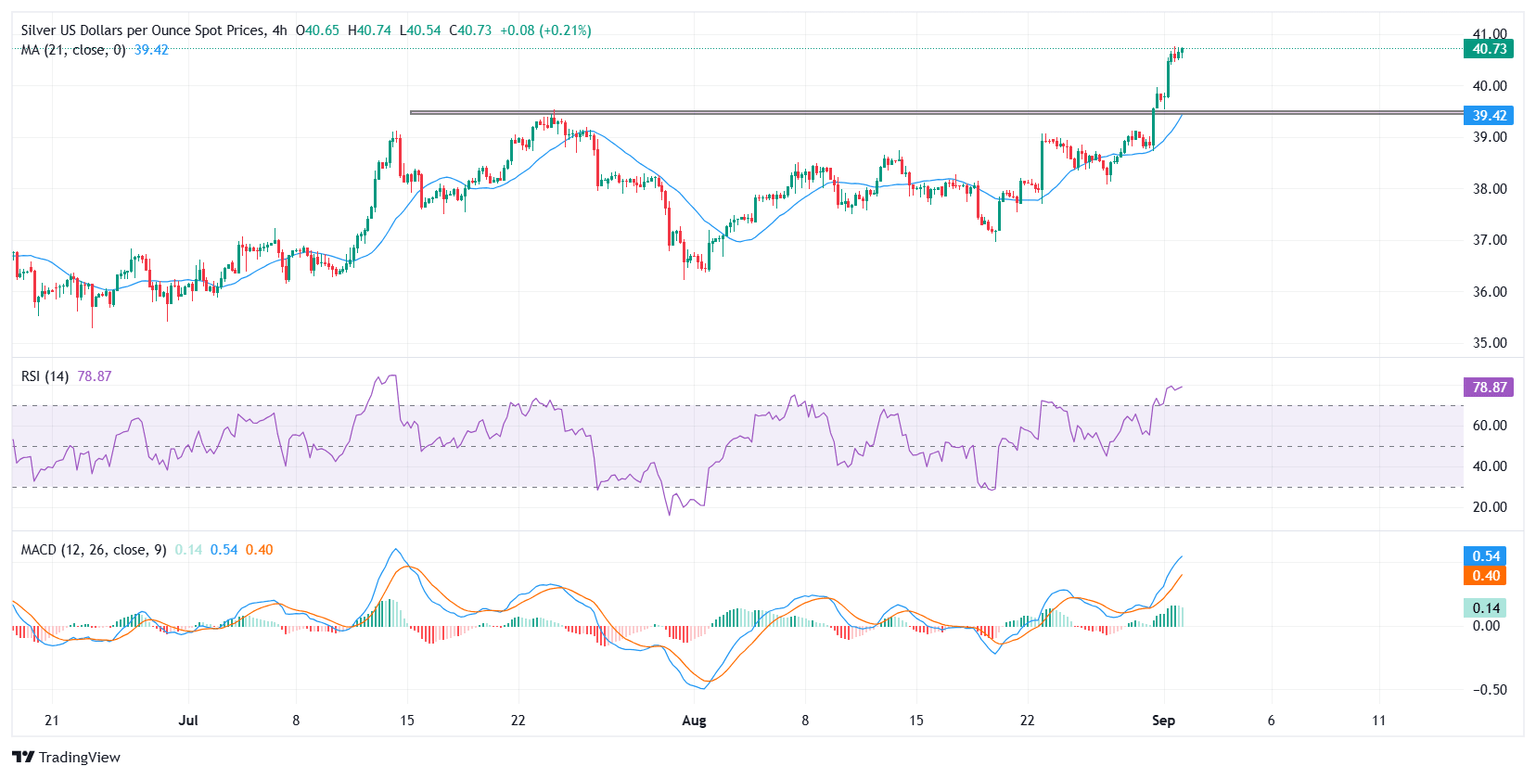

XAG/USD maintains a strong upward trajectory on the 4-hour chart, building on the bullish momentum that began in late July. After finding support near $36.00, the metal has been making higher highs and higher lows, indicating a clear uptrend with buyers consistently stepping in to defend dips and keep the bullish momentum intact.

The August close above the July 23 peak of $39.53 – a multi-year high – confirmed a significant breakout, supported by an 8.29% monthly gain. Price action has now decisively cleared the psychological $40.00 barrier, turning prior resistance at $39.50 into immediate support.

Silver is holding well above key short-term moving averages that continue to slope upward. Momentum indicators are elevated, with the Relative Strength Index (RSI) hovering near overbought territory, suggesting the potential for a brief consolidation or shallow pullback, though no clear signs of trend exhaustion are evident. The Moving Average Convergence Divergence (MACD) also signals strength, with expanding bullish histogram bars and the MACD line comfortably above the signal line.

Looking ahead, immediate resistance is seen at $41.00 and $42.00, with the next upside target at $43.40 — the high from September 5, 2011. On the downside, the $39.50-$39.00 zone remains a key support area, with any pullback toward this region likely to attract fresh buying interest. As long as broader macro and policy drivers remain aligned, XAG/USD appears poised to extend its rally toward new cycle highs.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.