Silver Price Forecast: Silver slips as US Dollar firms on strong PPI data

- Silver slips to $38.00, snapping a two-day rebound as the US Dollar firms.

- US PPI data shows inflation rising sharply in July, with both headline and core readings well above expectations.

- XAG/USD consolidates between $38.50 resistance and $37.50 support, with momentum turning neutral.

Silver (XAG/USD) edges lower on Thursday, snapping a two-day losing streak as stronger-than-expected US Producer Price Index (PPI) and upbeat Jobless Claims data bolster the US Dollar. At the time of writing, the metal is trading near $38.00 during the American session, down nearly 1.30% on the day.

Earlier in the Asian session, XAG/USD struggled to sustain gains above $38.50, peaking at $38.74 — its highest level since July 25 — before sellers pushed prices lower. Meanwhile, the US Dollar Index (DXY), which measures the Greenback against a basket of six major currencies, is staging a modest recovery after falling to a more than two-week low on the previous day. The index has climbed back above the 98.00 psychological mark following the release of stronger-than-expected PPI and steady Weekly Jobless Claims, as traders reassess the outlook for Federal Reserve (Fed) rate cuts.

The latest US labor market and inflation data underscore a resilient economy with pockets of persistent price pressure, complicating the Federal Reserve’s (Fed) policy outlook. Initial Jobless Claims slipped to 224K in the week ending August 8, better than the expected 228K and lower than the prior week’s 227K, while Continuing Claims eased to 1.953 million, narrowly undershooting forecasts.

On the inflation front, July’s Producer Price Index jumped 0.9% MoM, the sharpest monthly gain since June 2022 and well above the 0.2% consensus estimate, following a flat reading in June. This pushed the annual rate to 3.3%, surpassing expectations of 2.5% and accelerating from 2.4% previously. The upside surprise in producer prices comes on the heels of an in-line headline CPI and a slightly hotter core CPI earlier this week, suggesting that underlying price pressures remain sticky.

Technical analysis

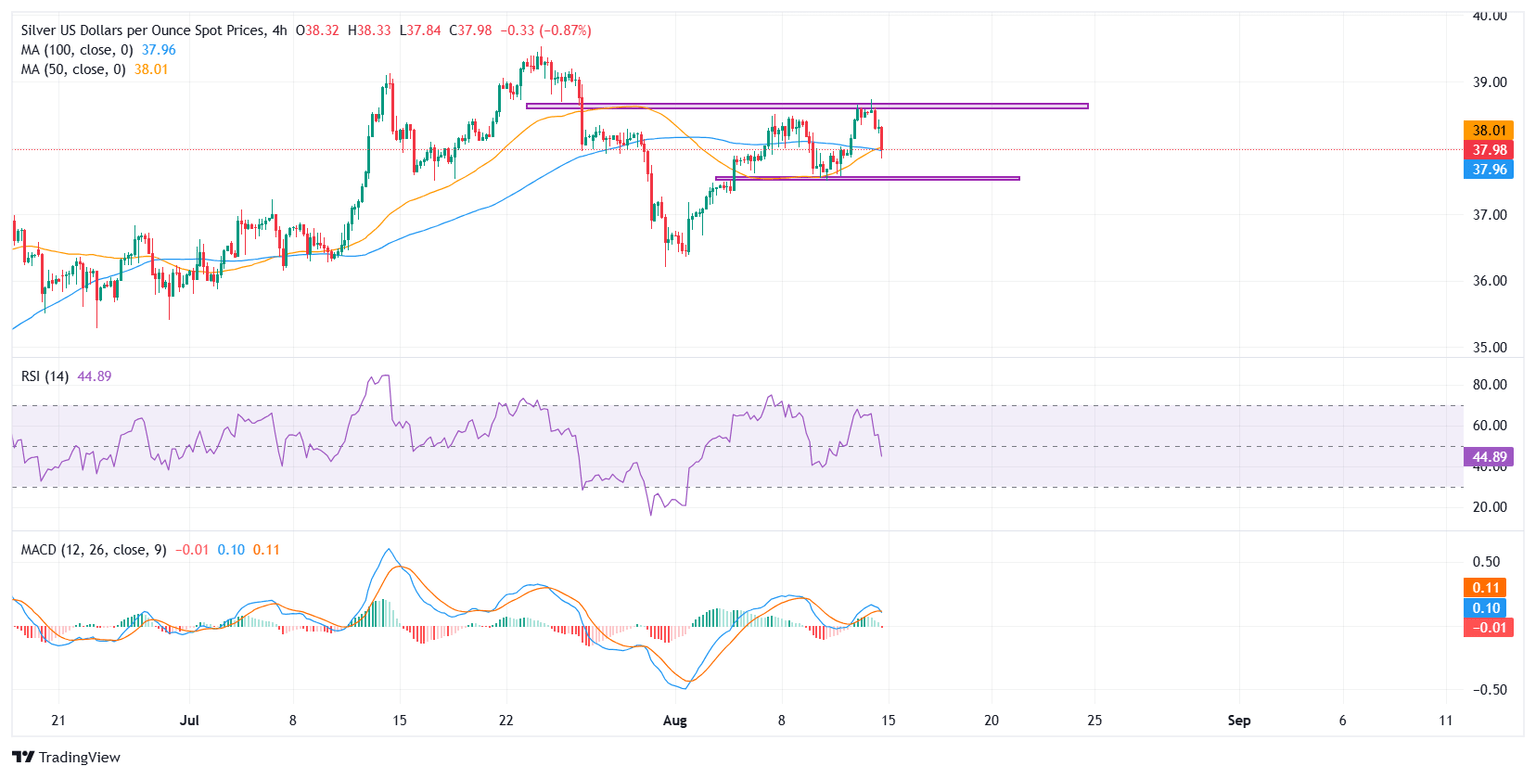

On the 4-hour chart, Silver (XAG/USD) is consolidating between resistance at $38.75 and support near $37.55, forming a short-term range after sellers emerged near multi-week highs. The metal has pulled back toward the confluence of the 50-period SMA at $38.01 and the 100-period SMA at $37.96, which are acting as immediate pivot levels. A sustained break below this zone could expose the lower boundary of the range, while a rebound would keep the consolidation intact.

Momentum indicators suggest waning bullish pressure. The Relative Strength Index (RSI) has retreated to 45, signalling a neutral-to-slightly bearish setup, while the Moving Average Convergence Divergence (MACD) is showing signs of flattening after a bullish crossover, hinting at potential loss of upside momentum. A breakout above $38.50 could target $39.30-$39.50, whereas sustained weakness below $37.50 would shift focus toward $37.00 and the July 31 swing low.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.